10/29 Weekly Report - “The Labor Market Tide is Going Out, CRE Problems, GD(P), and More”

In this weekly report - the team tackles everything from the softening labor market, the GDP data, snowballing CMBS issues, and more.

10/29 MacroEdge Weekly Report

@DonMiami3, MacroEdge Chief Economist

@TexasRunnerDFW, MacroEdge Contributor

@MrAwsumb, MacroEdge Contributor

@SquirtLagurtski, MacroEdge Contributor

@RealJohnGaltFla, MacroEdge Contributor

@GregCrennan, MacroEdge Contributor

Weekly Data Dive and the Labor Market Tide is Going Out (@DonMiami3, Chief Economist)

Hi all - hope you are having a great end to the weekend. I am going to piece my short this evening - focusing on a few datapoints from the labor market and deliver some brief commentary about where things are at with the market and economy on the aggregate.

We’ve seen continued shakiness in the actual equity markets - with both the worst breadth ever in the tech sector ever (which led me to draw the comparison of the Nasdaq today to the Dow of 1987). Of note from Stan Druckenmiller in an interview given years ago:

Macro risks and threats to growth are continue to snowball together to pose greater risk in the latter half of Q4 thru Q1/Q2. I continue to anticipate rate cuts on the Q1 timeframe. We have a weakening job market (coupled with rising job cuts), CRE/CMBS risks rising, a frozen housing market, wild weakness in the logistics/freight spaces and a weakening consumer. While consumption remains strong among certain groups of the economies, particularly among a subset of the Baby Boomer group, I anticipate they start paying more attention to their consumption habits if the equity market continues to see a larger move downward over the next several months.

On the job market, we’ve tracked over 82,000 publicly announced job cuts this month:

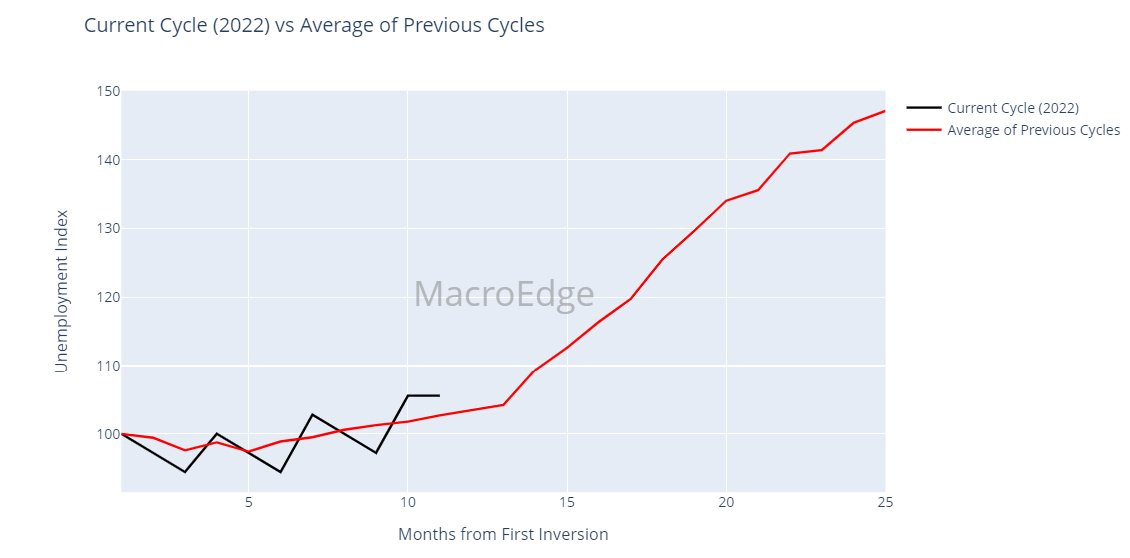

Our final report will be released via a press release on the first Sunday of next month, when we’ve finalized and corrected any errors in the data. I am closely watching both our figure, the Challenger figure, and claims data thru the remainder of the quarter awaiting the potential spike in claims. I will continue to monitor key markets like Nevada in anticipation of abrupt increases in claims (both initial and continuing). Continuing claims continues to track very closely on our index with the average of previous recessions - being slightly elevated above the average line now as of the large spike in last weeks print. I noted last month to anticipate claims rising as the BLS adjustments begin working against ‘stronger’ prints, meaning lower. Continuing claims can continue to rise as it becomes more difficult for the average American to find a job when they lose one.

