Redeye #2: Bourbon and Data with Don, John, and Awsumb (MF Niagara Falls, Cisvidia, and RE BLDR)

We're giving another round of MacroEdge Redeye a go (with Diet Coke on the way for me from the airplane steward as I type)

@DonMiami3 (MF Niagara Falls)

Well folks - another week and another unbuttoned edition of our weekly data report. We launched these to communicate data less formally to you all and integrate more community members into the discussion. MacroEdge itself is seeing incredible growth and that is only possible because of you all - so that is my cheers for this evening. (Oh and Ms. Kat - who has contributed great pieces on the hospitality sector over the last 2q’s - has specifically instructed for all of us to pour our glasses this evening over a cube, so less rocky and more cubey this evening - if you catch my drift).

While you do that - get two weeks to MacroEdge Ozone on the house while the team builds out V2 for all of us to enjoy, on track t for release in March or Early April.

The last week was an absolute cluster on the Wild West social media platform known as X with Cramer, Puru, and others taking wild victory laps that they had finally managed to get something right throughout their multi-decade-long careers. We’re seeing dumpster fire names rally again and the risk appetite for the casino patrons seems about as high as some of the people you’d run into at the Hard Rock Seminole (thank God that Kenny Griffin - who might be wealthier but not as good looking - was able to torpedo our South Beach casino idea to keep those gamblers on Robinhood and up at the Hard Rock). The AI casino continues to party on and the most important thing that I (and we) continue to watch at this point in the cycle is continuing claims - which remain elevated but are still a ways off levels of great concern. I talk about frequently in our weekly reports how continuing claims are very elevated in states like California, right now, which needs to be watched, although our WARN expert (@J77324) does a great job at breaking it down on a state-by-state basis, highlighting strengths in states like Florida. I won’t ramble endlessly since we’ve got some fabulous pieces from the great John Galt and Mr. Awsumb - but I will however give you an update on the multifamily timebomb looming over us…

