Midweek Macro Note: New Year, Same Markets? Nonfarm Forecast and Macro Data Recap

In this Midweek Macro Note - we dive into employment data from the week from the BLS/ADP/LinkUp/MacroEdge & more - discuss geopolitical developments, market risks, and much more.

Good Wednesday evening MacroEdge readers and community,

Tonight we’ll dive into a brief Midweek Macro Note - covering some of the high frequency data from the week thus far, and look at our expectations for the Thursday & Friday employment data, which is likely to continue to track in line with the trend we saw through the entirety of 2025. While equities have shown little care for a softening labor market, the Fed has shown much more interest in the deteriorating conditions, pushing rates lower (and we’ve also observed the short end dropping concurrently).

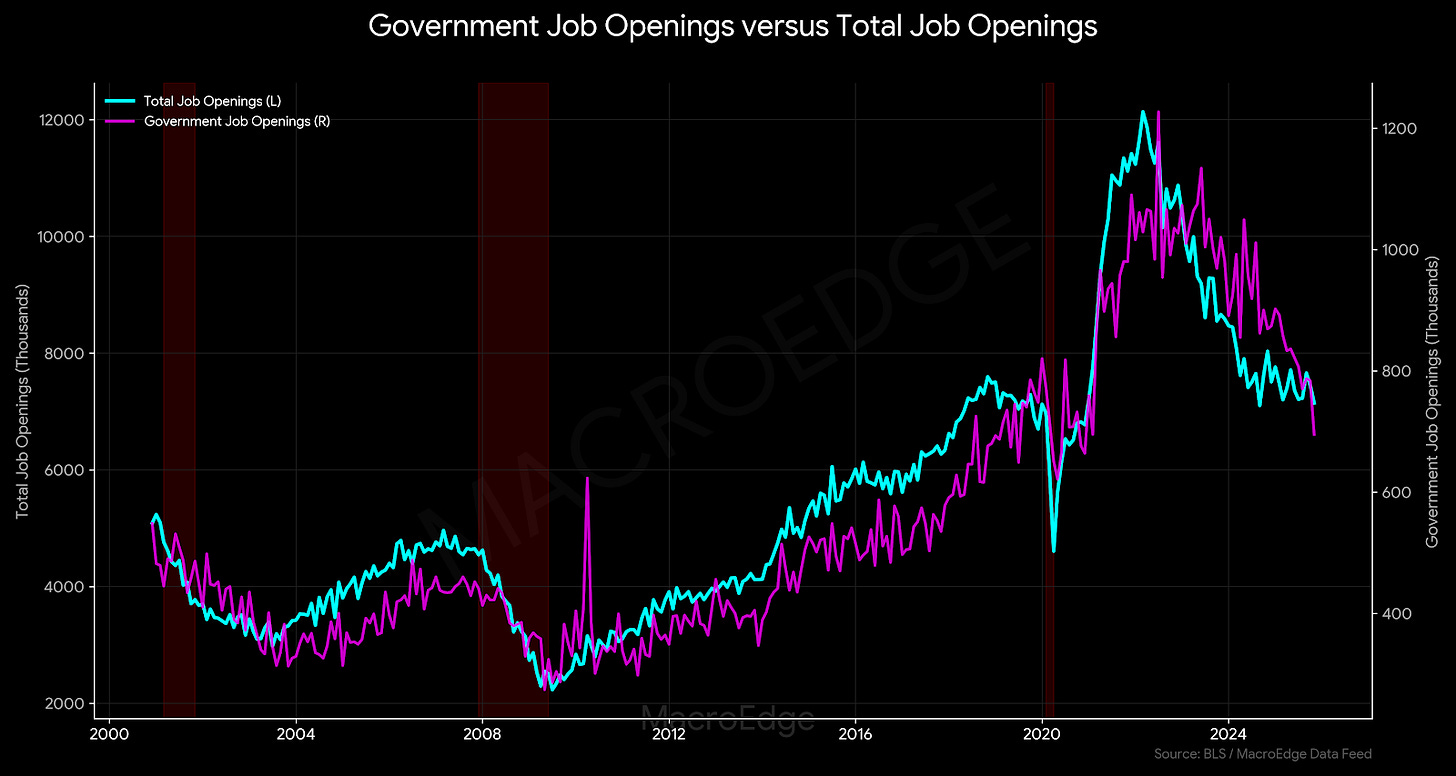

Today we saw job postings fall to their lowest reading since 2020, driven largely by the decline in government job postings, and ADP employment in the private sector (excluding education and healthcare) was also near 0 on a month over month basis. The Fed continues to grow concerned about the labor market, though it appears we will not be getting a rate cut this month, unless NFP prints sub-20K, U3 rises to 4.7%, or both. ISM data was mixed this week, along with S&P Global data. Also notable was the House of Reps voting to pass a Democrat extension of Obamacare subsidies for about 30 million Americans, signalling a potential shift in tone for midterms in a risky year for the GOP.

The 2-year has stopped pricing in further easing for the time being, and the earliest rate cut has been moved now to early summer. Some of the pause in further rate cut expectations has been due to a surge in commodities, which hit their highest level since June 2022 yesterday:

