Midweek Macro Note: The Bubble is a National Security Risk, How Did We Get Here?

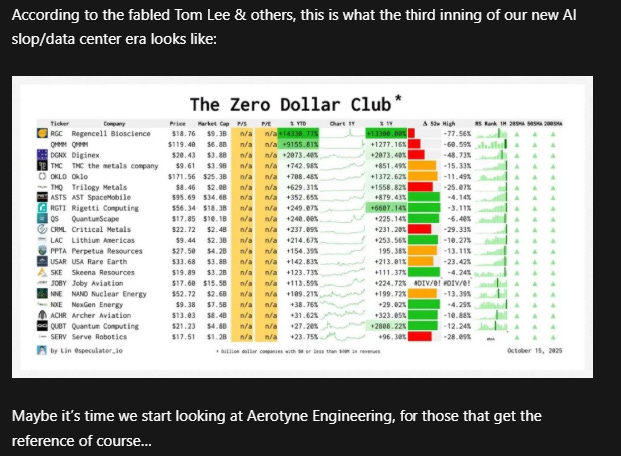

In this Midweek Macro Note - we dive into the 'bubble darlings' aka the zero dollar club, talk about the latest fiscal intervention in markets announced tonight, discuss distribution, & much more.

(@DonMiami3, Chief Economist)

Good Wednesday evening MacroEdge Readers & Community,

This Midweek Macro Note is going to be brief as data releases remain scarce due to the government shutdown – but the subject of tonight’s note is “the bubble is a national security risk – how did we get here?” We have the most aggressive fiscal arm of the government that we’ve seen to date in terms of direct equity market interventions in a non-crisis period, which leads us to ask these thought-provoking questions… In similar news tonight, which many of you have probably seen already:

Which Administration insider got caught on the wrong side of the trade today and asked for the bailout?

From our October 18th Redeye Macro Note… of which many of these names are down 20-50% from their highs in just a few trading days… but at least the government wants stakes in the Zero Dollar Club ‘memes’…?

Institutional Research now Ozone Pro

For name cleanliness & ease of understanding, MacroEdge Institutional Research is now Ozone Pro - there are no material changes to Ozone Pro, including the dashboard, 2 portfolio strategies, and much more - the trial period for Ozone Pro remains 4 weeks, which can be accessed below:

You can now also subscribe to the Ozone Pro Substack - where we’ll be releasing Ozone Pro notes - and much more.

Government Shutdown

There have been some signs of fatigue on both sides - and data sharing has been halted to the Fed from some private companies. It’s likely that we make it through or to election day right now before the stalemate has a chance to end the shutdown. It’s really just more theatrics and distraction from all of the other developments going under the hood.

