Midweek Macro Note 11/5: Walking the Superbubble Right into 'Too Big to Fail'

In this Midweek Macro Note - we discuss concerning comments from Nvidia CEO & OpenAI CFOs regarding their 'too big to fail' nature, talk macro data, election results, Hoover, and more.

(@DonMiami3, MacroEdge Chief Economist)

Good Wednesday evening MacroEdge Readers and Community,

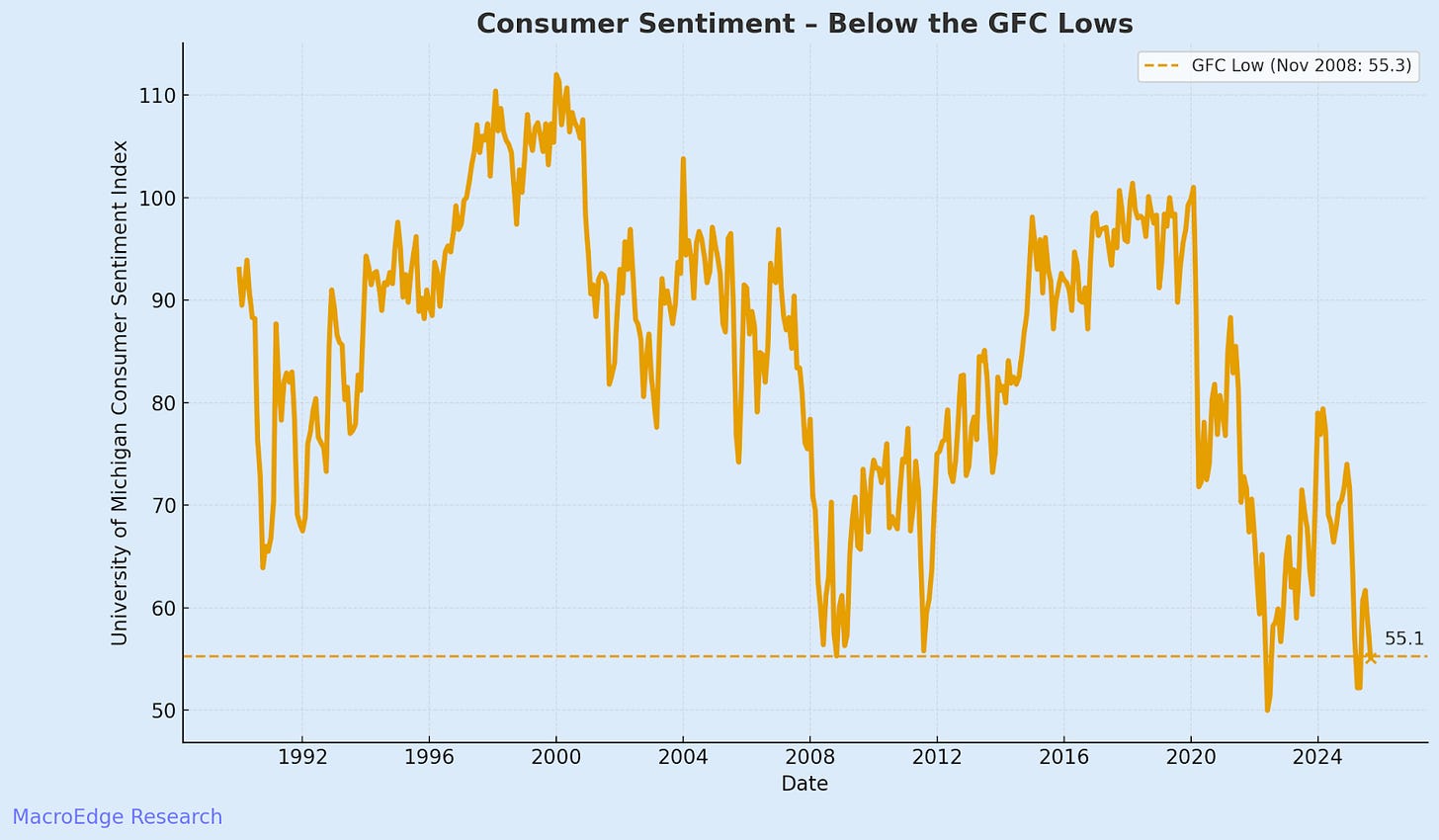

As I still find myself in Arizona this evening, waiting for a much anticipated return to Florida on Saturday (we’ll see how these DOT flight limitations go…), we’ll continue with our briefer macro note theme this evening for the Midweek Macro Note. It’s of no surprise that the election results yesterday evening trended the way they did based on all of our broad gauges of consumer sentiment, economic happiness, and employment data. You simply cannot run an economy for the 10% forever, without consequence, though it appears the incumbents seem hellbent on doubling down on that while they have another one year stretch to do just that. Unfortunately, when we misconstrue the Frankenstein bubble of today that’s being inflated, with capitalism - as young voters often due - the result is oftentimes socialism and communism - which is a very, very concerning trajectory if these conditions continue to accelerate.

While it may sound like *doom* today, we continue to follow a unique variation of what I’ve dubbed as ‘Project South Africa’ that continues to seem to move just a little bit faster by the way. The problem for the leaders today is that they’ve now enabled the bubble itself to get so large, broad, and intertwined with the actual economy and consumer spending that even a 2% drawdown terrifies them… in the 5% KOSPI / 4% Nikkei drawdown of yesterday - it was all hands on deck at Asian central banks, with leaders saying they were watching closely with ‘grave concern’... similar sentiment was echoed in Switzerland…

Every day the game goes on, we shift more & more towards the rock & a hard place analogy, with the eventual outcome being something Americans shouldn’t desire.