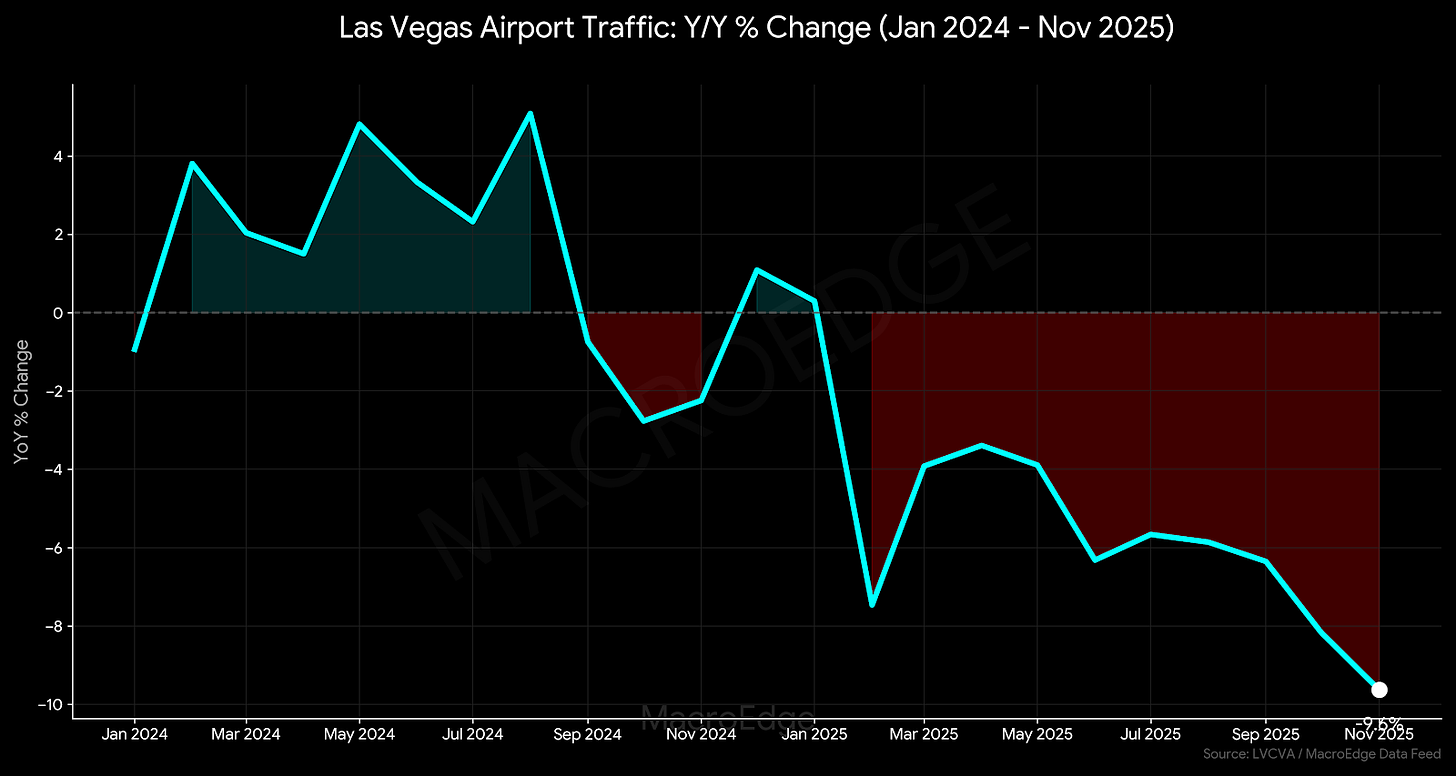

An interesting development in the travel data - international travelers continue to avoid the United States this year, especially in the Sunbelt states of Nevada, Arizona, and Florida. While it hasn’t disrupted markets & airlines to any substantial degree, it has been impacting tourism-heavy businesses and cities (like Las Vegas). While JETS - the airline ETF - hasn’t shown any signs of slowing, it may be showing its first signs of exhaustion in months as we see the number of airline travelers plateau and revenge travel continues to slow.

While influencer travel & ‘asset-class’ intensive travel remain robust - especially to Europe - there’s reason to believe that a slowing thematic could take hold this year as people shift their consumption habits. Travel and airline stocks remain ones to keep an eye on with these trends and shifts underway…

Though general recreational travel might slow, here at MacroEdge we’ll be busy continuing our mission of expansion across the Western Hemisphere… so we’ll try to make up for any drop in those influencers & the pajama-flyer crowd over the next year and more… Don’t miss our Friday Redeye Macro Note & Weekly Macro Note - where we’re going to discuss market opportunities to position for as we head into the middle of the month and additional real estate data next week. Get MacroEdge Ozone through Substack, or our website - and don’t miss a single market beat.

Also on Friday, we’ll resume daily editions of the Daily Macro Minute - found on our other Substack.