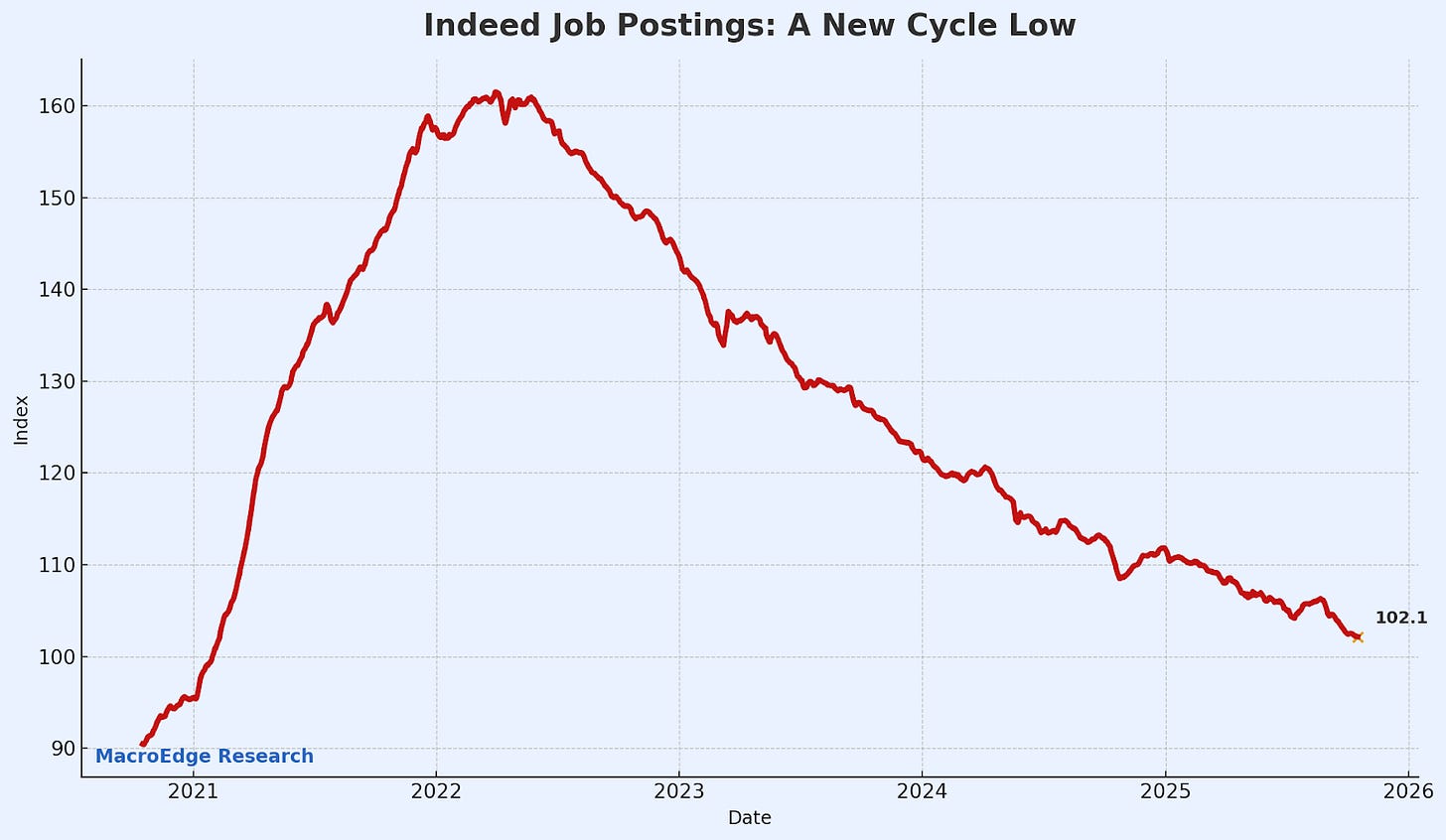

Labor Market Weakening Continues - Data Blind Fed, So Never Get Flat Footed

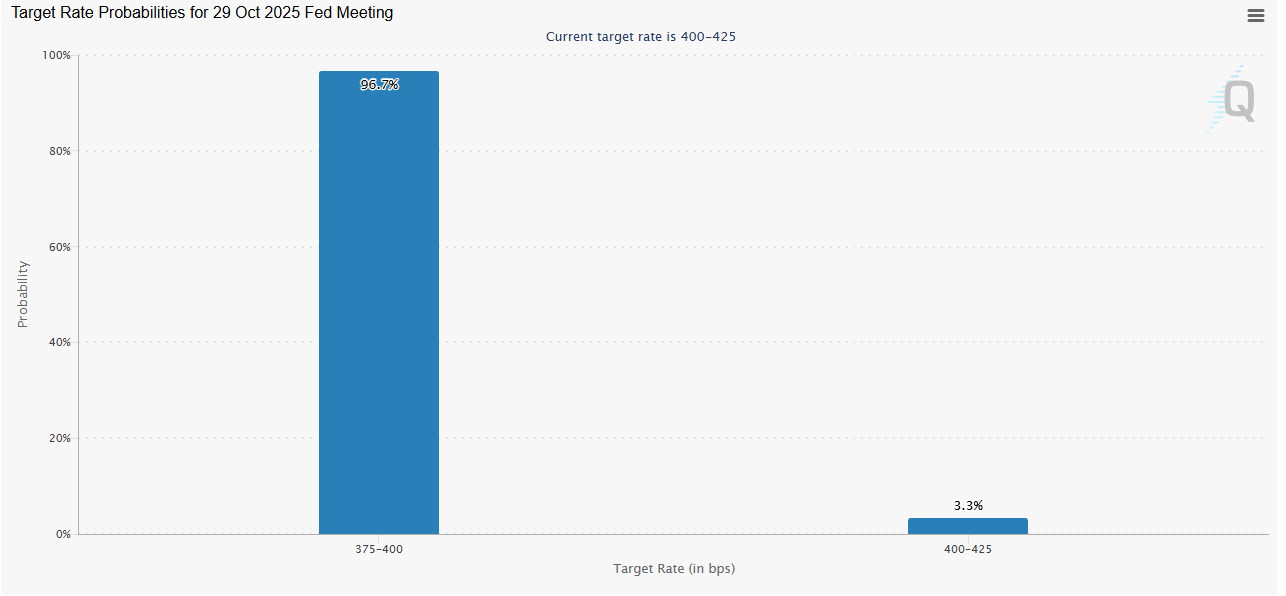

Odds of a rate cut are currently sitting at about a 97% chance, and it’s very unlikely the Fed changes course. If Powell wishes to stick it the Administration on his way, he has a generational chance to, which would likely put things into a freefall tailspin through the end of the year.

Given the labor market weakness that has the Fed on edge, coupled with the real estate weakness and contracting construction employment, I continue to view the 25bp cut as a near certainty. A hold would really put a panic fear into fiscal policymakers for the next month, especially as the government remains shut down.

CME Rate Cut Odds:

In the bizarre world we live in today, it’s never a 0% chance… so don’t rule out weird scenarios (right now).

Government-Backed Asset Bubble

The news that dropped this evening that the Trump Administration was considering government stakes in quantum ‘meme stocks’ is surprising - but not shocking - given everything that has transpired so far in terms of fiscal interventions. The fiscal arm of our government is shifting into a myopic mandate of pumping assets over everything else. The announcement of a possible intervention in these ‘quantum’ names isn’t just comedic, it’s idiotic.I am getting flashbacks to this scene:

It’s the latest in our long march to market mediocrity and the true death of free markets that we continue on, that’s going to take some time to really play out. Whenever the next crisis strikes, we should expect no less than full government support for equities, including outright purchases, and from the Federal Reserve - yield curve control - the day that crisis arrives. The period between market intervention and direct government control, and the initial warning signals, is the limited time that those seeking to benefit from left-tail vol strategies have, for the time being.

Here’s the real details on these companies:

IonQ (Ticker: IONQ)

Revenue: about $52 million (trailing twelve months)

Employees: around 400