The unemployment rate continues to track well inline with our average, and I expect this to remain in the 3.7-3.9% range for October, with the possibility of a slightly higher reading on the upside. It is likely the labor market still has 1 to 2 more quarters to see ‘surprising’ realized weakness in the headline figures, although this can happen quicker if larger risks materalize.

Regarding the blowout GDP report which many are preemptively celebrating (peak growth, as many others are calling it)… just remember that history always rhymes as Q3 ‘23 matches with Q3 ‘07:

As risks continue to snowball against this economy and a mostly resilient consumer - continue to watch the risks for signs of things unravelling on the outer edges…

Leaving the rest of the read up to the team and keeping it short this evening as promised, I appreciate you all reading and look forward to many of you accessing our portal and data dashboard November 5th when pre-access goes live. Options to get pre-access will be available through both Substack and https://www.macroedge.net/

Talk soon…

DJ

Gross Domestic Pretending (@TexasRunnerDFW, MacroEdge Contributor)

“The big question concerns whether GDP provides a good measure of living standards. In many cases, GDP statistics seem to suggest that the economy is doing far better than most citizens' own perceptions. Moreover, the focus on GDP creates conflicts: political leaders are told to maximize it, but citizens also demand that attention be paid to enhancing security, reducing pollution, and so forth - all of which might lower GDP growth.

“The fact that GDP may be a poor measure of well-being, or even of market activity, has, of course, long been recognized. But changes in society and the economy may have heightened the problems, while advances in economics and statistical techniques may have provided opportunities to improve our metrics.” -- Joseph Stiglitz, The Economist’s Voice, September, 2009

Despite what feels like a collective persistent gloomy economic sentiment, US Q3 GDP came in hot at 4.9%. Inflation appears to be abating. Employment remains relatively robust. Consumer spending, albeit increasingly on credit cards, is still a force to be reckoned with. The economy, using our standard accepted methods of measurement, is doing okay. This data should be reassuring, and yet, for many, it’s disconcerting. Why is good news bad news?

A few nights ago, I awoke abruptly from a feverish dream around 1 am. My throat was on fire. Chilled, achy, and feeling a bit delirious, I stumbled into our Master bath to find some Tylenol. Something was wrong, and since my son had recently recovered from Strep Throat, I figured Strep must be the culprit of my sudden misery.

The next morning, I headed to the Doctor and was tested for Covid, Strep, and Flu A. Everything was negative. It was good news, right? I didn’t have any of these awful diseases! And yet, I received the test results with mixed emotions. If I didn’t have any of these things, why did I feel so bad? And what could I do about it?

When we feel bad but are presented with data that indicates nothing is wrong, our first reaction is typically to question our own perceptions. Am I the only one who feels this way? Am I crazy?

But perhaps instead of questioning ourselves, we should be questioning the data. First, is it accurate according to the accepted standard of measurement, and second, if it’s accurate, is the standard method of measurement adequately capturing the information we need?

In the case of my mystery illness, my sore throat and chills persisted the following day, showing zero signs of improvement. Consulting a second opinion, I was informed that rapid strep test results have a significant clinically recognized false negative rate. Sure enough, within 4 hours of taking the first dose of antibiotics, my sore throat began to improve dramatically.

In the case of our GDP, there is additional information that needs to be gathered in order to adequately assess the health of our economy. To investigate how we might do this, I consulted a research paper on this subject from the US Bureau of Economic Analysis.

The two main things we need to consider are:

The Distribution of growth in incomes across households, businesses and regions

The Sustainability of Trends in the Economy

For example, growth in real disposable income and real compensation must first be put on a per capita or per worker basis, to reflect something closer to the average worker’s experience. Part of the growth in incomes and production simply reflects growth in the labor force—especially when unemployment is near record lows.