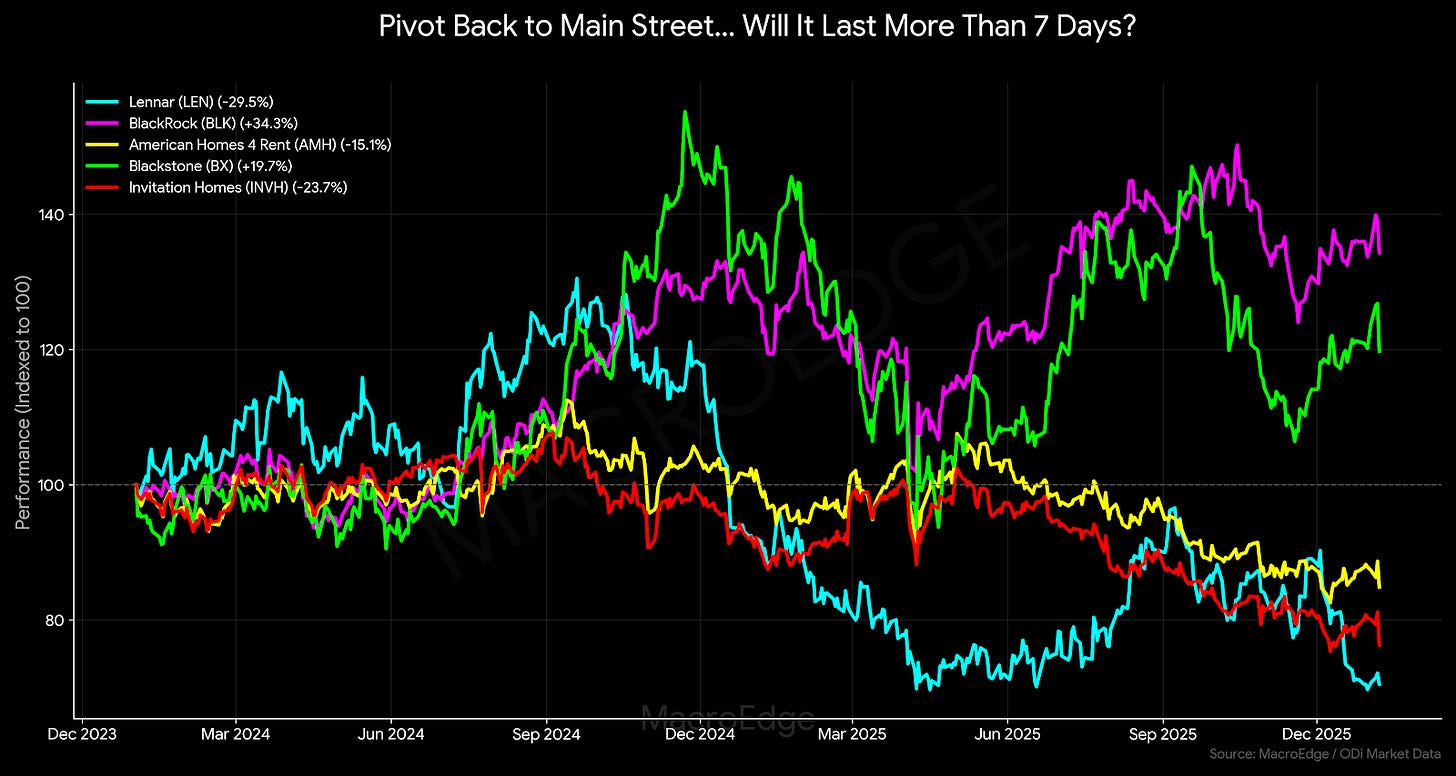

Pivot Back to Main Street?

The last two trading days, we’ve observed a minor shift in language and rhetoric as it pertains to ‘Main Street’. The Administration has done things like sink institutional single-family homebuyer stocks on news of a potential ban of these buyers from the single-family home market, and tank defense stocks on potential buyback bans, salary caps, and more. Bessent has also been very quiet over the last two weeks, with far fewer TV appearances, and this could be part of a midterm strategy to boost popularity (along with things like the Maduro raid) though they could be very short lived if it begins to spook equity markets. While there’s talk about Main Street, the Administration still has one of its largest priorities as the stock market, with the President discussing all-time highs and equity prices frequently.

Lennar has continued to get crushed, while single-family homebuyers Blackrock, American Homes 4 Rent, Blackstone, and Invitation Homes were all punished by the pivot today against institutional purchasing of single-family homes. While there wasn’t any particular language against build-to-rent, if the ‘anti-corporate’ theme is used by the GOP to attempt to minimize midterm damage, then we could see these equities continue to get punished over the next year… some of the equities have clearly already been aware of these shifts before the headlines have dropped.

Subscribe to MacroEdge Ozone via Substack below:

Venezuela/Russia Tensions Rising

