Midweek Macro Note 10/2: Stepping off into a Data Free Nation, the Latest Technicals

In this Midweek Macro Note we discuss the lack of BLS/BEA data, how we're filling the gap, the latest on Institutional Research, bailouts for farmers, technicals, and much more. #MacroEdge

Good Thursday evening MacroEdge Readers & Community,

At the time of this writing - we’ve stepped off of the train in Shinjuku Station into a data free nation (at least for the time being). With the Bureau of Labor Statistics & Bureau of Economic Analysis halting all data collections and analysis, as well as releases for the time being, we’ll do our best to continue filling those gaps in the employment and inflation data.

With the government shutdown likely to last until about October 15th or 16th - likely the earliest unless a deal is reached over the weekend - we’ll have very light data through the middle of the month. Markets have shrugged off the shutdown, largely as expected, and the money supply (M2) is again expanding at its most rapid pace since the post-pandemic free cash era. Tomorrow was supposed to be a key employment data day for sealing the deal day on the October rate cut, but the ADP employment data is likely what the Fed will be taking into consideration for the cut, along with regional Fed surveys & the Beige Book. ISM & S&P Global readings were soft, but not horrible, so the most likely outcome is a 25bp cut.

Institutional Research Update

Links for all of those who submitted a form for Institutional Research will be dispatched this evening, or tomorrow, and the October Institutional Research Report will be available on Saturday.

Included in Institutional Research:

Monthly Institutional Research Report A detailed publication covering macroeconomic data, financial market developments, and critical insights for portfolio positioning.

Full MacroEdge Portfolio Viewing Access

Clients can track two distinct portfolio strategies, with transparency into performance, allocations, and risk exposures.Interactive Research Dashboard

Access to the MacroEdge Research dashboard with 100+ live charts and analytics tools for real-time monitoring of markets and economic indicators.Macro Notes Coverage

Includes all Ozone Macro Notes, monthly research notes, and inter-month updates that capture major global and domestic market shifts.Portfolio Strategy Alerts

Direct, actionable alerts tied to MacroEdge’s strategic views, helping clients adjust portfolios quickly as conditions evolve.

The new Substack for Institutional Research will be available on Saturday, and reports will be posted there (and distributed via email) and in the new Macro Research dashboard.

Those upgrading from Ozone to Institutional Research (IR) will automatically have your account type transitioned; billing will not occur for two separate accounts as Ozone is included in IR. For those of you have multiple Ozone accounts under an enterprise profile, and are upgrading to IR, please contact our team at Info@MacroEdge.net, where we can now assign multiple users under one parent account.

It’s a beast of a report coming this weekend, so don’t miss it.

New Data Coming During the Government Shutdown:

MacroEdge Monthly Inflation Composite Index (Ex & Inc-Energy and Food)

MacroEdge Jobless Claims Estimate*

MacroEdge Recession Indicator

MacroEdge Employment Momentum Index

MacroEdge Market Valuation Signal

No Data for our Employment Forecast

Tomorrow would’ve represented the latest release from the Bureau of Labor Statistics for the September employment report - but we’re relying on the data from ADP for the latest.