Also, instead of simply using the BEA’s disposable income measure, a more useful piece of information would be to measure discretionary income, perhaps something we could call “adjusted disposable income.” Deducting the amount that consumers spend on such goods and services as food, shelter, and medical care offers a notion of what households’ have left over to spend on more discretionary items. The cost of these essential items has increased dramatically in recent years. Some, but not all, of that increase is being captured in CPI data. More targeted discretionary income data might prove helpful in assessing the spending that households have available to increase spending and saving over time and over the course of the business cycle.

The second consideration, sustainability, speaks to the future. Instead of just looking at GROSS domestic product, we may wish to consider NET domestic product. Just as business accounting deducts the cost of depreciation of capital when calculating profits, we need to consider the cost of resources needed to replace the capital and natural resources used up in production. This information would help us assess how much we are effectively borrowing from future generations in order to get today’s GDP. Record high peacetime Government spending made up a large portion of our current 4.9% GDP—how sustainable is this aggressive fiscal spending?

When we examine our recent blockbuster GDP in a more critical light, we see that our ability to produce a strong number like this going forward may well prove to be a challenge. Wage growth continues to lag inflation, and income and wealth distribution is skewed heavily towards the top 10% of earners. Personal saving rates have collapsed, as the median consumer struggles with an increase in spending on essential items, leaving little leftover for discretionary income needed to sustain a robust consumer economy.

It's easy to look at this one very strong GDP print and pretend we’re neither in, nor headed for a recession. But that’s all it is—pretending. Afterall, the last time we had a stellar 4.9% GDP print? Q3 2007. A lot can change in a year.

Construction Update (@MrAwsumb, MacroEdge Contributor)

This month’s New Construction Survey confirmed again, that For Sale Homebuilding is in contraction through 7 quarters. Across all Residential Construction Sectors, we haven’t quite entered contraction yet. Worth noting that we have built more housing units this cycle than the previous cycles dating back to 1970. This includes Multifamily, For Sale Single Family, Contractor Built and Build for Rent.

When we dig a little deeper, we set a record this year. 2023 and 2022 prior, saw the most Residential Construction by units built since the Census Survey started tracking the data.

This is of note both because the top and bottom years by volume correlate rather well.

June of 2023 set a single month record for number of multi family construction in the US. In fact, 25 of the top 50 months of Units Under Construction are from 2021 to 2023.

Each month approximately 30,000 new Multifamily units get completed. And while we’ve had declines in each July, August and September in number of units under construction, it may be too early to call that contraction. Here’s where we are in the cycle vs previous cycles.

While construction employment is holding, the demand for additional employment seems to have cooled drastically. The residential construction sector is showing signs having peaked.

The Cost of Doing Business (@SquirtLagurtski, MacroEdge Contributor)

The trucking industry has been the subject of speculation this year as it struggles to find an equilibrium since the Covid-19 pandemic began in 2020 which ushered in a freight boom lasting around two years. But what many don’t know (or remember) is that 2019 was a soft year for the industry, making the need for rapidly expanded capacity much more pronounced and its subsequent effects on carriers less predictable. An important but often overlooked caveat to the freight boom was the previous reduction in fuel costs from 2018, and 2019 which also gives insight to the relationship between traffic congestion and its effects to carriers costs. The American Transport Research Institute began tracking this source of cost pressures to carriers in 2012 and has since updated their methodology in an attempt to accurately identify how the industry faces operating costs from a variety of perspectives including the effects of idle time, wasted fuel while trucks manage high congestion areas, and more. To date the cost of congestion has proven to be a significant factor in the industry and has implications for multiple points of pressure currently being faced.

Below is a table representing the Annual Operational costs.

• Between 2016 and 2021 shown above it shows how the multiple costs form a trend. After 2016, rising fuel prices, and driver wages contributed to rising costs in 2017 and 2018. Fleets increased spending during this period due to freight market strength that began in 2017 and continued through 2018. The market then softened considerably in 2019, leading to a drop in capacity and truck volumes.

The pandemic in 2020 the Covid-19 pandemic created a unique situation for carriers as demand increased while consumers received stimulus, and were under lockdowns, coupled with much less congestion offering more stable and consistent route travelling and lower fuel prices when demand softened (fuel costs also had fallen under their averages). In 2021 the industry saw a truck, and part shortage and a rebound in diesel prices signaling the beginning of cost reversals for many and began quickly eroding cost saving from the previous two years which has yet to look back. This is the time the industry started to see a sharp reversal in operational costs when averaged against the 2016 period and totaling 27% between 2016/2021, at the same time U.S consumers saw CPI increases which translated to increased costs to carriers and forcing them to be mindful of potential cost saving measure now that lockdowns were largely over and highway congestions were starting to effect costs more.