The Trump Administration and its relationship with Russia have soured quite dramatically over the past week. The administration’s posture toward Russia has shifted from an emphasis on personal diplomacy and peace-brokering to a strategy of aggressive economic and military pressure. Over the last week, several key escalations have signaled this hardening stance:

Greenlighting of the “Sanctioning Russia Act”: President Trump has officially backed a bipartisan bill (led by Senators Lindsey Graham and Richard Blumenthal) that would impose tariffs of up to 500% on any country (including major economies like China and India) that continues to purchase Russian oil. This move is designed to fundamentally starve the Russian “war machine” of its primary financing.

Seizure of Russian Oil Tankers: In a dramatic escalation of the U.S. blockade, the U.S. European Command boarded and seized the Marinera, a Russian-flagged oil tanker, in the Atlantic. This follows a two-week pursuit and marks a rare direct physical intervention by the U.S. military against Russian commercial shipping to enforce energy sanctions.

Frustration with Peace Process: Reports from the White House indicate the President has grown “sick of meetings” and frustrated with Russian President Vladimir Putin’s perceived obstinacy in peace negotiations. This shift follows a phone call where Putin informed Trump of a Ukrainian drone strike on his property (a notification that failed to yield the diplomatic breakthrough Trump had anticipated).

Formal Security Guarantees for Ukraine: In a first for this administration, U.S. envoys Steve Witkoff and Jared Kushner attended a “coalition of the willing” summit in Paris. They committed the U.S. to binding security protocols meant to deter and defend Ukraine against future Russian attacks, signaling that any ceasefire would be backed by U.S. “backstops.”

