Midweek Macro Note Pre-Thanksgiving Edition: Nvidia Analysis, Short/Long Term Technicals, Carry Trade Back in a Big Way, Employment Data Cancelled, September Payrolls Preview

In this Midweek Macro Note - we dive into the Nvidia earnings, discuss technicals on a short/long-term basis, talk about the Carry Trade rewind, highlight our employment forecast, and more.

Don Johnson (@DonMiami3), Chief Economist

Good Wednesday evening MacroEdge Readers & Community,

Today we’ll be breaking down the report from Nvidia - which is driving much of the market action in the overnight hours - look at the shorter-term technicals, as well as longer-term technicals, discuss the cancellation of the October employment data (as well as delay of the November employment data), and lastly discuss the September payrolls which are set to be released tomorrow. I’ve got extra time to write this evening, since I’ve fallen under the weather with this year’s ‘conference flu’... something I don’t recommend.

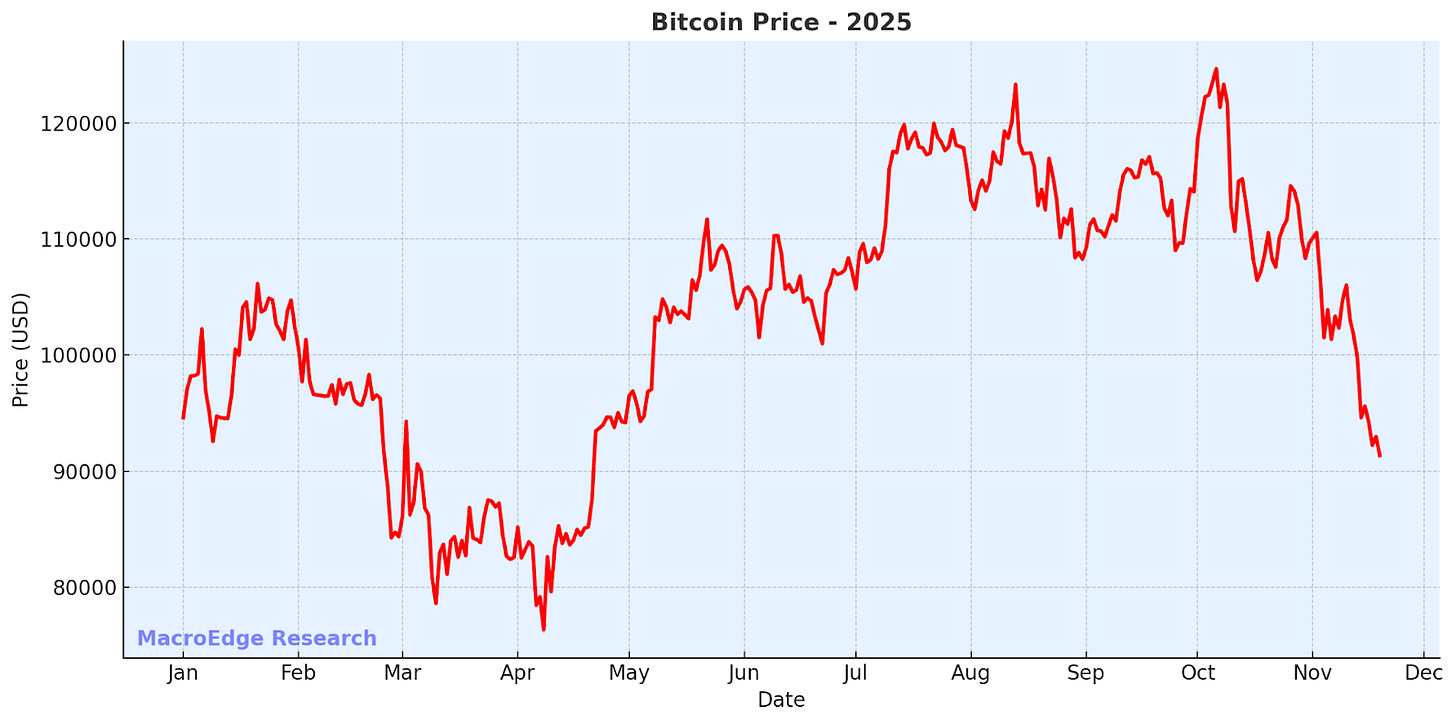

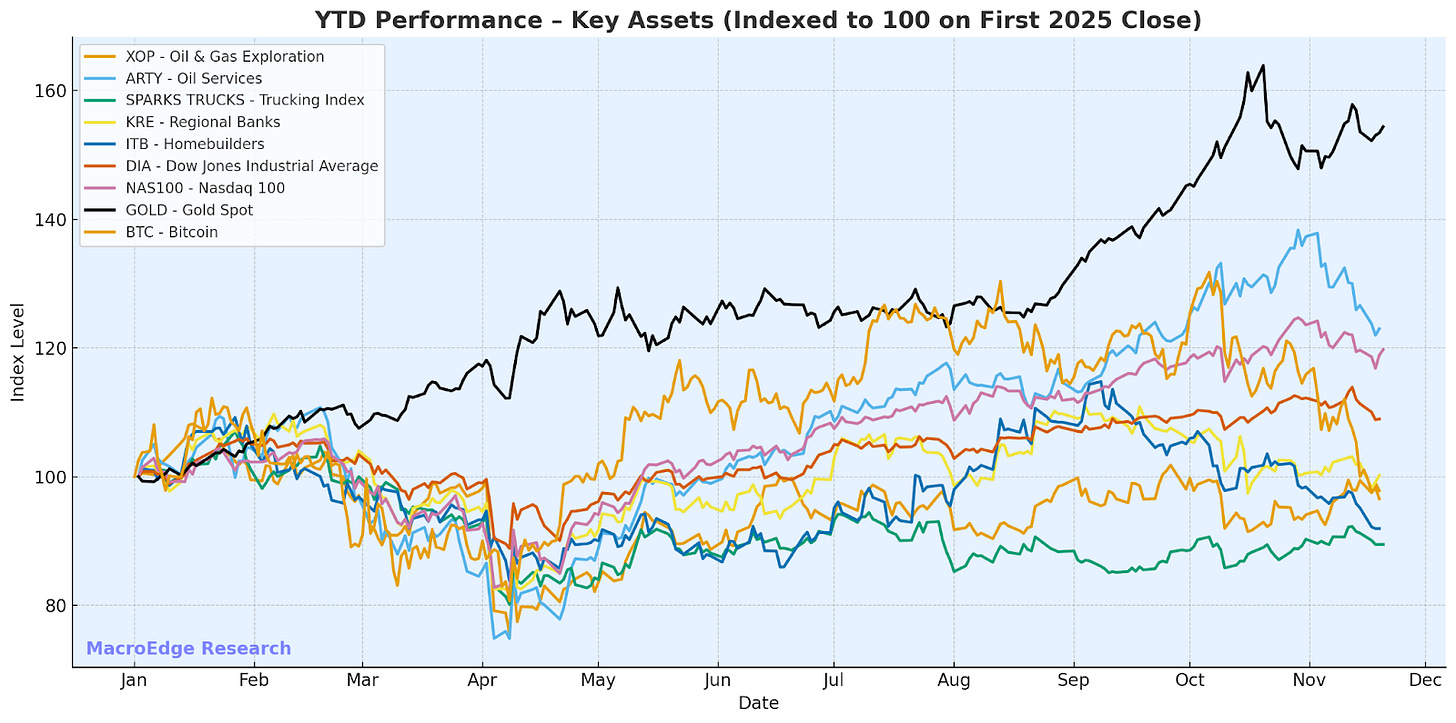

Overall, the broader thematic continues to be one of distribution & sideways action when one zooms out. Performance in the Dow has been rather lackluster given its lack of AI shine, while the Nasdaq has remained substantially more positive on the year, along with SPX. Lots of major sectors and thematics have struggled, such as homebuilders & airlines, have struggled this year versus the AI names (charted below is the AI thematic versus the real economy thematic). One of the worst performers of the year has been Bitcoin:

Which is now negative on the year, and has largely been sideways for the entire year. The big spike in October, driven by a bizarre *deal* with the Chinese, was quickly sold, and this asset remains our best real-time financial conditions index. The Balanced Price metric from Glassnode that we utilize remains in the mid-40s.

Following the 6% correction thus far, things look like they may be setting up for somewhat of a relief bounce, with the potential for a final push higher into the end of the year if key downtrends are broken (see charts below for more). Risk / reward profiles in a lot of names remain poor to very poor, given extreme fundamentals, soft internals, and technicals looking like they’re finally rolling over again on the longer-term timeframes (ie, weekly & monthly). The national security mandate to protect the equity market is back in full force with this > 5% correction, and investors should take note whenever we start to hear the Administration get very aggressive on interventions in equities.