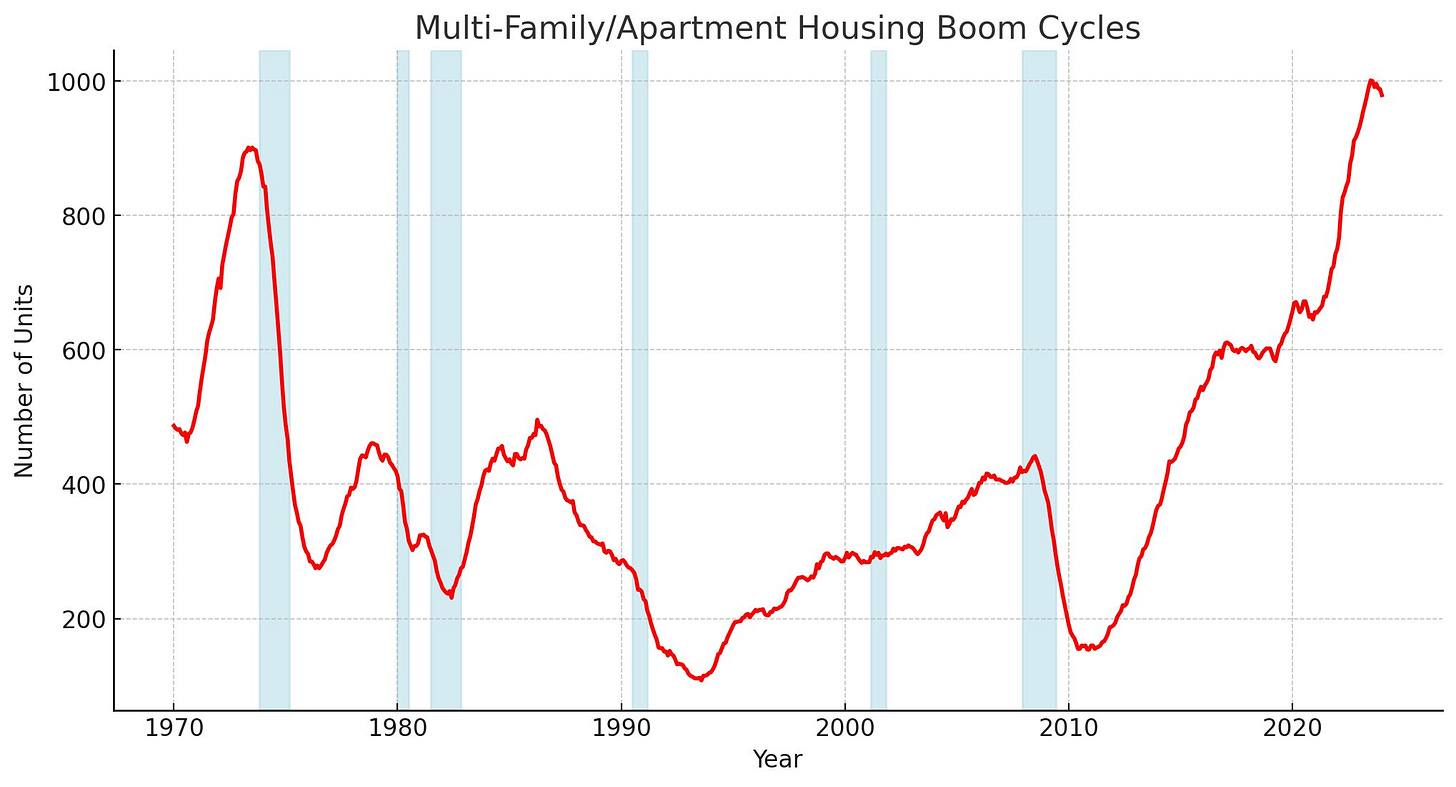

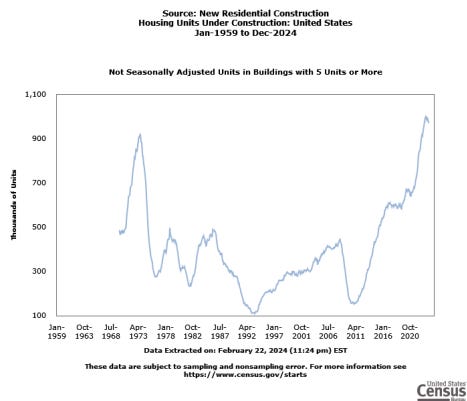

As I highlight frequently in our weekly reports - the multifamily constructive environment has been very conducive for strong construction employment growth… the music is stopping at that party (looks like ‘MF’ Niagara Falls):