Strategic Pivot in the Arctic: The administration has designated the acquisition of Greenland as a top national security priority, explicitly citing the need to deter Russian and Chinese military activity in the Arctic. The White House has notably refused to rule out the “military option” to secure the territory as a strategic defense hub.

Potential Defense Spending Surge: Citing “troubled and dangerous times,” the President proposed increasing the 2027 defense budget to $1.5 trillion. This surge is intended to build what he termed a “Dream Military” capable of securing U.S. interests regardless of the “foe,” with a specific focus on countering adversaries in the Western Hemisphere and the Arctic.

Also, keep an eye on the latest developments out of Iran with a potential revolution underway. There’s likely US/Israeli intelligence also involved in the situation - even if remotely - and the Iranian regime is under great pressure due to the economic crisis.

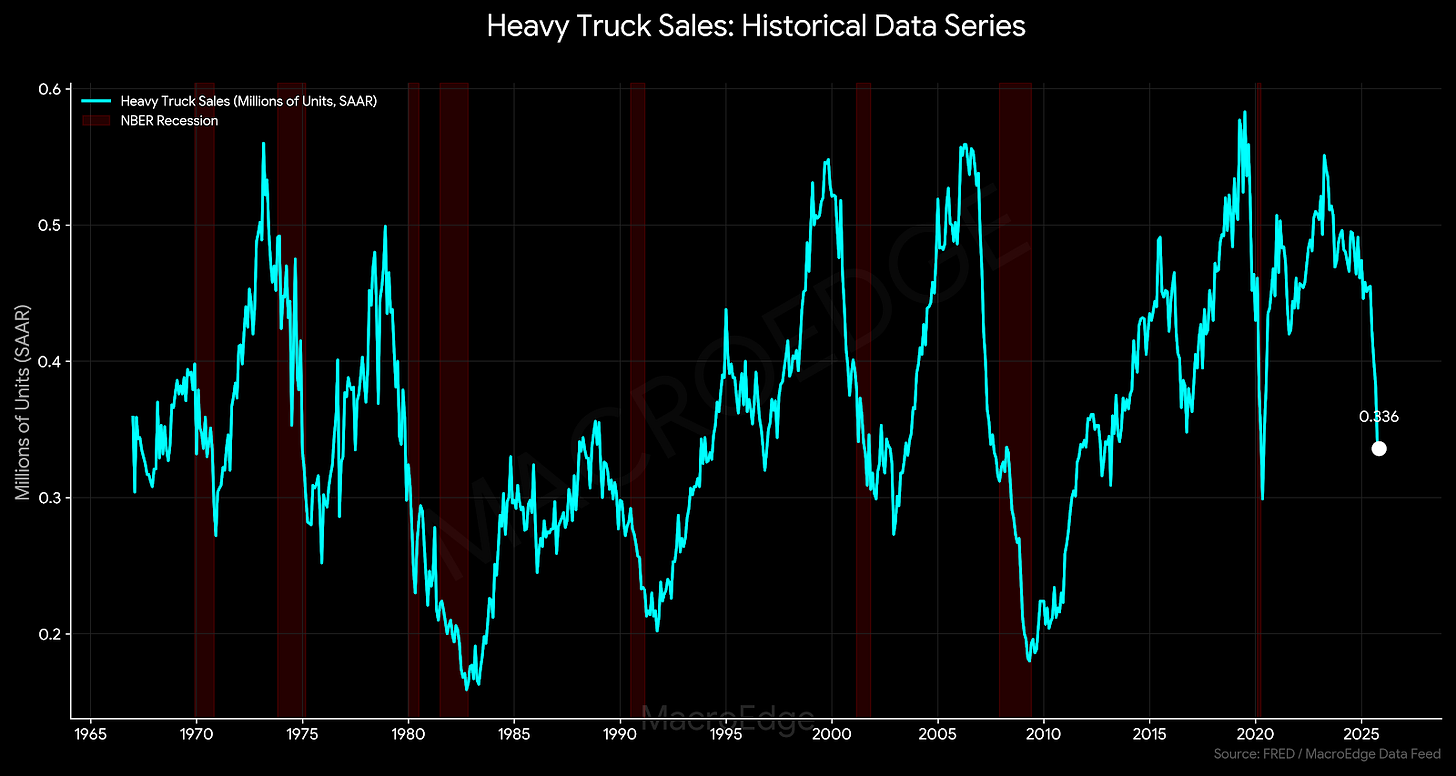

Heavy Truck Sales Fall Further in November

One of the more reliable leading indicators in the *old* days from a macro standpoint, though trucking equities have continued to move higher - and this figure likely rebounded in December based on heavy truck sales data.