The industry as a whole was no seeing a complete reversal of trend and accelerate while the macro environment generally speaking was becoming more difficult at a consumer level also, a dynamic which hadn’t been felt since 2019 and quickly eating through cash quickly. Between parts issues, and other supply chain adjacent problems, higher driver compensation, the beginnings of a weakening in consumer demand, and higher traffic congestion causing delays and higher idle times. The entire industry was in the early stages of pivoting and also trying to deploy climate change initiatives and streamline operations to increase driver productibility, during that time there were still shortages of drivers but at the same time industry leaders were attempting to make up for shortages by finding ways to increase said productivity of existing fleets. Congestion was averaging 3% of total operation costs or ~$7,000 per truck and trailers in operation (it’s estimated that 6.9 billion gallons of fuel was unnecessarily used in 2021 due to much greater congestion related to the average, costing the industry an extra $22 billion).

There’s an argument to be made as GDP has risen it effects costs related to the industry, for example the study found some of the areas where higher costs and congestion occur are also the same areas GDP has risen the most (Memphis being one of the greatest). Memphis is one of the most important hubs in the country having strong intermodal, air, and an inland port. It has also seen the biggest growth in freight volumes (and delays) in the nation over the last 10 years, this has been exaggerated further as the southern and eastern ports saw the shift from Western regions as port costs have risen due to many factors (congestion being one) and has also led to Memphis seeing the largest growth in job creation and has outpaced the national average.

Why does this matter? In these trying times for the freight market we have seen major structural changes which include most recently (and even more concerningly) broker shutdowns, mergers within the trucking space as a whole, and massive volume shifts/instability forcing carriers to adapt to multiple moving targets. Cost saving measures have been effective and competition between industry leaders has been hot to the touch (most notable the bidding war for Yellow Corps infrastructure ultimately won by Estes) however carriers are still under pressure ands consumers are still in the process of scaling back leading us all to wonder where we go from here. Finding ways to maximize efficiency, build resilient portfolios, and maintain healthy margins can be achieved but at the end of the day trucks still need people to drive them, fuel to run them, and roads to drive them on.

Through the Bipartisan Infrastructure Bill the federal government aims to bring $1.2 Trillion into the economy to combat the $94 Billion annual cost and stands to make a big dent in congestion problems across the nation which will in turn relieve a major portion of the burdens faced by carriers. But if there’s one thing I know about the government it’s the incredibly slow turnout of major projects, for example the aging bridges and overpasses which have been largely left on the back burner in many regions due to State level conplications. This funding and the benefits will make a difference yes, but that won’t happen overnight and from what I can see many in the industry have faster growing concerns about consumer demand which is on the front line of the battle to survive a economic slowdowns in any form. Not to mention highway congestion is only made worse during updates to the country’s current aging infrastructure and give no immediate ease to the instability facing the entire freight sector and trucking. Truck and trailer leasing have suffered, spot rates have given no clear signals which in my opinion is worse than a trend in either direction, belts are continuing to tighten while consumers also face persistent pressures. Will the holiday season give us a sign? Maybe, but that sign won’t show up until spring-ish 2024 and by that time there will only be more pressure on consumers given the effects of student loan repayments and a smorgasbord of other factors currently taking shape in the macro environment. Only time will reveal how the industry moves forward in 2024, I don’t have a resolution but I do have hope for stability albeit as I have said before not until 2H24. Until then, I feel those with strong fundamentals, efficient fleets, and well-established contract negotiations will stand out as value in this tough landscape while the fat will be trimmed as less capable names will likely go the way of Marten, Yellow etc..

The Faith in Models Will be America’s Undoing (@RealJohnGaltFla, MacroEdge Contributor)

For the long time followers of these pages dating back to 2007, this opinion piece shall not come as a major shock or surprise. But for those who are new to my insane rants, it would be wise for you to file this in your memory banks as an important marker as to where American society is today and why our insane addiction to the output of computer models might well result in the implosion of the once great American economic and political system.