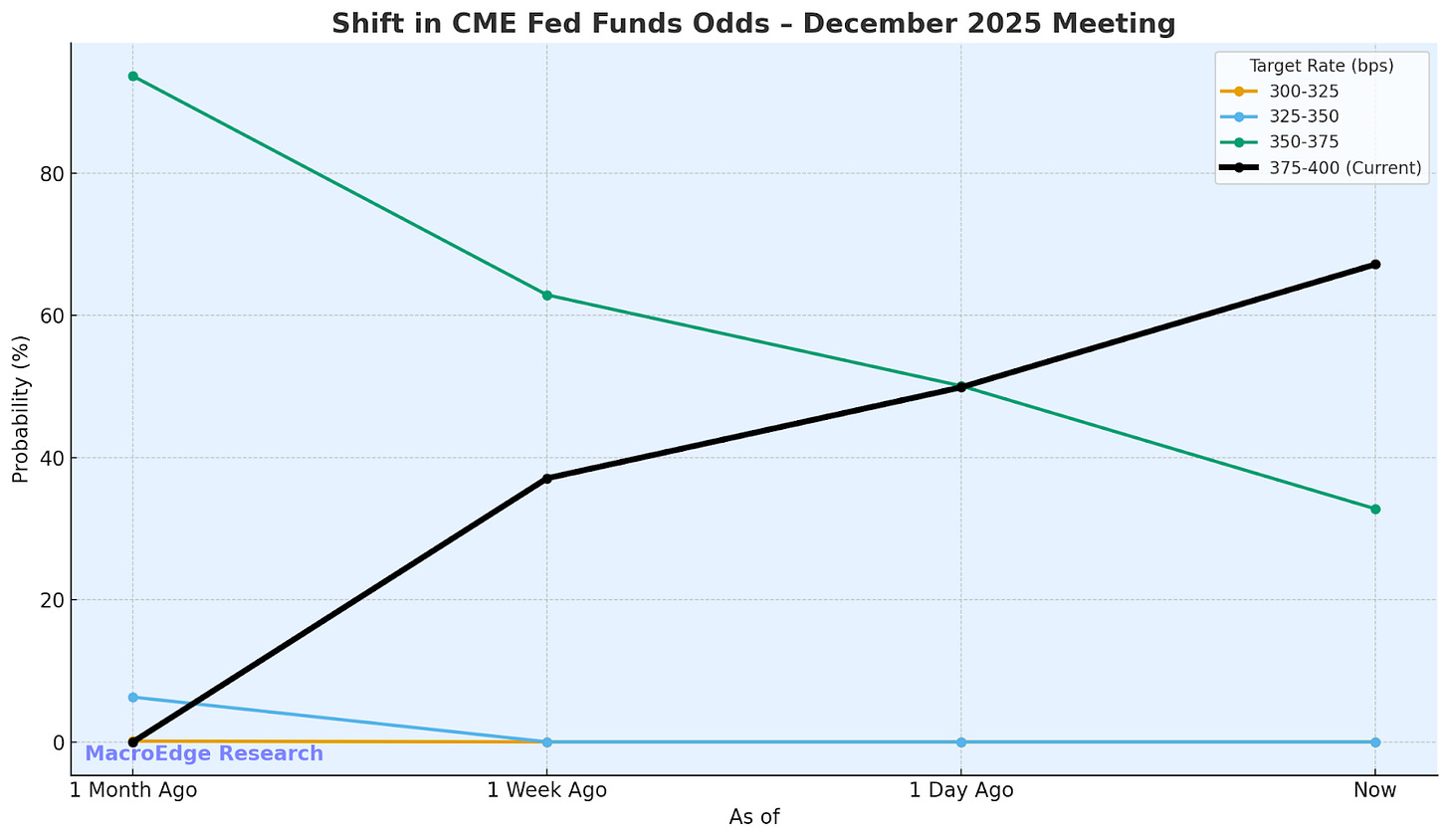

On Friday, we’ll see the NFP / payrolls for September, which I personally think will be quite useless in its pre-revision state. Nonetheless, it will weigh into the December rate cut decision, and this is the last labor data (payrolls-wise), we’ll have before FOMC. Today, the BLS announced that the October data was cancelled, and November data was pushed behind the FOMC date in December, which caused rate cut odds to fall for December rather sharply.