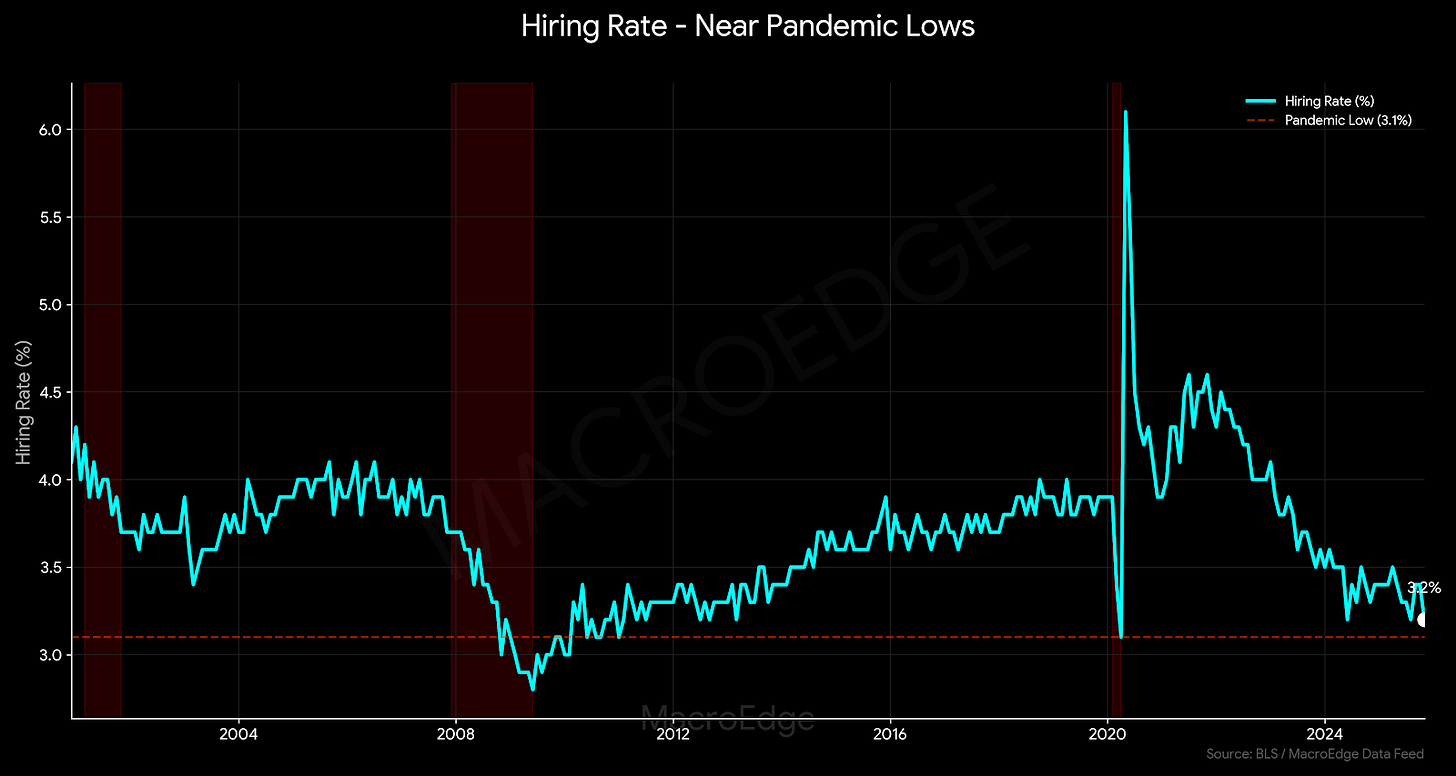

The steep decline aligns with the cooling in the labor market that we’ve seen for the better part of 18+ months.

