Midweek Macro Note: Where's the Magic, Jensen? Technicals, Risk Update, Yen, Earnings Review w/Vision Team, Gold

In this Midweek Macro Note - the MacroEdge Team dives into the latest risks and movements in the markets - notably the Nvidia earnings report, talks technical, macro, gold, and more. #MacroEdge

(@DonMiami3, MacroEdge Chief Economist)

Good Wednesday evening MacroEdge Readers & Community,

This evening in this Midweek Macro Note we’ll discuss the latest in macro, technicals, sentiment, and internals - as well as the Nvidia earnings update and a quick market outlook/overview to take us through to our Friday evening report, post-PCE.

If you’re reading this Midweek Macro Note from the YEET, we’re very glad to be sharing another note with you all and I’ve enjoyed Milt’s options chain analysis of late. If you’re interested in learning more about MacroEdge, you can do so below with two-week access to MacroEdge Ozone, or one week through Substack.

Overall, the Nvidia post-earnings session was essentially a ‘non-event’ as the stock failed to do anything in the post-market hours. The hype is now under a powerful microscope from institutional and foreign investors, and that’s evidenced by a nearly 12-month sideways performance from SOX & SMH. The broader semiconductor/AI trade has bled into the MAG7 with the capex announcements of late, and these capex announcements have not brought about positive tailwinds to MAG7 components. Salesforce’s buzzword galore product line was also met with heavy selling, as investors are questioning what their payback is going to be on these offerings. ON Semiconductor announced they are chopping 9% of their global workforce, and they’ve been a downside leader for the last 6 months, with the stock seeing heavy losses.

The broader market remains in a holding pattern for now - with weekly and monthly technicals and internals weakening - alongside mounting valuation pressures that we’ve discussed for some time. It’s not all doom and gloom, and the sell-off for now has yet to materialize into a broader event, short term oversold conditions almost always permit market bounces throughout history, although those factors are hinging on the Yen & PCE later in the week. Let’s dive into the data:

Macro Data Thus Far This Week

This week we’ve seen the Yen continue to put pressure on US tech equities (as well as crypto) - as we’ve discussed being a risk since last July - as well as in its mention in our ‘Trump Risk Matrix’. The Yen strengthened against the USD to the mid-148s, which as highlighted on Sunday night, is not positive for US risk assets or crypto. One positive has been the overall resilience thus far of the broader indices, but the outlook continues to weaken on the weekly and monthly timeframes, with both being relevant to 12+ month or longer price action trends.

We’ll cover the housing data this weekend in the RESights + Vision hybrid report.

All worth watching.

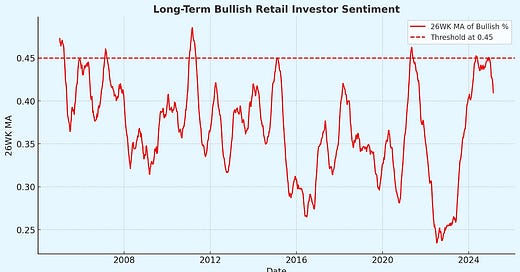

Retail investor sentiment has also soured:

For bounce catalysts later in the week, there’s a chance of Yen weakening, along with positive tariff developments, or a cool PCE reading. With Trump and Bessent now blatantly targeting prices to get inflation down, we’ll really get our first idea of their efforts in the February report, rather than January. Oil is back below $70/bbl and natural gas has come off of the highs.

Valuations Continue to Pressure Forward Returns

While modern valuations may live at a higher baseline for a variety of factors, a CAPE above 38 has never seen a positive 2-year return, and remains pressured at 1-year, even though there’s only one instance where a positive return was seen 12 months from CAPE > 38, which was late 2001.

S&P Performance from CAPE > 38

Nasdaq performance from CAPE > 38

CAPE has dipped below 38 again, for the time being:

If MAG7 + Semiconductor/AI ‘hype’ fades and a new narrative fails to appear, the market is going to be in broader trouble which is what the technicals seem to be confirming as well, for the time being.

Technicals Continue to Weaken:

My technical outlook is showing a market weakening on the longer-term timeframes, which isn’t a bullish signal. For the Nasdaq (QQQ shown below), the trend is still intact, however:

With the bearish divergence in effect - any lower from here would signal the start of a new trend to lower price levels, and on the monthly time frame, the trend lengths are clear - long. The monthly candle for February will be the third candle in the range, and adds to the bearish Nasdaq developments:

Same goes for the Dow, and many others we’ll discuss in our Vision update on Friday/Sunday:

Note that longer-term timeframes don’t usually impact intra-week action - so I look less at the noise of Twitter feeds, hype, and other market movements - focusing mostly on these longer-term timeframes.

Where’s the Magic, Jensen?