The weekly close this week is quite significant, given the holiday period next week…

Global Macro Strategy Portfolio - MIRP Strategy

Updates will be available in the Ozone Pro dashboard on Friday.

Nvidia Analysis

Performance-wise and on paper, a strong report from Nvidia. Huang even went so far as to challenge Burry directly in the report, and has continued to move closer & closer in with the Administration in what I expect will become a ‘too-big-to-fail’ environment of sorts.

Short-term technicals - >

About a 4% move in the after-market hours, leaving many of us wondering why it wasn’t a lot higher.

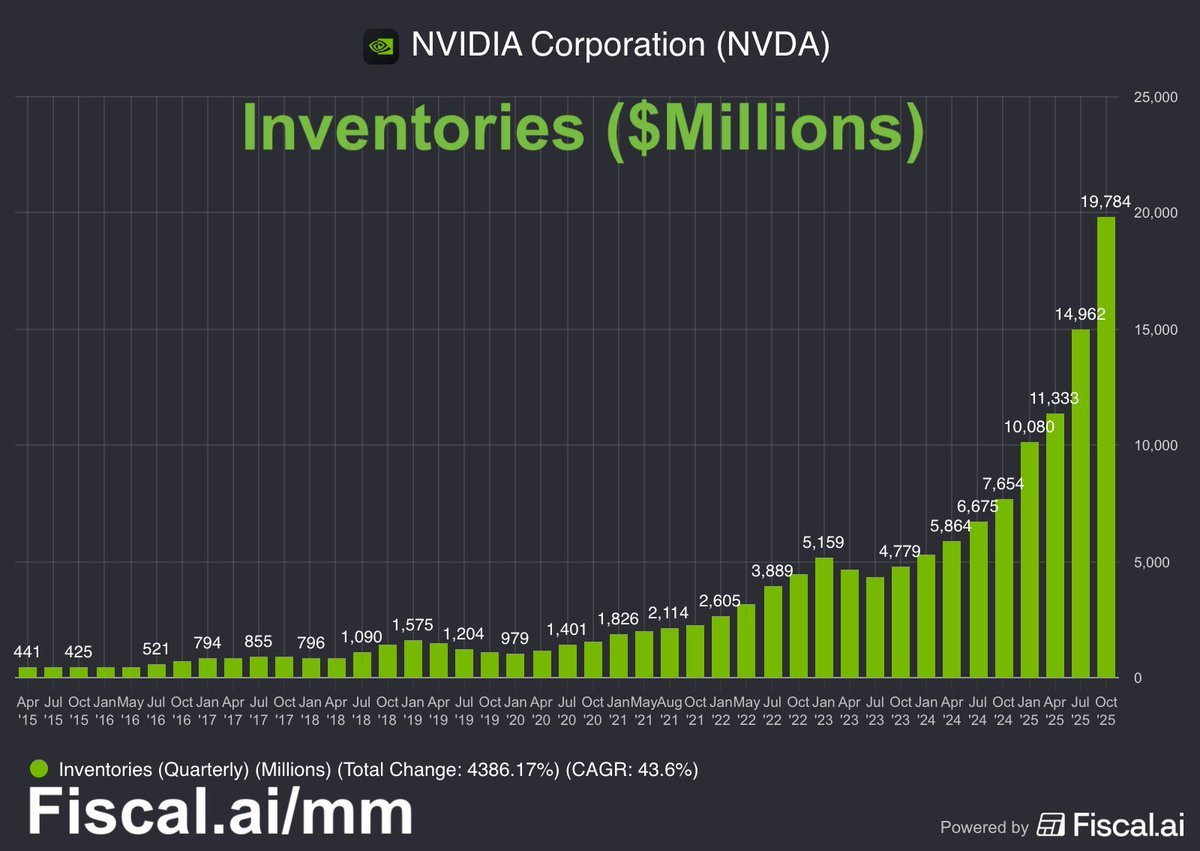

Inventories jumped significantly

Data center headwinds should not be understated + political risk

The overall notion, with a bulk of revenue growth coming from data center revenue, is that we will continue to see this infinite revenue loop higher as it pertains to data centers. Screenshot it, take photos if you need, or write it down, but I expect 2026-27 to be quite negative for the *hyperscaler* style growth in the space, as with all of the circular financing and follies that we’re recommitting to in this cycle, it’s likely the data center construction rollover brings the leaders, big and small, down with it.