Employment Data This Week (In Review)

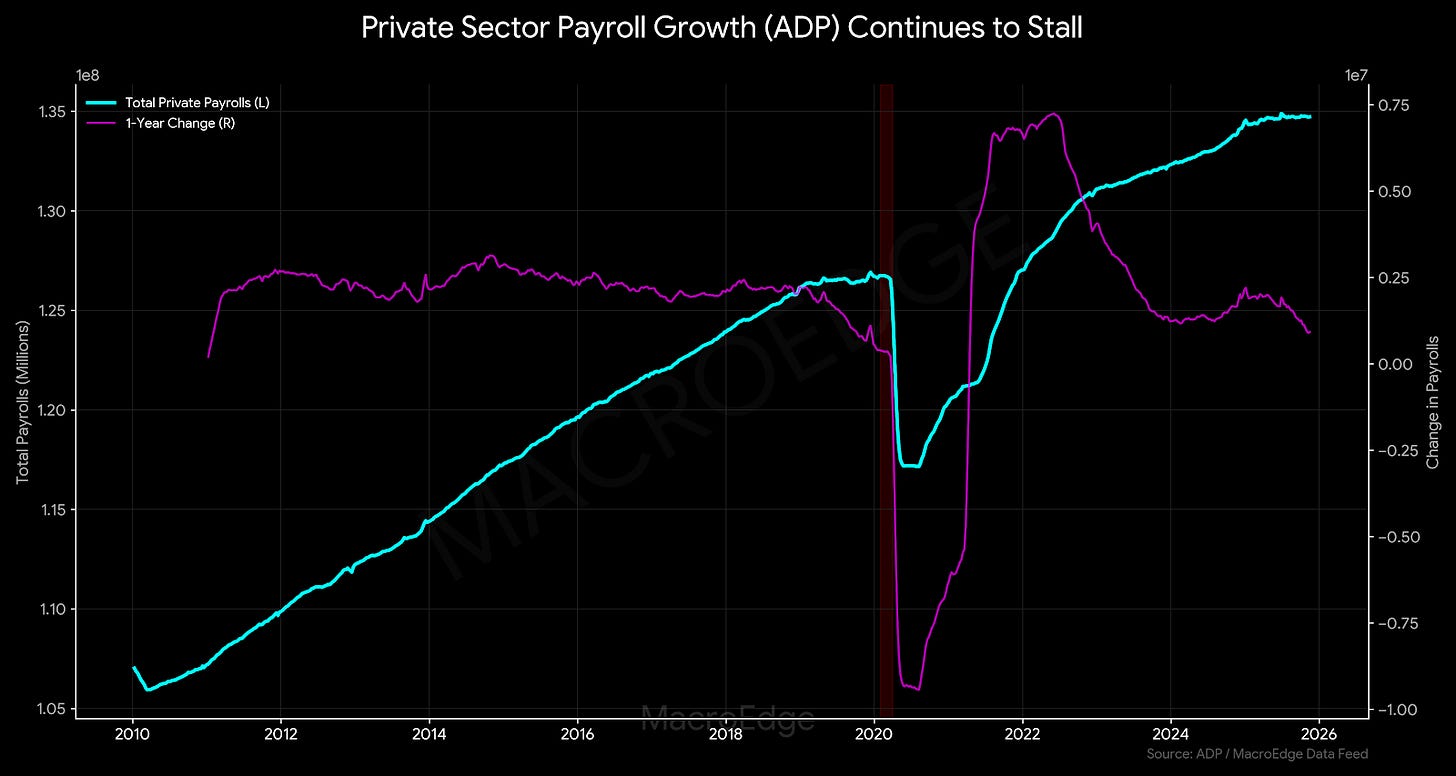

This week, we’ve gotten employment data through ADP/ISM/S&P - and the cooling trend of the last 18 months that has the Fed concerned is continuing.

