November Ozone Pro Report - Knocking on Trouble's Door, Data Center Issues, Travel/Hospitality Deep Dive, Macro Data Ahead, State of Labor, and More

In this Ozone Pro Report - we expand on the left tail risks discussed in October, talk about the rising movement against data centers, discuss travel & hospitality, trends, explore data, & more.

Critical Points Discussed

Rising Left-Tail Macro Risk: Labor market softening, falling job postings, and deteriorating consumer sentiment signal a weakening U.S. cycle. With federal data obscured by shutdown distortions, private-sector indicators now reveal a clear downshift beneath the surface.

AI Capex Bubble Under Stress: The AI buildout has moved from cash-funded growth to debt-fueled overreach. Idle data centers, widening credit spreads, and early downgrades echo past infrastructure manias—where builders lose and platform users ultimately capture the value.

Geopolitical Flashpoints Elevating Volatility: Simultaneous risks in Cambodia–Thailand, India–Pakistan, and U.S.–Venezuela raise the probability of sudden geopolitical shocks. These conflicts reinforce safe-haven flows, particularly into gold, and add a new layer of uncertainty to the global macro backdrop.

Policy-Driven Illusion of Stability: Aggressive fiscal support, QT abandonment, tariff rebates, and political market-management aim to stabilize headlines rather than fundamentals. This engineered calm masks accumulating structural risks that are likely to reprice abruptly.

Don Johnson (@DonMiami3), Chief Economist

Good Sunday evening MacroEdge Readers & Community,

We shifted this month’s Ozone Pro Report back a few weeks because of the extensive travel schedule of the last few weeks, lack of general broad macro data with the government shutdown, and to allow time for us to update things as the month has progressed.

I am back on the ground for the next week, and very glad to be - the last few weeks of travel have been intense and make accomplishing things behind the computer very difficult. There are new changes coming to the Ozone Pro dashboard over the next several weeks - including a data swapout to reflect only MacroEdge data while we evaluate the efficacy of what data Ozone Pro members want. Given the breadth of third-party data available to us, we’re selecting which datasets are actually going to be usable for everyone utilizing the dashboard. Far too many interfaces and dashboards today are filled to the brim with a bunch of useless garbage - not what I am aiming for from a user experience standpoint.