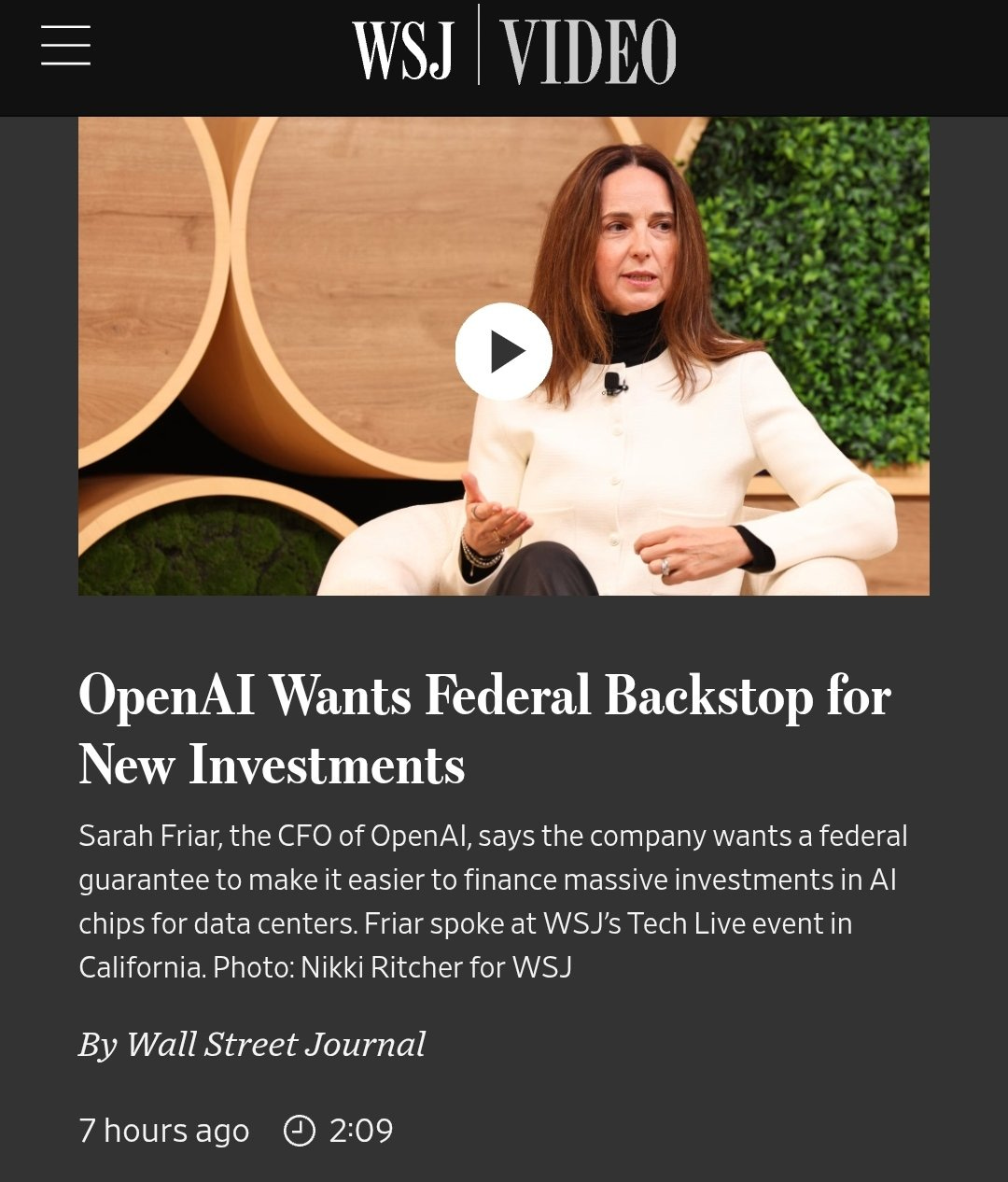

Because of our (and particularly my) pragmatic approach to forecasting at MacroEdge, we continue to correctly see the future. One of the many examples arrived today with the CFO of OpenAI stating that they ‘want federal backstop(s) for new investments’...

This should concern anyone with investments into data centers and LLMs. If the supposed gold standard, Altman’s cream of the crop, is now backing away from an IPO until they are pre-guaranteed bailouts, why should we trust any of the other companies following the exact same footsteps?

Like most bubbles that run away, this one is now far too progressed and far too big, that the government will again have to decide if they can tackle this national security risk (being the bubble itself) through the gradual deflation of it, or they continue to enable the parade and circus - resulting in far more severe consequences down the line. Maybe the outcome will be much the same as previous responses, in a new era where only a small select few are represented by policymakers, and then we’re left wondering why political outcomes will continue to grow more concerning…

For those thinking a *woke* trend is dead or disappeared, it’s simply hiding in the shadows, waiting to re-emerge with greater vengeance than ever before. With that being said, let’s dive into our brief note.

Macro Data for Rest of Week

We’re likely to see talks start to lift the government shutdown as quality of life for millions becomes impacted, data will resume by the end of month this month or in December - with Trump explicitly calling out the shutdown numerous times today. For the time being, it looks like the card was overplayed, and it hasn’t panned as GOP members were expecting it to.

Ozone Pro - The New Way Forward

We are continuing to release improvements and data additions to Ozone Pro this month, with a more robust live portfolio strategy interface on the way, that we have discussions on with another firm tomorrow.

MacroEdge Ozone Pro is for those looking for a far more in-depth experience than what those with Ozone are getting, including, in my opinion, most importantly - our two portfolio strategies - the MIRP & GMSP.

Get four week access to MacroEdge Ozone Pro, below:

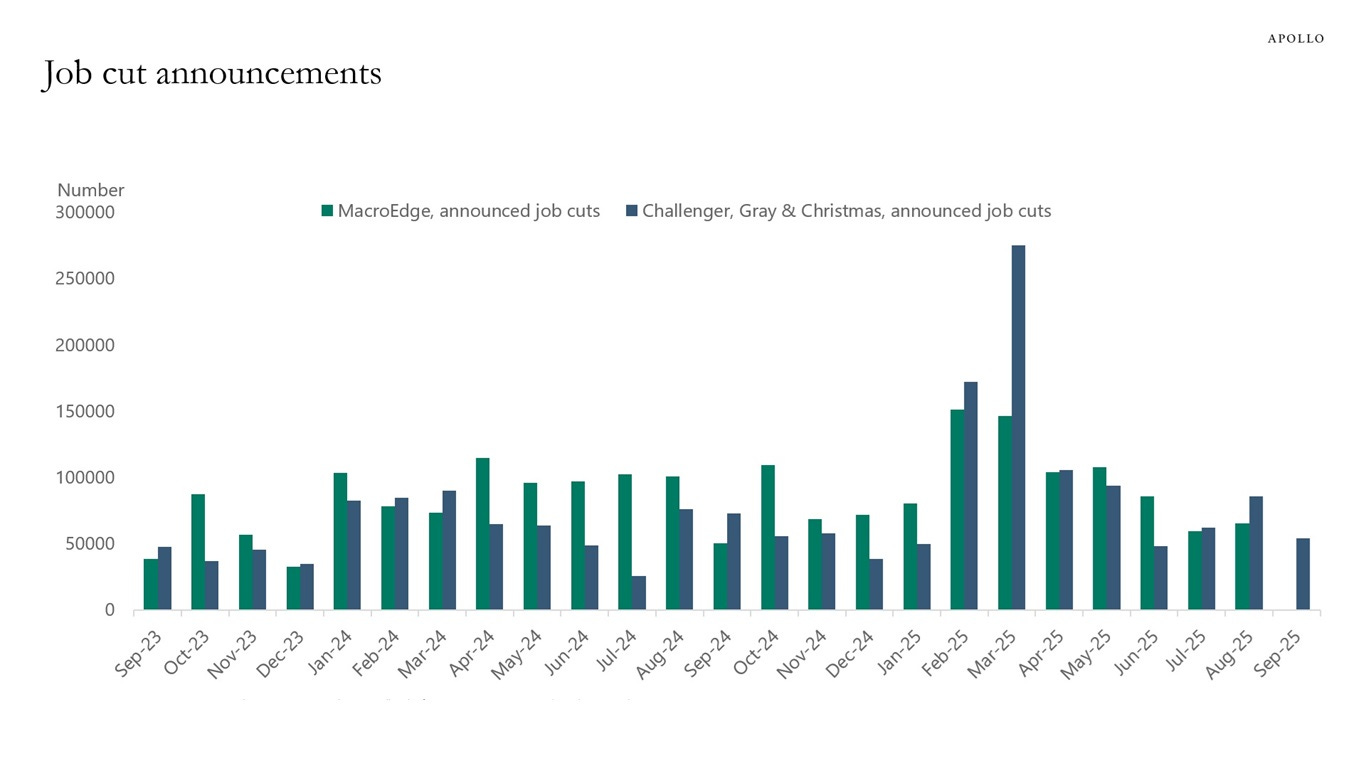

Our Data in the News

With the government shutdown at the top of mind, and with economists, funds, and companies seeking out alternative (and in our opinion - far more accurate data) we’ve seen MacroEdge data in CNBC, Bloomberg, Fox Business, Apollo over the past week, which is tremendously exciting. Many of these clips will go out on our YouTube page over the next two weeks…

MacroEdge highlighted as alternative labor market data provider by Apollo:

https://www.apolloacademy.com/alternative-labor-market-indicators/

We continue to lay the foundation for something much greater, and as we continue to expand our capabilities, and team, releasing superior research, data, and professional services work to our clients around the globe remains the #1 priority.

Too Big to Fail is Now a Business Model

While I am typically deeply critical & harsh of any business or business model that requires taxpayer dollars or funding, the developments with the comments from both OpenAI and Nvidia today are deeply concerning. Both companies are now framing their operations (and respective bubbles) as too big to fail.

In the case of OpenAI’s CFO, Sarah Friar, signalled that the company is seeking a federal back-stop to make massive AI-infrastructure investments feasible, suggesting the firm already views itself as “too big to fail.” Her remarks that the U.S. government could guarantee financing for data-centres and chip upgrades underscore a shift from private-sector risk to taxpayer exposure. If a private company expects public-sector guarantees to fuel its expansion, it raises serious moral-hazard and competition-policy questions.

Jensen Huang warned that China’s rapid advances in artificial intelligence pose a “national-security risk” and that semiconductor leadership is now a battleground. He emphasized that the U.S. must retain dominance in AI chip manufacturing and ecosystem control to prevent adversaries from gaining a technological foothold. Are the national security risk comments I made from several weeks ago starting to fall into place?

Bubble Talks are Emerging

With the re-emergence of Burry on X - something I expected just 4 weeks ago, the UBS chair warning of similar signals to 2008, and even central bankers warning about these data center financing structures - there’s no shortage of bubble talk.

(Continued below…)

Keep reading with a 7-day free trial

Subscribe to MacroEdge to keep reading this post and get 7 days of free access to the full post archives.