Price-to-Earnings: not applicable (company is unprofitable)

Fact: IonQ claims to operate trapped-ion quantum computers but has yet to demonstrate a fully universal, fault-tolerant quantum system capable of outperforming classical hardware.

Rigetti Computing (Ticker: RGTI)

Revenue: about $11 million annually

Employees: around 140

Price-to-Earnings: not applicable (operating losses)

Fact: Rigetti is developing superconducting quantum chips, but it hasn’t built a commercially scalable or fault-tolerant quantum computer.

D-Wave Quantum (Ticker: QBTS)

Revenue: about $9 million annually

Employees: roughly 220

Price-to-Earnings: not applicable (unprofitable)

Fact: D-Wave focuses on quantum annealing systems suited for specialized optimization problems, not general-purpose quantum computing.

The bailout this evening was announced after significant selling on all three as the retail gambler crowd grew more cautious:

IonQ

RGTI

QBTS

Technicals & Internals

Under the hood, institutions have continued to sell with size over the past 2-3 weeks, in what is amounting to our next period of ‘distribution’, somewhat similar to the period we saw from July to February, where price action remained largely flat. Because the Administration is fighting these large block sellers & movers now, even in their direct market engagements, it’s likely that this distribution takes some time. The froth basket has been very weak this week, which is likely to reverse now after the after-hours intervention, at least for the trading day tomorrow. More of a pitch to create exit liquidity than anything else - since there a LOT of names like this.

Nasdaq distribution continues… the MacroEdge ‘Katana’ scenario if it continues to stall

There is going to be a lot, lot, lot of opportunity for us to strike when our signals give us the greenlight, especially in the global names above, as the MOAB continues to inflate ever-larger. Join MacroEdge Ozone and Ozone Pro, and be ahead of the trend when we position for the next major move.

Keep reading with a 7-day free trial

Subscribe to MacroEdge to keep reading this post and get 7 days of free access to the full post archives.