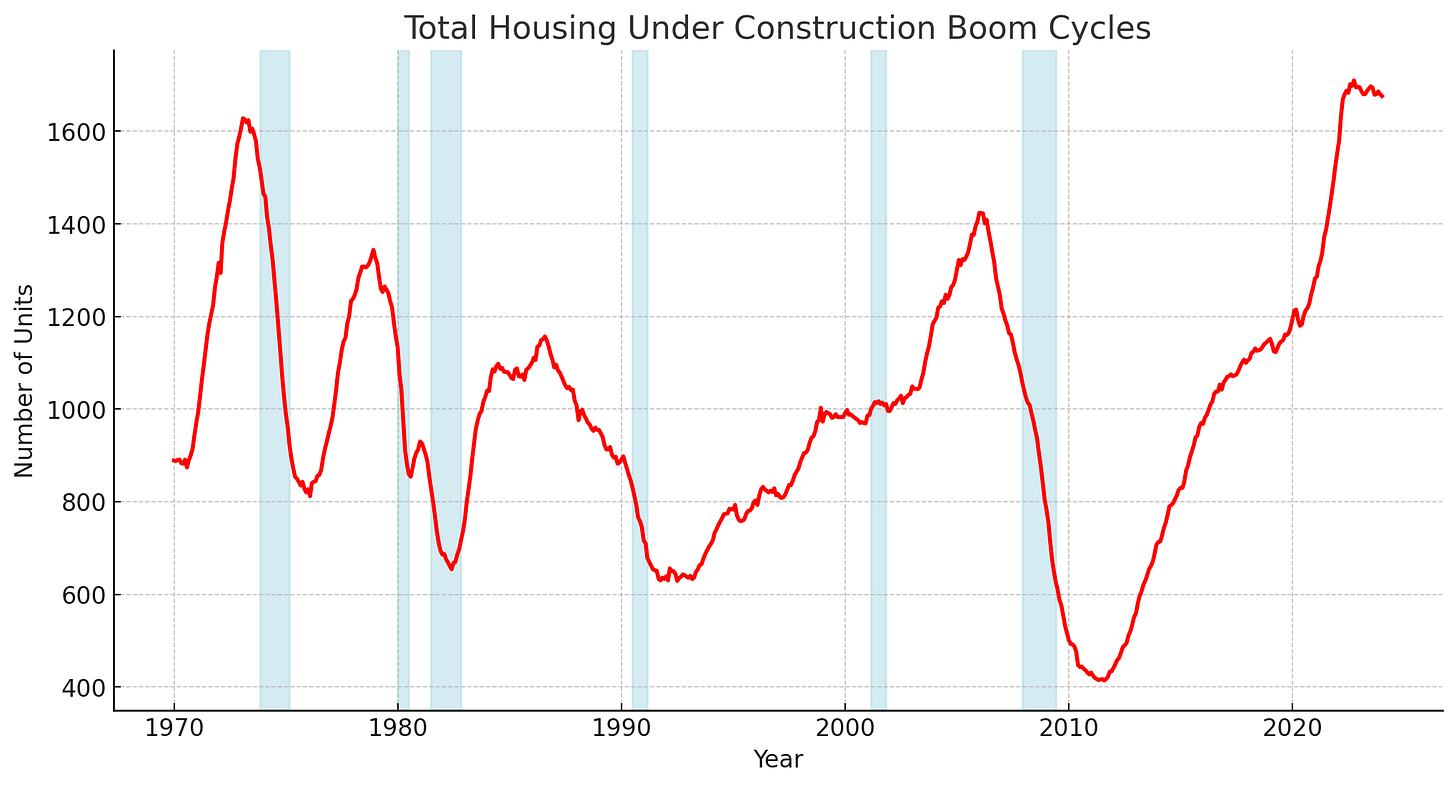

Contraction cycles in multi-family take years so this may act as a headline for further residential construction growth once the train leaves the station on the number of units (actively) under construction. Take a look at total units as well:

Rates staying elevated will likely continue to slow anything on the construction side and let’s keep a close eye on the employment in the res. construction sector as this situation evolves over the next several years.

(@RealJohnGaltFLA, “Cisvidia”)

The media, the financial world, and civilization came to a stop this week.

Wars were paused, children’s births delayed, and the heavens shone a light again on the sleepy little blessed village of San Jose, CA.

TheStreet.com headline said it all:

‘The most important stock on planet earth’

I’m not so sure Pfizer appreciates their status being removed since they invented the “shot that saved humanity” just three years ago. But I digress.

The cacophony of calls for universal praise on the future artificial intelligence possibilities has long been touted by those pumping this stock. The usual suspects did their bull cases on the Bubblevisions proclaiming that although the risks of Terminator robots eradicating mankind were there, a stock with the potential to raise the S&P 500 to 5,200 by April was far more important than Mother Teresa, the Pope, and humanity itself.

In reality, this is just another repeat of the United States economic, stock market, and speculative bubbles throughout history.

If one looks at the current chart of Nvidia stock, one will see a quite familiar pattern.