A core driver of the H1 2024 ‘screamer’ rally, Nvidia hasn’t done much of all in the last year. The earnings today were again sold off, and perfection has been priced into to this stock now for the last 9 months - Jensen & the Nvidia team better come up with some really new and really sexy to push above an almost 30X P/S.

The same trend goes for Nvidia:

Closing Comments

Overall - focusing less now on the noise of daily movements and headlines - we can focus on longer-term valuations, metrics, and technicals to give us a better idea of where this market lives - it’s back in a place where mounting risks and catalysts are tilting to the risk back towards the downside, even though I remained positive on assets simply going up on the hype & insanity for much of 2024.

MacroEdge Vision Update February 26, 2025 (@SixFinance, MacroEdge Head of Research)

NVDA

“AI is way over its skis in terms of practical value being brought to users” -Paul Singer, Founder- Elliott Management

In my view, we are now at at least a local peak in the AI thematic trend. While the Deepseek frenzy came too close to reporting season to alter capital expenditure guidance, it has become likely in my view that much of this capex will find a fate similar to METAs Metaverse investment.

Salesforce, the face of agentic AI, the next step in the monetization of AI, reported a worse than expected full year outlook this afternoon. They expect agentic AI to make only a modest contribution to revenue this year.

From here on out, investors will likely become more focused on how much revenue is directly attributable to AI investment. I think the best gains have certainly been had, and we are going to look back and think about “city sized data centers” in similar light to dotcom projections of 50% of discretionary income being spent on internet access.

Risk

We are staring down the barrel of a significant economic shift as US Treasury Secretary Scott Bessent takes aim at the federal budget with a dual mandate: slashing spending and easing long rates. While the intent to rein in deficits, averaging a hefty 7% of GDP over the past four years sounds noble, the execution could throttle growth and hit risk assets hard.

From here on out, investors will likely continue to zero in on how these cuts impact GDP growth, which has been chugging along at a solid clip yet notably decelerating. Historically, fiscal austerity, like we saw in the ‘80s and ‘90s when interest costs ate 14% of tax revenue slows momentum.

Risk assets thrive on growth signals. A stumble here, and we’re looking at a sell off. This is a very real and pronounced risk. With markets this extended by most valuation metrics, and high levels of leverage, it wouldn’t take much. Balancing the budget would fit squarely in the category of: much.

I think the glory days of unchecked bullishness are behind us in the near term and we’ll look back on Bessent’s “fiscal housecleaning” as a trigger for a leaner, meaner but far less vibrant market, much like post dotcom sobriety.

The goal here is clear: reduce the federal deficit, bring down long rates, and then attempt to term out the debt.

Positioning

In light of the continued risks to equity markets and the increased sensitivity to growth given valuations, the asymmetry in equity directionality is becoming more pronounced. I would like to see how tech responds to NVDA earnings during cash trading tomorrow and, conditions permitting, open a tactical swing short in NQ futures.

The Specter of Personal Gold Ownership (@RealJohnGaltFla, MacroEdge Contributor)

To say this has been one hell of a week in the markets so far is an understatement. I do not recall which of the bubblevisions I was unfortunately trapped into listening to, but I distinctly remember hearing the discussion as to why gold was a terrible hedge against inflation compared to equities once again.

It reminded me of just how insane that line of thinking in the past year has been thus far.

So if one is to believe the talking heads and many of their guests, the 15% or so return on one’s money is much better than the “hedge” which has produced a return of 43.45% over the same time period. While math might not be my strongest subject, linear and logical analysis certainly is, thus 43% is still higher than 15% unless I’m completely delirious.

In fact, gold over the past five years has provided nothing but solid returns while remaining the only real offset of the Federal Reserve’s, along with other central banks, insane monetary policies.

Regardless of this, the mainstream media continues to push the narrative that gold ownership is for eccentrics, kooks, survivalists, or doomers who live in lead clad homes with five years of survival food stored for when eggs are poisoned by the New World Order.

Scratch that last sentence, sort of.

On a more realistic viewpoint, it’s each individual’s personal responsibility to determine if a mix of precious metals in one’s portfolios is wise. If you’re young and believe that inflation will never be a factor ever again in ten years, decide accordingly. However, I wish I had listened to my gut and stocked up on gold coins from the mid-1990s until mid-2000’s when the price was over $2500 lower.

This old guy’s advice?

Do not let the propaganda scare one away from investments in gold or silver. The specter of being un-hedged against sustained periods of inflation due to government and/or central bank incompetence is too risky if one thinks about what has happened since the 2007-2010 GFC. Think about obtaining the security of historically real money versus out of control monetary inflation.

Or face the haunting prospect of depending on a central banker to determine what few assets one holds are really worth. The specter of personally obtaining in and investing in precious metals requires discipline and the ability to be personally responsible for one’s own finances. Just remember that a fiat currency regime is not a democracy, and one does not get a vote in how the powers that be determine what one’s assets other than gold are really worth.