In fact this past week, the faith in modeling cost people their homes, their livelihoods, and their lives. The following video is not an indictment of the National Hurricane Center which has done a fantastic job in recent years, but in mankind’s innate desire to have faith in the output of man-made data being input into these systems.

Did you hear about Acapulco practically being wiped off the map this week?

Few Americans in fact did or cared. But how was a forecast this bad that the residents of this once flourishing tourist destination fail to get enough warning? In fact the graphic below is the National Hurricane Center’s model just three days before landfall which occurred on October 25th.

No warnings, no major concerns, and why should they have any? Per the model output it appeared it would be a minor tropical storm with no impacts before dissipating and becoming a depression or tropical low. Even after adjustments to the data input, just one day before landfall, the only warnings were tropical storm warnings, to which most people in Mexico and places like Florida accept as a normal occurrence because we have learned to live with the tropical weather and the forecast models from the NHC have been so effective.

The storm came ashore as a category 5 hurricane with 165 mph winds and higher gusts. The devastation as the video above illustrates, was widespread and as catastrophic as one would expect.

Can we pin the blame on the computers and the mathematical models? No.

When All Else Fails, Blame the Computer

The immediate response to any crisis which causes undo loss of life or money is to immediately blame the computer or the system’s dependence on said computers. This is nothing new in our society. As recently as 2021, the Pentagon’s war game scenarios highlighted that our dependency on computer networks would be terminated almost immediately during an invasion of Taiwan by China. The outcomes were so terrifying, the Department of Defense scrapped its original designs for this conflict and hurriedly started to revamp their contingency planning. Unfortunately these are also the same nonserious people who have changed the parameters of previous war games to get the desired output from a computerized simulation in the past.

The very same mindset extend pervasively throughout the economic and financial system the American people participate in on a daily basis. The data being promoted and published to verify political claims of a magnificent economic expansion are doubted by the majority of the American public as those who are living with daily inflationary reality and financial strains are finding the reassuring nonsense publicized by most media as nothing more than economic propaganda.

This past week the world known as ‘FinTwit’ (Financial Twitter) was abuzz with the theory that we wold repeat the 36 year anniversary of “Black Monday” from October 19, 1987, these posts are ongoing even into this upcoming Monday, the 30th.

Everyone wants to be the “first” to predict another Black Monday event but for those of us who watched it happen live on television or on Wall Street can really explain why this is failure in so many different ways. The crash itself was a monumental event which temporarily ended a laissez-faire free market era where investing was just beginning to understand the impact of modeling and computers on financial markets.

The perceived cause of the crash has been summarized by those in the current financial press and historians as due to “portfolio insurance” aka, blame the computers. The reality is that the research into the causes created some actual logical papers which helped to dissect the problem and really laid waste to the idea that portfolio insurance was the main cause of the crash. Noted economist Robert Shiller’s piece summed is up nicely:

“Portfolio insurance, because of the rapid growth of its adoption by institutional investors just before the crash, does qualify as something unique to 1987. It ought to be explored in the search for an explanation for the very different behavior of the market in that year. However, the technological advance represented by dynamic trading strategies is not of the kind that would seem to create changes in investor behavior of sufficient magnitude to cause something like the stock market crash we observed. Ultimately, the technological advance allows us to optimize our trading strategies. But even without any knowledge of the theory of dynamic trading strategies, an intuitive portfolio manager with the same objectives might well roughly approximate such portfolio strategies, though not optimally.” -Robert Shiller, Portfolio Insurance and Other Investor Fashions as Factors in the 1987 Stock Market Crash

If none of this seems familiar in this current investing environment, then one is simply doing their best imitation of an ostrich, hoping and praying that the powers that be know what the hell they are engaging in. The truth is far scarier, and should be a warning to everyone involved.

Bad Data, Bad Math, Bad Output

The unfortunate part about computer modeling is that it is one hundred percent dependent on human input. It is no different than political polling, a very hot topic nowadays, whereas if a human provides false answers, the polls provide false expectations. The very same applies to economic and financial modeling which is no different from 1987.

