Midweek Macro Note: NFP Forecast, February Frost, Japan Risks Mount, Navigating the Extremes, Vision Update

In this Midweek Macro Note - the team dives into our NFP forecast, discusses employment issues in the month, talks Japan risks, extremes, and the Vision team provides an update.

NFP Preview - February Frost, Japan Risks Mount, Navigating the Extremes, Vision Update (@DonMiami3, MacroEdge Chief Economist)

Good Thursday evening MacroEdge Readers & Community,

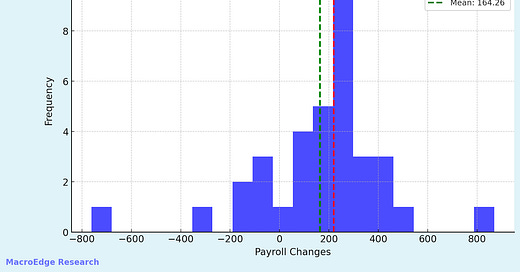

This evening in the Midweek Macro Note we have our latest NFP preview, from both myself and John, as well as a Vision update for how the markets are continuing to trend this week. We continue to draw from both past cycles and present data to shape our view on the market as things continue to evolve. We’ll dive more into the technicals tomorrow evening in our Redeye Note - that is delivered around 12am EST - for those that care to wait and hear more about my thoughts on the initial NFP data as well as market action to close off the week. Valuations, technicals, and internals continue to be unfriendly for US equities, with valuations still remaining at the second most overvalued level on record, behind 2000 (in modern history). Bessent and Trump notably seem to be providing us with hints around the fact that they’re ‘not watching the markets’, topics around short-term pain, and the fact that the long-term economy will be very strong. Today we saw some of that pain in the data, with February job cuts reaching their highest level since February 2009 (our data was a leading indicator to the Challenger reading), and we’ll dive into how that correlates to higher claims this summer.

Overall, the state of the markets is fragile - with technicals looking even more so, and we’ll have more on that tomorrow evening. We continue to hear about a possible March rate cut - unlikely at this current point - and tomorrow’s data is unlikely to be enough to move the needle on that front. Let’s dive into the employment, the extremes, and more below.

Keep reading with a 7-day free trial

Subscribe to MacroEdge to keep reading this post and get 7 days of free access to the full post archives.