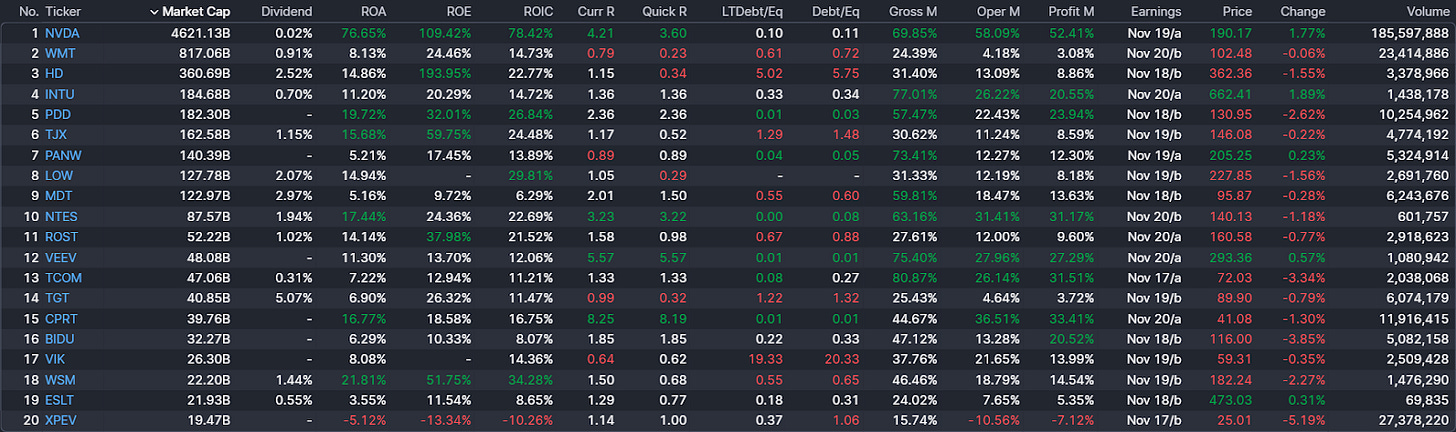

In this Ozone Pro Report, we’re diving into a lot, ranging from the data releases and calendar of the week ahead to an exploration of the travel/hospitality sector, looking at the state of labor, Japan issues, and much more. As we continue under the ‘national security’ thematic as it pertains to equity markets, the left tail remains largely hidden and under the hood, though risks and oppositions to AI and data centers are mounting. Coupled with a weakening labor market and broad American unhappiness about the state of the economy due to inflation and record high price levels, these create conditions for tail risk. As we head into the second half of November now, barring any material shifts and changes to the current narratives, a distributive environment and expansion into broader downside seems like the most plausible pathway forward right now, though we still have some economic data (and most importantly, Nvidia earnings to work through). From an earnings standpoint, as well as from a real estate standpoint, the left tail risk continues to mount, and much of this we already discussed in our previous Ozone Pro Report “Opportunities for the Left Tail, Euphoria in Corporate Credit, the Fossil Frontier”, which I suggest you should read if you haven’t caught up on item below:

The misinterpreted ‘K’ shaped economy, which I label an ‘I’ shaped economy, has a lot of issues, from weakness in cyclicals like real estate, freight, and banking, cracks in the employment market, and persistently high CPI, the Administration faces an uphill battle to solve these problems.

Our pragmatic approach frequently gets misinterpreted as ‘bearish’ - when it’s more along the lines of ‘realism’. If one is looking for the unicorn fairytales and random, far-out price targets - Tom Lee and Cathie Wood are almost certainly taking new emails for their lists. Just one example highlighted earlier today on our X page was Mesa Airlines, which I highlighted in April… there’s no ‘doom’, ‘gloom’, or ‘delusion’ when these opportunities put themselves in front of us. It’s our job to capture and turn around all of the information and make it actionable for you, and that’s what Ozone Pro is all about.

With that being said, let’s dive into the November Ozone Pro Report.

Not yet an Ozone Pro member? Get 4 week access below and transform your financial insights, strategy, and data arsenal:

The Week Ahead - Short Term

The government has noted that they will be releasing *some* bits and pieces of economic data over the next several weeks, of which most should be taken with a huge grain of salt for these initial releases for September, October, and November data. Data is likely to be both flawed and questionable, and revisions will happen on this data for an extended period of time.

For Bitcoin and other risk assets - some of the tailwinds of April - September have left the party, and cryptos have continued to move lower, while equities have flattened out, standing sideways for the last month and continuing a ‘distributive’ nature - that has some echoes to the January to March period where we saw things go sideways for an extended period of time.

Bitcoin is now flat on the year, and flat since November 19th of 2024:

This is a notable development signalling (in my view) a lack of liquidity, troubles in the crypto space with more Wall St involvement in the space, and potential systemic risk here with the leverage involved. With the heavy selling of the last few weeks, we’re likely due for some shorter-term relief, barring the materialization of further downside catalysts that could hit. I am more in the ‘BTC as a leading indicator camp’ than a 1:1 coincident one, especially with what we saw in March/April for the coins.

Futures tonight (11/16) are slightly higher - with Bitcoin sitting about 95K, the Nasdaq up about .4%, and ES up about .3%. There are notable things to look out for this week - for both earnings and macro data - and as we eye the ever-so-elusive *07-esque* markets highlighted in some of our previous articles, that means a churn lower into end of year, and failure to reclaim the highs for the indices.

In the prediction markets, the October forecast for U3 was 4.4%, and November currently stands at 4.5% (obviously, this will move a lot if, for some reason, the numbers released this week look a lot different than the private sector data):

This aligns with the private sector data (that we’ll discuss below in ‘State of the Labor Market’) and an increasingly angry voting populous that hasn’t seen much gain from the equity market blowoff induced by the Administration since April, measured by steep declines in economic happiness readings since then.

On Wednesday evening, we’ll have our employment forecast for the delayed September and October reports.