A primary example, and constant complaint of this author, is the idiotic birth/death modeling designed to estimate a perceived number of new jobs created which is basically created by throwing darts at a dartboard. The BLS defines it as follows:

Birth–death adjustments are model-based estimates. They are based on the history of business births and deaths as observed in the Quarterly Census of Employment and Wages (QCEW).

If business conditions are improving, then there should be a larger number of businesses created, correct?

If the population is not expanding at a fast rate and many citizens are choosing the gig economy now for economic survival, one has to ask just how bad the quality of business formation is now, and what happens to these “gig” workers when a real economic contraction occurs.

This modeling technique should work accurately as long as the administration in power does not pressure or force revisions to provide desired political outcomes. The reasons to doubt these estimates is by analyzing actual statistical data regarding birth rates and business creation. For example, the United States is now bouncing of its lowest birth rate in history, far below the replacement rate for citizens who are aging out of the workforce and dying in larger numbers.

Meanwhile, with the population growth stagnating, the labor participation rate has only recovered to levels last seen in the late 1970’s. Thus the doubts begin to creep into the reality of the BLS modeling when the BLS publishes data like this:

This is why I consider WARN notices, state unemployment claims data, and bankruptcy filings as a much better metric for measuring actual employment growth or declines. The Federal government is still operating its data modeling with the same lack of self-awareness as they have since the Obama administration. If one remembers, the Obama administration pressured the BEA (which was compliant) to revise the measurement techniques for GDP to provide a more favorable picture of the economic recovery than reality. These changes persist to this day and are used to provide desired outcomes versus realistic measurements of economic performance.

Of Luddites, Ignorance, and Repeating History’s Mistakes

The measurements president in last week’s GDP report showing 4.9% growth are as I’ve indicated above, laughable at best. A few week’s ago I penned a piece on these pages titled “The Economy is Sinking so Follow the Smart Money” which is warning of the dangerous divergences appearing in credit markets and the economic data underpinning the appearance of “growth” in the broader economy. The data point within that article was the indication of tax receipts which should be surging at the national and state level, especially if the economy is still expanding.

The problem illustrated by that conundrum is but a symptom of what happens when actual data, not estimates are used for analysis and the alarmists are dismissed as attention seeking doomers. This is not the first time this has happened in history, nor will it be the last.

Preceding the Great Financial Crisis (GFC), economist Raghuram G. Rajan dared to issue a paper for the 2005 Kansas City Fed Jackson Hole meeting which flew into the face of Greenspan’s folly titled Has Financial Development Made the World Riskier?

From this paper, Rajan dared to rain on Greenspan’s party by pointing out the risks if CDS (Credit Default Swaps) and stated the following.

“The interbank market could freeze up, and one could well have a full-blown financial crisis.”

In this paper he also stated that liquidity and illiquidity would become major concerns, yet few would listen during this era.

Individual banks, obviously, did not step up to save the mortgage lenders, the GSE enterprises (Fannie and Freddie) collapsed, and ultimately the Federal Reserve and other central banks around the world had to stop the collapse in 2009. For his bold warnings in 2005, the “esteemed” Larry Summers, at that time the President of Harvard found the paper to have “basic, slightly Luddite premise.” A special thank you to Danielle DiMartino Booth for that reminder from page 95 of Fed Up.

Fast forward to this current situation. The banks began to collapse in February and March of this year and the Federal Reserve started a backstop program to inject liquidity which of course has become the methadone treatment for our regional banking system.

The “emergency” lending facility is still at its highest level ever, with no signs of it winding down. As rampant speculation is coming to an end in real estate, cryptocurrencies, and the “artificial intelligence” bubble deflates. All while the government is increasing spending for the potential of a broad multinational conflict which would only further cripple economic activity and increase societal instability.

The Federal Reserve will meet next week and odds are, they will repeat Volcker’s mistake from 1980 speculating and promoting the idea that inflation has been beaten and that economic stability can not afford any more rate increases; or words to that effect. The truth is that the Fed is still fighting the battles of 2008 and 2018, not what has evolved in our modern economy or markets. The models and systems they use are based on archaic economic theories which are not applicable to this modern society.