The AI trade continues to be both dramatically overstated & overhyped, and with all of the mounting concerns from profitability issues of the actual Nvidia buyers themselves (hello circular deals), to concentration risks, and now political risks, things will get murkier as we enter the new year. Political pressures will be one of the more fascinating forces to watch evolve against the near-blantant fraud we’re seeing in the sector… and that’s just the tip of the iceberg. Accounting concerns are very real, and the list goes on, but for now few care.

Data centers and their subsequent construction story are hugely advantageous for politicians in the short-term, which is why they’re so popular. This story is going to be a multi-year one, however, not an overnight change in how the boom changes, barring any major political shifts in the interim. The Administration is all-in on the AI and data center trade, which means fierce backing until they lose at least one Chamber of Congress next year.

(The weekly situation) above…

A Year of Mixed Performance

This year has continued to be very mixed for a lot of sectors. Take a look at our YTD performance map below…

For the ‘real economy’ equities and cyclicals, it’s been a pretty mediocre year. The entire growth story has been AI / Nasdaq… and metals?

Carry Trade Back in a Big Way

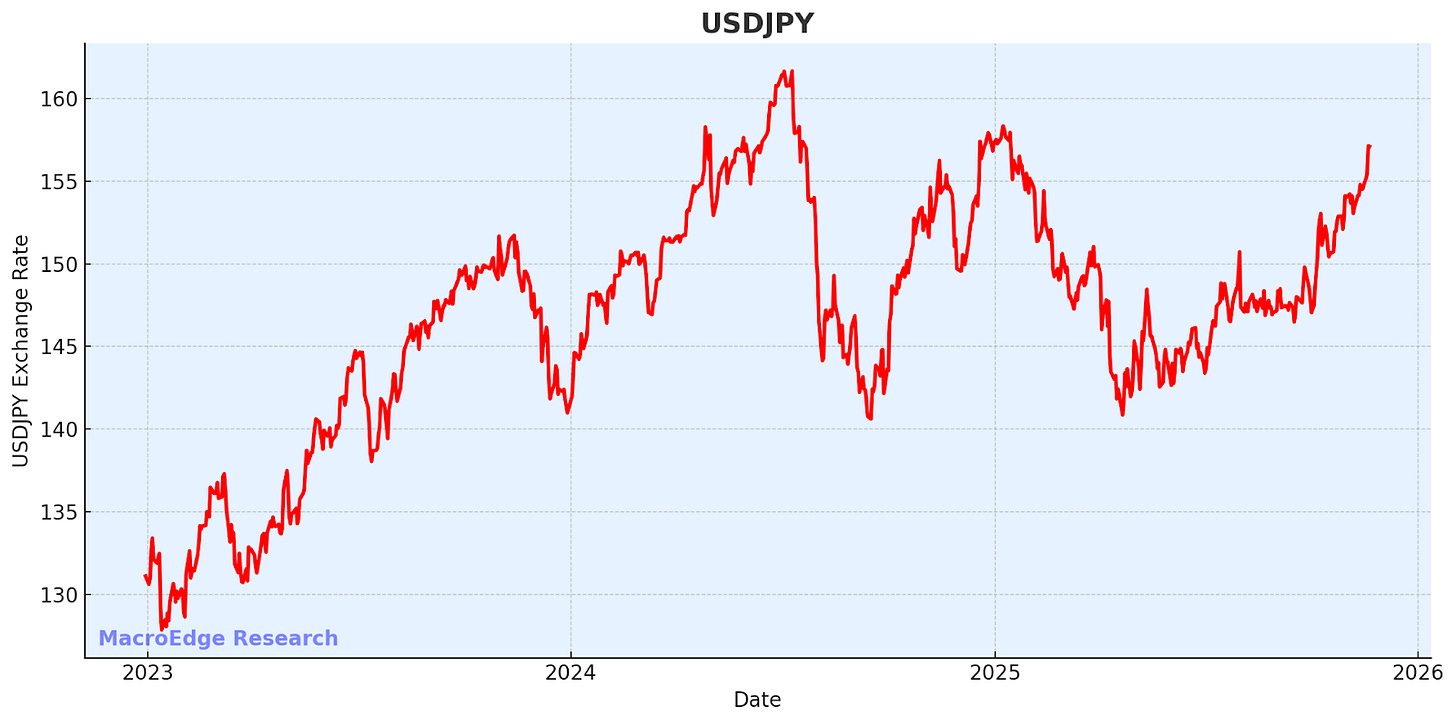

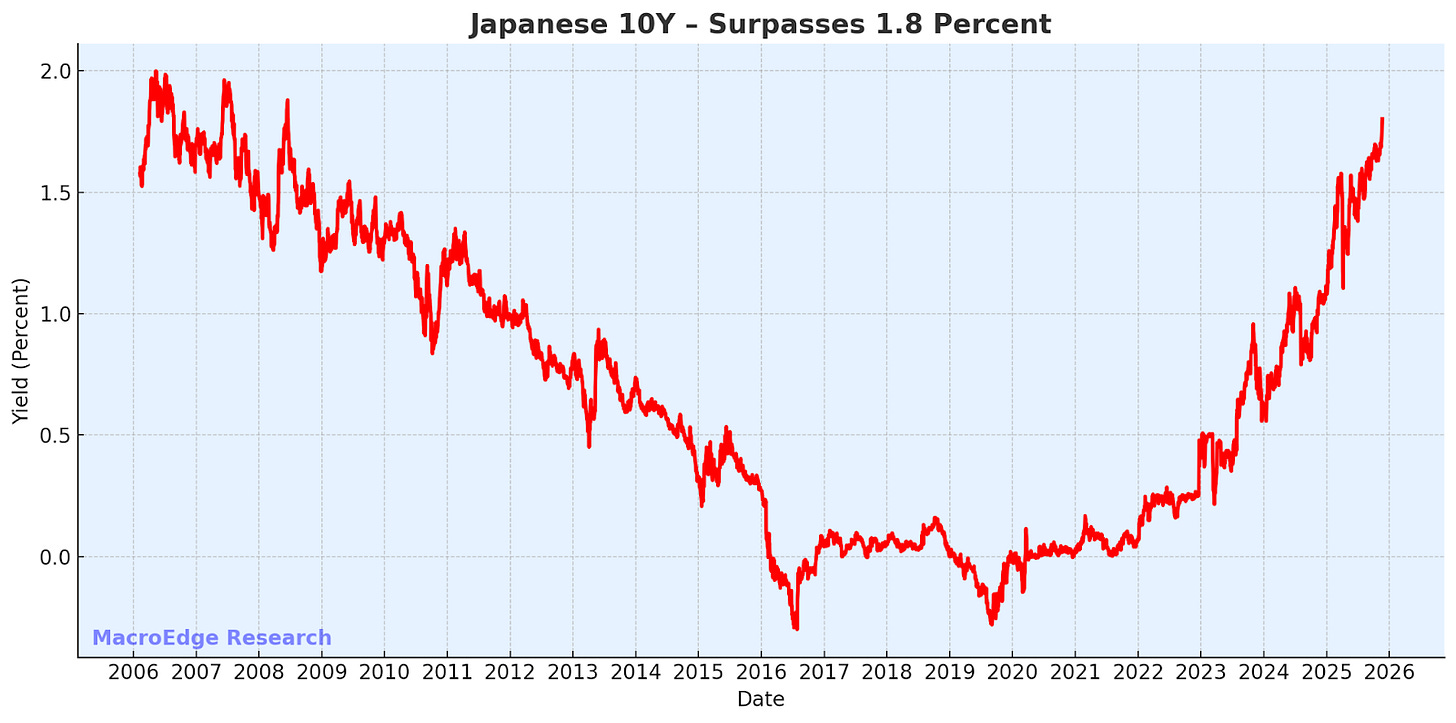

Back in late September, I covered the over-bearishness on the dollar, and we’re now seeing the dollar rally gain some steam. This has been most noticeable against the Yen, which weakened below 157 today. Given the blowout in yields in Japan, alongside the newly elected PM watching their currency smolder (remember - Bessent’s goal?), I think an intervention is back in the cards in the 160 - 170 level. With the recharging of the Carry Trade, a reversal and strengthening of the pair (notably from the Yen) will be risk off for US tech equities.

Trouble in Tokyo…

& there’s this too…

I’ve long thought that cuts, rather than hikes, will be a more bearish signal for US equities, though it’s about time for Japan to give it one more 15/25bp hike… at least if they want to save the Yen.

Short/Long-Term Technicals

Shorter Term - NQ

On the Nasdaq, the shorter-term structure is above, with a key support level having been established from late September. A potential retest of the downtrend is in order (yellow line), and right now the structure, given the lack of the volume, isn’t directionally bullish or bearish.

Longer term - Nasdaq…

Keep reading with a 7-day free trial

Subscribe to MacroEdge to keep reading this post and get 7 days of free access to the full post archives.