Arriving this week:

BEA to release construction, trade, factory orders data from August

BLS to release September (and potentially October as soon as next week) employment reports

Fed speakers

ADP employment data

(Potentially) Home sales data, home construction data

UMich Consumer Expectations and Sentiment

Earnings this week:

Nvidia (19th AMC)

Walmart (20th BMO)

With the recent FOMC hawkishness and inflation concerns, odds of the December rate cut have moved sharply lower:

The Nasdaq is now back in its broadening formation, after the breakout/blowoff failed:

Most likely, we see chop and some volatility into the Nvidia earnings window, which will then be followed up by the employment data (now approaching 3 months old) and pre-revision, though markets will of course react to them given how much the lack of data was covered throughout the shutdown… Two different trendlines are being drawn to back two very different scenarios for BTC - this weekend on X:

I say we continue to let the highest beta of them all lead the way, and until the relationship breaks down, keep it simple on crypto.

Knocking on Trouble’s Door & Data Center Issues

One of the more notable trends in the last few weeks has come in the form of opposition to data centers. While this will become a very powerful political force in 2026 (especially locally), it’s also expanded somewhat into a social media force as well.

Recently, it’s come to light that there are many data centers now sitting idle, lacking power hookups for the next several years, as the infrastructure simply doesn’t exist to get them online. Ironically, with the multi-year waiting periods being handed out to these firms, there will probably be completely new tech by the time we get to 2028/2029, rendering these legacy data centers obsolete. While we can’t be certain of the purpose of many of these facilities, they did attempt to shift the window and test the bailout waters a few weeks ago, which they’ve gone very quiet on in the last couple of days… interesting, isn’t it?

Problems with the water supply, grid, electricity costs, and more are mounting, though they’ll be even more relevant in the 2026 political cycle, especially with a soft labor market, as an anti-AI movement may only be in its infancy, and right now a pro-labor political cycle may be at play for the midterms, starting with what we saw with the Mamdani/early Dem victories a few weeks ago.

Empty data centers…?

