12/29 Weekly Macro Note: What's Left in 2025

In this very brief Weekly Macro Note - we review what's left in 2025, things to pay attention to the in the last week, and highlight the remaining 2025 updates we'll be giving each day.

Don Johnson (@DonMiami3), Chief Economist

Good Sunday evening MacroEdge Readers & Community,

This evening we’re going to keep it very short as we continue the end-of-year / holiday mode during this quiet period in markets. Volume should continue to remain well below average, and we’re continuing to see a massively historic run-up in precious metals (with gold >4,500, silver >83, platinum & palladium moving higher, and copper nearing all-time highs).

In the next three reports, we’re going to cover more details about what’s new for Ozone in 2026 as we gear up for new data on 1/1 - including our data center data, hiring data, and inflation data. We’ll have our full ‘Year Ahead’ outlook on 12/31 - going over our early-year forecast and outlook - looking at everything from equity markets, to employment, inflation, and more. As we turn into the new year, you’ll also be seeing from 2-3 new contributors under our ‘Macro Research’ umbrella, and we’ll start to ramp back up into our full report cadence come 1/5 as the new year kicks into high gear. Very much looking forward to the year ahead and the last few ‘update’ geared reports for 2025, and stay tuned for what’s in store, there are a lot of exciting things in the pipeline.

Economic Data Calendar:

The coming week is very light outside of ISM Manufacturing data & Fed minutes.

December 31st, 2025 (Half Day - Bond Market, Full Day - NYSE)

January 1st, 2026 (Full Day Market Closure – Thursday)

Remaining Reports for the Rest of the Year:

12/29: A Special Ozone Welcome for 2026 - Ozone & Pro

12/30: Midweek Macro Note, New Data from MacroEdge

12/31: The Year Ahead - Welcome to 2026

Attention for the Week - The Nikkei & Crypto

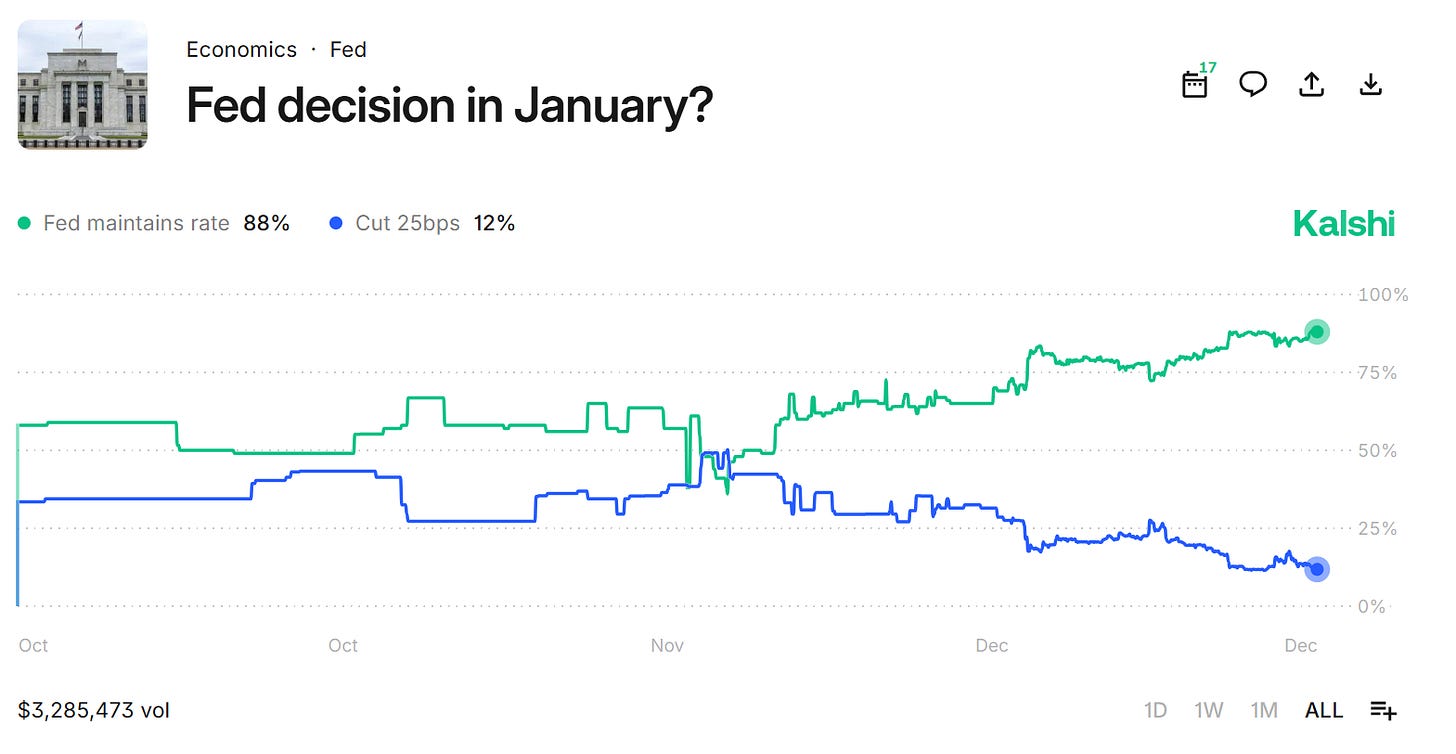

While we’ve fully ‘priced out’ - or just about - the cut next month, the data over the next few weeks may reverse that. There’s not much to disturb those CME odds this week, and the same goes for the prediction markets, with roughly a 9/10 chance of no cut:

While I am most interested to see what happens next with the Bank of Japan and interest rate policy there - given the implications of what cuts, rather than hikes, would signal - for the time being, it does not seem like the BoJ has the conditions it needs to even remotely think about easing. If anything, they hiked too little at the previous meeting as judged by movements in yields & the Yen, though the Nikkei has been a pretty long-term.

Bitcoin remains another key signal during this lull period, and has been sideways for over a month now after it’s steep drop in October / November:

Data is shallow this week, and volume & trading action won’t pick up now until the new year when institutional traders return from the long Christmas/NY ski & beach vacations. I myself am glad to be back in the United States, and we’ll continue to have some more light details over the pre-NYE week.

Have a great start to the second holiday week, and we’ll see you for the report tomorrow.

For more details, please refer to our Terms and Conditions.