This leaves the Fed trapped in its own morass, with few viable policy actions that could not be called anything but harsh political and economic medicine if they were to raise rate to combat resurgent inflationary pressures. Regardless, the policy decision this will ultimately result in a return to QE by Q3 of 2024 as the their models will perceive the threat of deflation as far greater than a base case of persistent 3-3.5% PCE inflation for several years.

The situation our nation is in illustrates that our economic overlords are repeating the same historical mistakes of the 1970’s, the early 2000’s, 2005, and 2018. The lack of political, economic, academic, and military leadership is an almost perfect mirror image to the year 1979. This time however, a recovery from these policy and financial errors might take a decade or longer before a recovery in the US economy and our society is possible.

Revealing Achilles Heel Of The Magnificent 7 Tech Stocks & More (@GregCrennan, MacroEdge Contributor)

As we approach the end of 2023, we find ourselves in a landscape that is strangely reminiscent of Greek mythology. Just like the Titans back then, Achilles and Atlas, the US economy and stock market, once thought to be invincible over the summer like those Greek Titans, may have found their vulnerabilities. In this edition, we will draw parallels between these Titans and our current financial reality, shedding light on three key developments that are shaping the economic narrative.

1. The Fall of Tech Titans: Like Atlas Holding the Sky

The stock market has seen a roller coaster type year, and as we enter the final earnings season for 2023, the results from the world's largest tech companies are less than stellar. It appears that these tech Titans, once considered as enduring as Atlas holding up the heavens, have shown their mortality.

Early results from the "magnificent seven" tech stocks reveal that they are not invincible titans. Tesla, Microsoft, Google, Meta, and Amazon have all reported disappointing earnings, with significant declines since the summer ranging from -10% to -20% and even more from the record highs as much as -50% for the case of Tesla. Their extremely high price-to-earnings ratios today of 35 versus the market multiple of 18 mean they are priced for perfection, and these results have exposed their vulnerability.

CEOs from Elon Musk to Mark Zuckerberg have cited pessimistic macroeconomic conditions for their forward guidance. With interest rates hovering around 5.5%, investors are seeking better returns elsewhere, leading to increased risks for these tech titans. The S&P 500 remains uncertain, with 2023 gains slowly eroding away, & possibly ending the year with little to no growth.

2. Unemployment's Achilles Heel

Unemployment claims are on the rise, signaling a potential Achilles heel for the US labor market. Continuing claims have increased by 28% year-over-year, totaling 1.74 million, nearing the highs seen after the 2020 lockdowns. As company bankruptcies increase, like Rite Aid's recent fall, become more common, more Americans are left searching for employment opportunities.

Compounding this issue is the fact that companies, like Meta, have significantly reduced their employee head counts by 24% year-over-year. This reduction in hiring makes future economic growth increasingly challenging, further exposing the economy's vulnerability.

3. The Inflation Achilles: A Closer Look at Q3 GDP

While some headlines celebrate GDP growth of 8.5% in nominal dollars, it's essential to consider the details. After adjusting for inflation, the growth rate stands at 4.9%, driven in part by lower gas prices on a year-over-year basis which showed YoY declines in the reports. However, most other consumer goods have seen nearly a 10% increase in prices, suggesting that we may not be witnessing real growth but rather increased expenses on essential goods.

Another red flag is the decline in the personal savings rate, now near record lows, at $776 billion, down from $1.04 trillion, representing a quarter-over-quarter decline of approximately -25%. Real disposable income has also fallen by 1%. These trends, along with the fact that credit card debt has surpassed $1 trillion and delinquencies are rising, indicate that consumers are prioritizing their financial obligations selectively. Banks and credit card companies, like Mastercard said on their earnings this week, are forecasting weaker revenue in anticipation of economic slowdown.

In summary, the once "invincible" US economy and stock market are facing significant challenges due to inflation and higher interest rates. Like Achilles and Atlas of the Greek titans, they have found their weaknesses. The tech titans are faltering, unemployment is rising, and the true growth of the economy remains in question due to inflation, higher interest rates and consumer debt.

As financial analysts, it's our duty to keep a watchful eye on these developments and provide you with insights to navigate these challenging times. Stay tuned as we will continue to dissect the ever-evolving financial landscape.

Excellent read!