Wait and see…

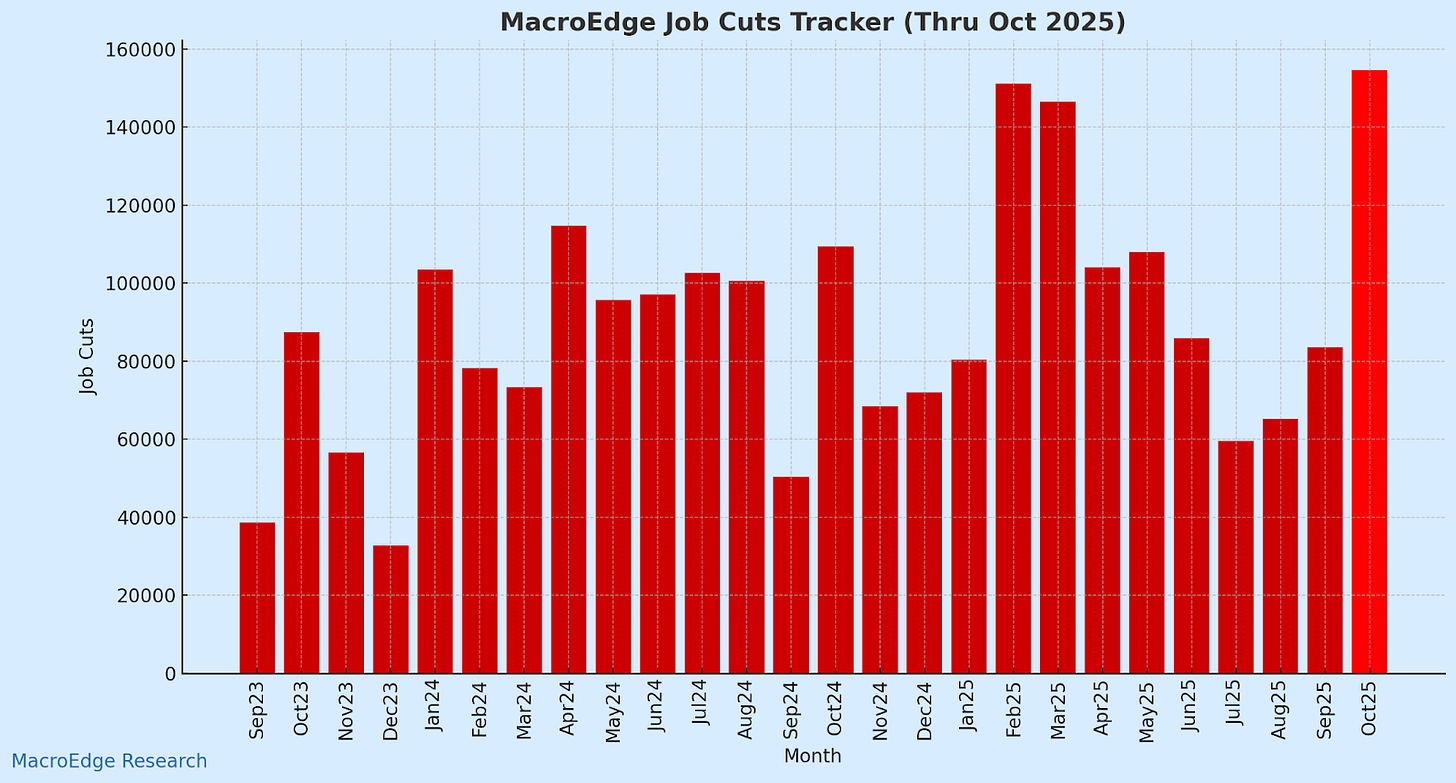

State of the Labor Market

Continuing the trend we’ve highlighted now for almost 3 years, the labor market continues to weaken. That has picked up at a more noticeable pace in the last 6 months, as job gains have cooled, and job cuts have spiked. October job growth was likely breakeven or negative, and things may continue to worsen into the 1H of 2026 as the seasonal spike wears off for the holidays. The labor shortage talks are really not to be believed at this point and time, and as data centers shift from under construction to *completed and idle* expect that more of those construction and trade workers that have cashed in on the data center pandemic/boom move to an idle status as well and end up sidelined. Many investors that I interact with are growing more weary of capital returns from data centers, as the United States lacks both the electricity and the capital to make these AI and data center fantasies a reality.

What looks to be more likely is that the facilities are being laid as the groundwork for another foolish too-big-to-fail program, where you and I bail out the deliberate mistakes of technology billionaires who can’t wait to harvest more of our data and create China-like infrastructure to make our day-to-day lives more cumbersome. What these facilities won’t do, however, is maintain large permanent workforce bases. Stargate, the massive Ellison/OpenAI/Crusoe project in Abilene, TX, will have just several dozen full-time employees when the operation is all said and done. While this project is out of sight, out of mind for a lot of people, I think we should keep a real close eye on the intentions and outlook for this facility, which is having both local and regional impacts on the community, and will likely have national, when it either lands in the too big to fail pile, or is the first in becoming our privatized Ellison-utopia of a permanent surveillance state on the American public… There is a whole lot of irony in the entire situation, especially given how light deportations have been this year relative to the total visa issuances and number of unlawful migrants actually in the country, but we’ll save that discussion for another day. The phenomenon of ‘human QE’ is one that politicians proudly rolled out in the post-2020 world, and we’ve seen it in many Western nations - from the US, to Canada, New Zealand, Australia, and more. The biggest driver in supply tightness is now coming from the lower number of illegal migrants, which is undoubtedly impacting and softening headline employment numbers.

Job cuts:

Indeed Job Postings lead JOLTS by about 3 months, aka job postings are declining and will likely be below the pre-pandemic level in the next few weeks.

Indeed has discontinued updates through FRED for the time being, so we’ll have to shift how we pipe this data in over the next few weeks.

Travel & Hospitality Deep Dive

Hotels have been sideways for a year (note how many sectors have been sideways for a year)... almost all the gains have been driven by the AI/T10 contribution and growth in market cap concentration…

Marriott is near an all-time high:

As is Hilton:

If the employment situation continues to weaken, these names and leaders will be dented. Note how soft casinos have been:

Especially as Vegas travel data has looked 07/08-esque this year.