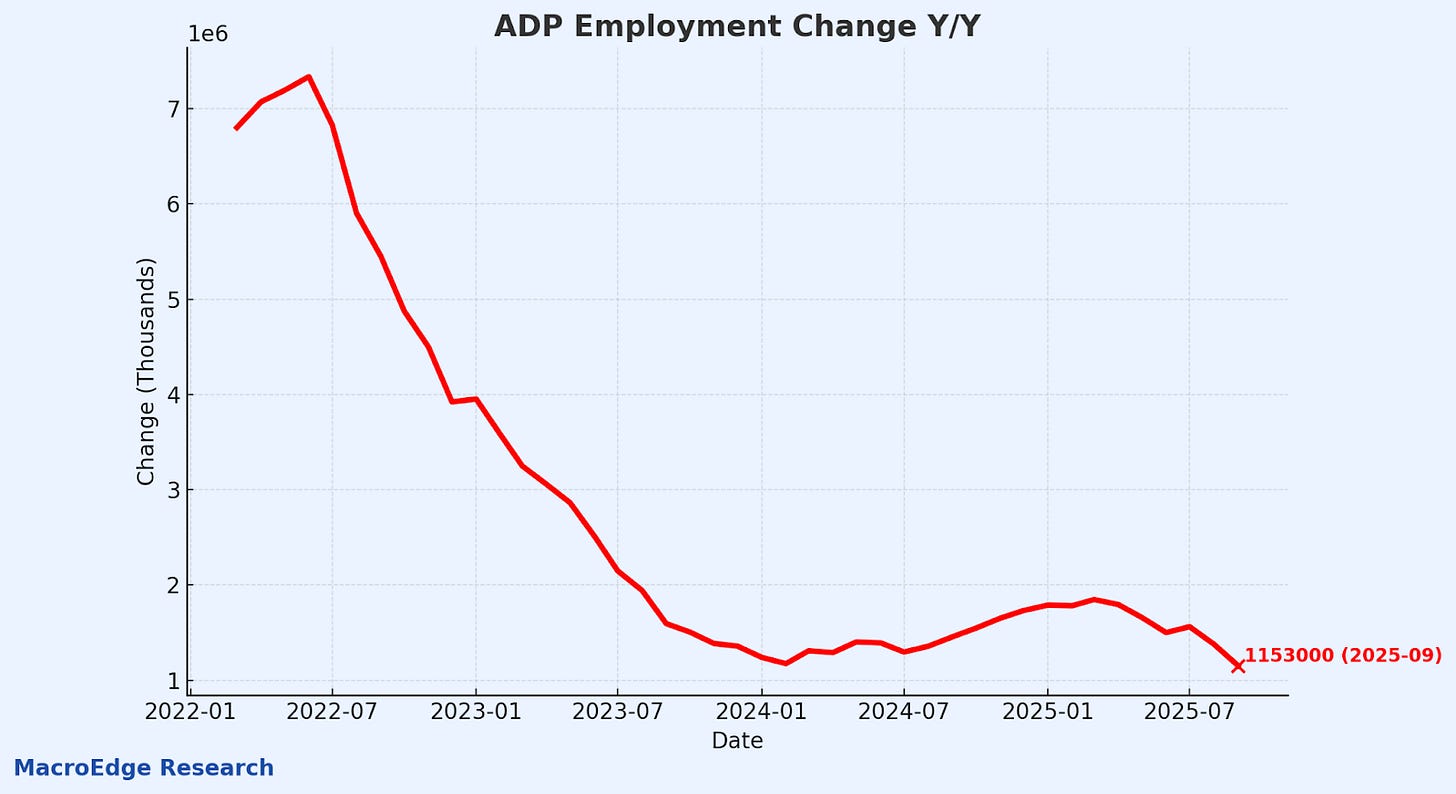

The employment growth rate continues to slide, though the data from last month from ADP will likely be revised up. The data from ADP gave us a lock on the rate cut this month, and next – which means the Fed is easing further in a stagflationary environment:

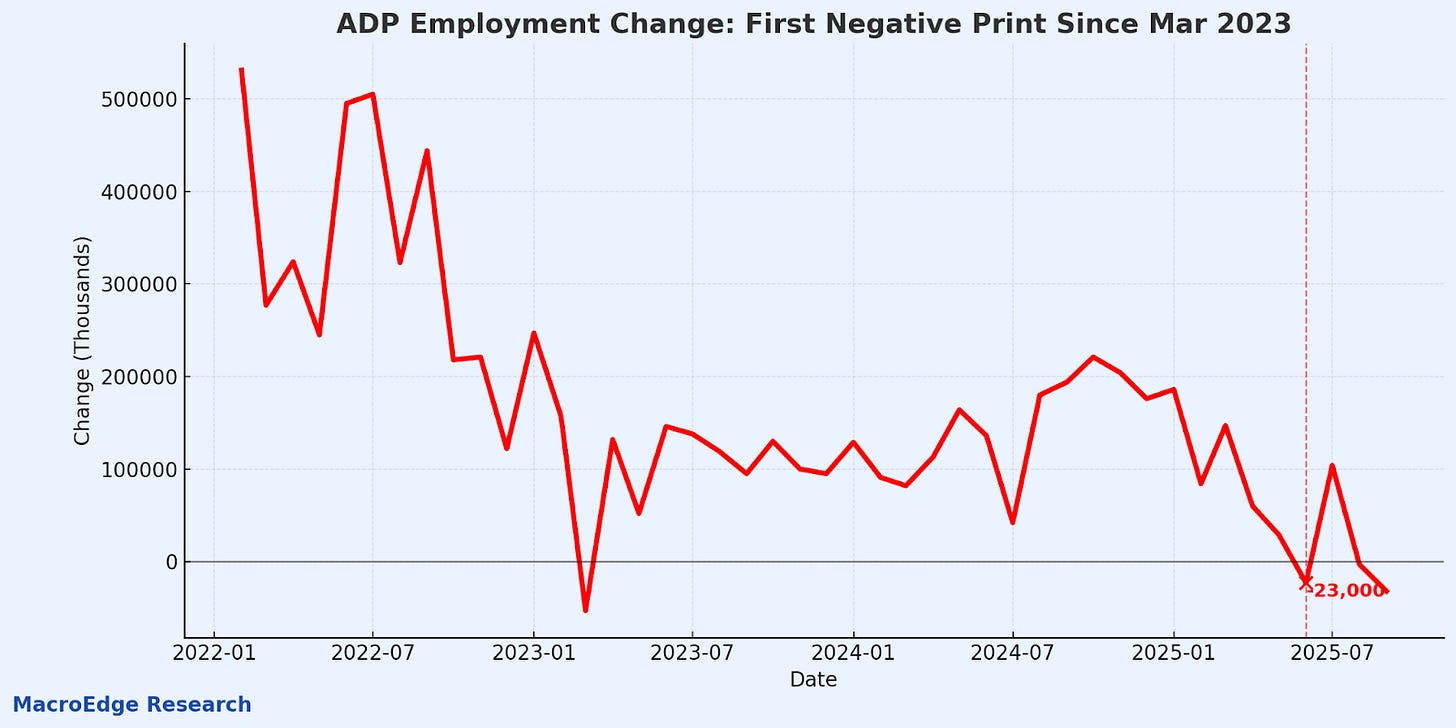

Viewed in monthly terms…

The first pre-revision negative print since March 2023:

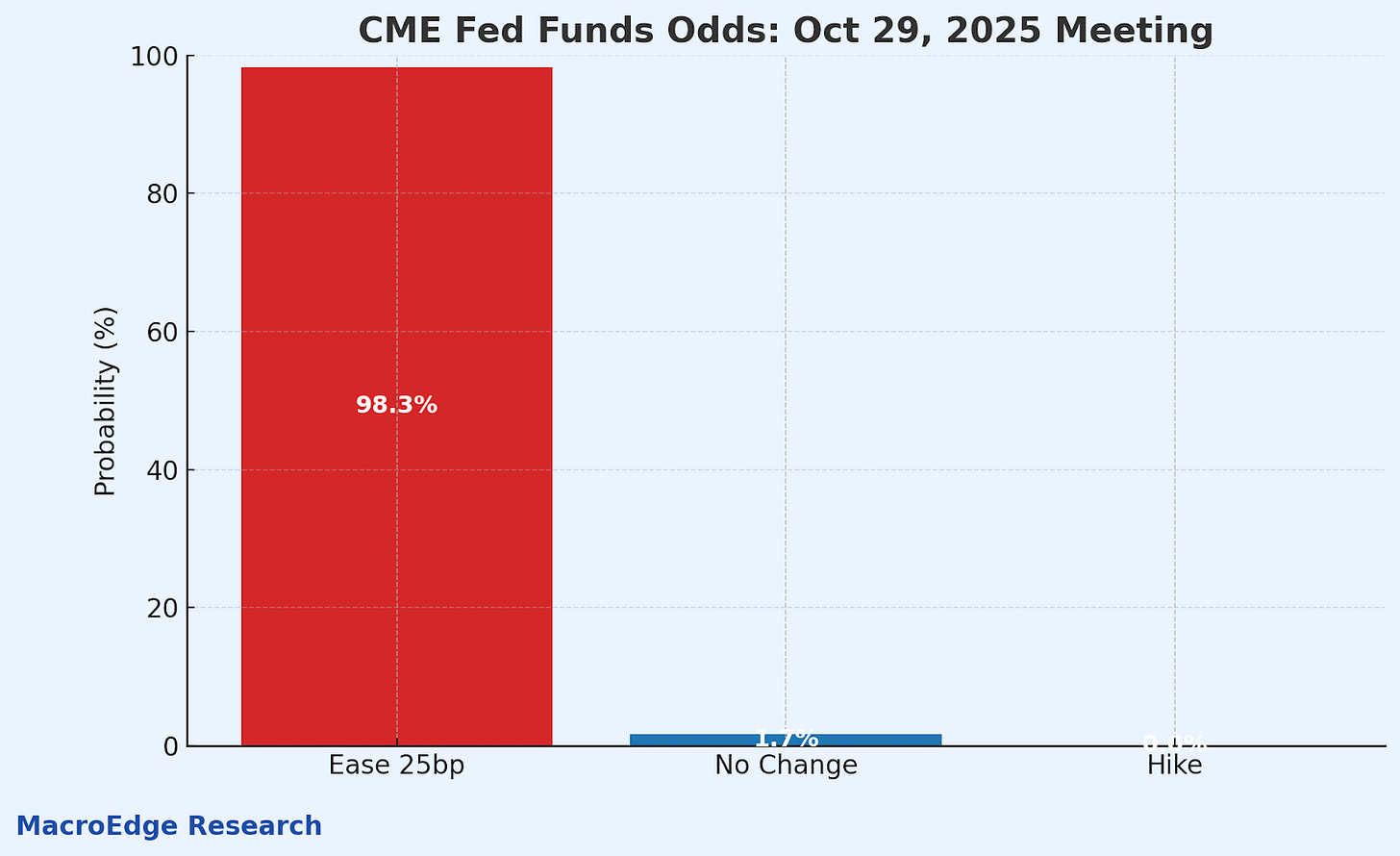

October Cut is a Near Lock

With the ADP employment data for September - and lack of inflation data likely next week - odds of a rate cut jumped up to almost 99%:

With the lack of data now, we can turn our attention the bond market for signs of further Fed action as the government remains closed (especially on the short end) - being the signal for macro weakness (especially in labor) and risks (in inflation). The 3-month and 2-year yield are are best signals. Mortgage applications fell sharply w/w as the lower rate hype and mini-refi cycle already showed signs of waning, largely to be expected.

Bailout Coming for Farmers

The administration announced a proposed bailout for U.S. farmers today valued at between 10 billion and 14 billion dollars. The money would be drawn from federal tariff revenue rather than new congressional appropriations. The package is designed to support farmers facing higher input costs and disruptions linked to trade policies. Aid would focus on soybean producers and extend to other parts of the farm economy.

Implementation of the bailout is complicated by the ongoing government shutdown that began on October 1. With USDA operations suspended, including farm payments, disaster aid, and loan services, distribution of the funds is expected to be delayed until normal operations resume.

The Latest Technicals

Nasdaq 100:

Keep reading with a 7-day free trial

Subscribe to MacroEdge to keep reading this post and get 7 days of free access to the full post archives.