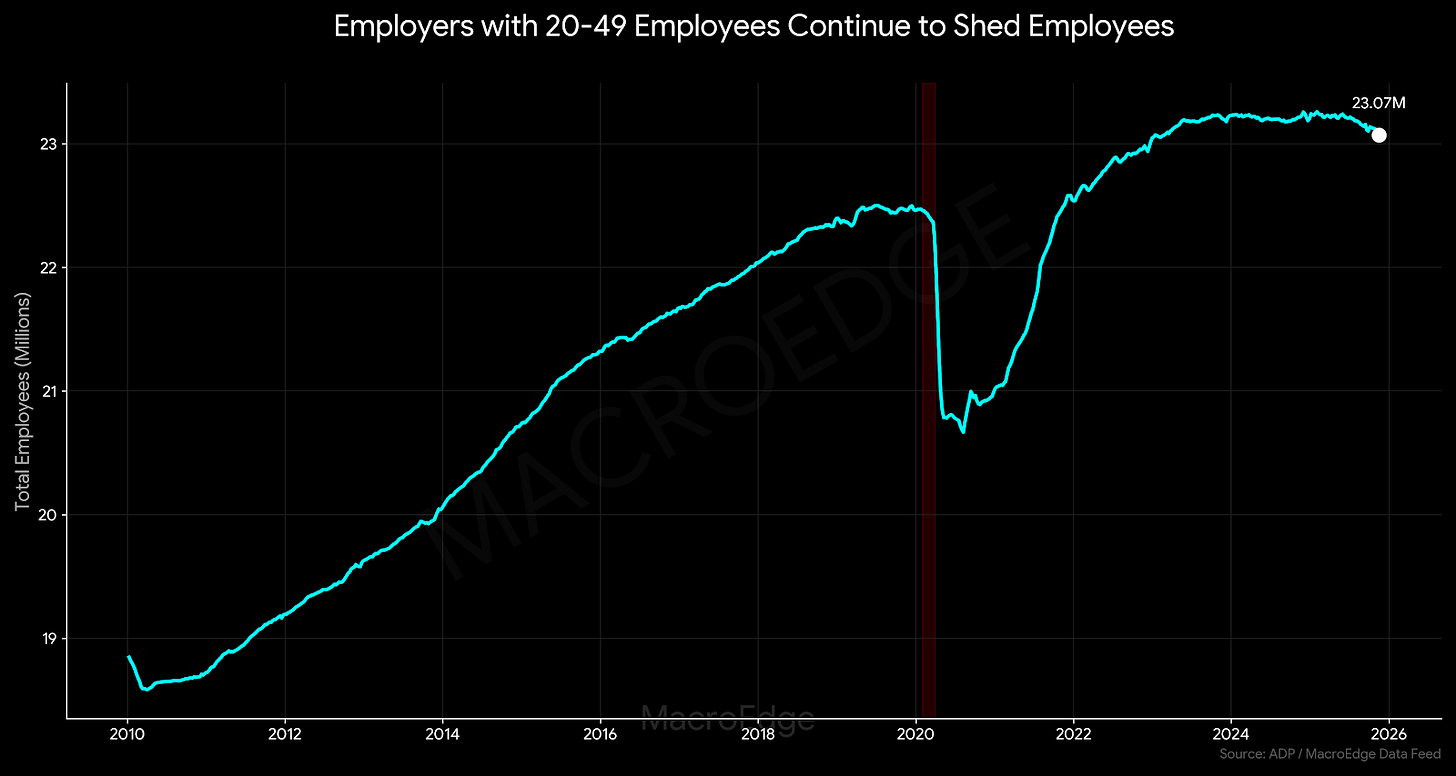

Private sector payroll growth continues to stall - especially at small firms:

Employers with 20-49 employees continue to shed labor and have been the largest loser in the last 6 months.

Job postings (measured by lagged JOLTS data) and measured better by leading Indeed and LinkUp data - dipped by about 600K today.

The biggest dip was in government job openings, which has been one of the last to break lower. The federal hiring freeze remains in place (outside of national security functions) though state and local openings still haven’t bled lower as we need to see government job openings below 600K.

The hiring rate is near pandemic and GFC lows:

Nonfarm Expectations (for Friday)

(continued below - nonfarm expectations & forecast for Friday, market risks for equities, and more)

Keep reading with a 7-day free trial

Subscribe to MacroEdge to keep reading this post and get 7 days of free access to the full post archives.