Just as these equities are leading the warning signs going in, especially with the potential for U3 to be at 4.5%, look for them to lead on the way out, which they are not currently doing.

JETS is another name that sharply rebounded off the April lows - though when you zoom out, you see a similar pattern as the names above - sideways for a year.

AAL / DAL / ALK . LUV - domestic majors

DAL:

ALK

LUV - arguably the most attractive look in a very ugly-looking broader picture right now.

Though Thanksgiving air travel will likely set another new record, there’s a lot of reason for caution in the airline space, with the broader macro backdrop being in the ‘concerning’ range. While a lot of downside has materialized since our previous aviation report - I say it’s best to watch the data through the end of the year - and low fuel costs continue to help the majors.

Japan Wobbles

In Japan, something I never like to skip over for too long - yields are continuing to push higher - as the new Prime Minister doubles down on money printing, and more money printing…

While the BoJ has a limited window to hike, they’re still unlikely to do so now, given the weakness in the Japanese economy. When they start cutting even as the long end continues to rise, that is when things will get a lot more interesting for the island nation.

The Yen has continued to weaken since the major interventions of April, which is precisely what Bessent wanted, and the Carry Trade is back in full action:

It’s likely that we see BoJ involvement here at some point, as we’re getting back to a very uncomfortable level for Japan in Yen weakness. When this occurs, it will likely be net negative US-tech and high-beta like BTC.

Additionally, the blowoff in the Nikkei has been unfathomable:

With elevated inflation, record high debt:gdp, promises to spend more, and a weak economy, coupled with a Nikkei concentration bubble, Japan’s got a lot of problems, and US policymakers know this - so they try and kick the can on them for as long as possible.

Homebuilders as a Signal

Homebuilders continue to see softness, like some of the other cyclicals (trucking, travel, gambling… listed above). NAIL, the 3x builder ETF is back near the 2025 lows:

… While lumber has continued a free fall, even as other commodities have surged:

Toll Brothers for the luxury segment is technically looking weak:

TOL topped out in December of 2025, almost a year ago, and hasn’t recovered that high - alongside many of the other builders following this pattern. While the debate is still out on whether or not the extended hike and hold period has done enough damage to the building cycle to give us something similar to the early 90s or 07-12 from a construction standpoint, we can utilize the builders as an important *leading* indicator on the broader business cycle. This holds true for both previous significant real estate recessions (of course, there’s nuance here).

ITB is sending macro warning shots:

Problem? Yes, meaningful to the broader market yet? No.

Though critical for the broader macro picture, and most importantly of all, the labor market. (even though data center construction matters a lot right now, too).

Where the Bubbles Stand

The market will continue to be defended at any and all costs now through the remainder of the year by the Admin, and this will become noisier as we head towards midterms and polls become more relevant. They blew the bubble up in a select few names, and concentration risk terrifies them - so the easy solution is to keep the party going. While this masks things like repo, private credit, and employment issues under the hood, these things usually don’t stay contained in their respective bottles forever.

The substantial equity bubbles and concentration risks (many of which we highlighted in the report last month) that I linked above are a significant threat to the economy, which is why the downside has been limited. The Administration has shifted its tone to benefit both ‘Wall St. and Main St’, though voters aren’t seeing any benefit of the latter. Even those on the Street are growing more skeptical that much, if anything at all, will now get done by next November (which is less than a year away now).

I say we worry less about politics, more about these opportunities in the bubble names, and continue to chart our own course forward.

Hopefully, there was something, or a lot to take away from here, and I will see you Wednesday evening for the Midweek Macro Note.

The Great AI Repricing - Six Finance (@SixFinance), Head of Research

The U.S.-China trade detente is the latest marker of trade deescalation as the legality of tariffs are deliberated at the Supreme Court level. Regardless of outcome, tensions remain high between the world’s two largest economies, evidenced in continued US bolstering of US minerals and rare earth element supply chain capacity, and aggressive stockpiling of oil by China. Deglobalization continues to persist, with continued upside pressures to inflation.

Keep reading with a 7-day free trial

Subscribe to MacroEdge to keep reading this post and get 7 days of free access to the full post archives.