Of course the comparisons to the 1990’s .com bubble returned with a vengeance and the defenders of Nvidia and this rally replied with their usual version of “it’s different this time” drivel:

Wall Street keeps likening Nvidia to dot-com-era Cisco. Is the comparison justified?

Of course they use the usual catch phrases of “valuation calculations” and newer more sophisticated accounting standards plus my favorite of “modern investors are more sophisticated.”

Bunk.

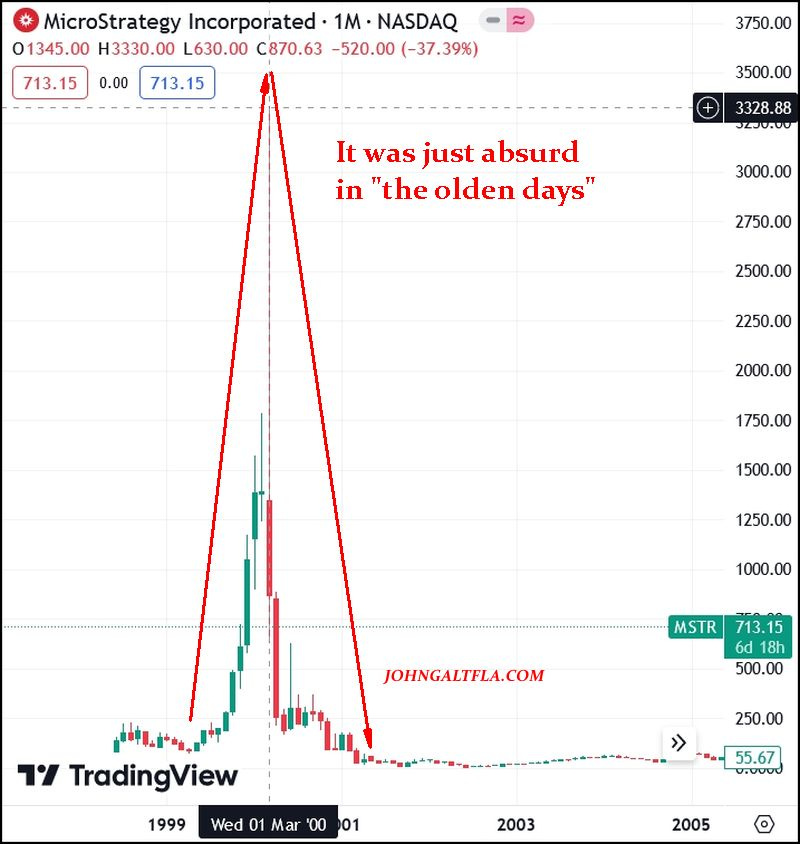

Here are some reminders for those that survived the internet wars of 1999-2002 to refresh one’s memory:

Cisco Systems (CSCO):

Intel (INTC):

Corning (GLW):

And of course MicroStrategy (MSTR):

If one reflects on chart patterns alone, this is a stark reminder that the mistakes of the past can be repeated. In 1997 through 2000 the American public was constantly reminded that fiber optics and the internet were the future. There is no way that the economy could contract again and a new future was upon us.

In reality, human nature, aka, greed and avarice won out, and the NASDAQ cratered in a 1929 fashion which obliterated the speculative bubble, just like 1987, just like 1981, and of course, the old worn out reference of 1929. One could go back further but the comparisons to the auto and radio bubble of the 1920’s was apt, considering the speculative fervor the 1990’s initiated in an almost identical manner.

Here is society again, on the so-called precipice of artificially capable intelligent machines capable of logical and rational behavior. The flaw however is that humans are the ones initiating that usage of said machines and also programming them. Much like the automobile boom of the 1920’s, the idea that all of the companies would succeed was thrust upon the public and the theories of unmitigated, unlimited capitalism could catapult mankind to new heights.

Of course the interference of government action was never taken into account.

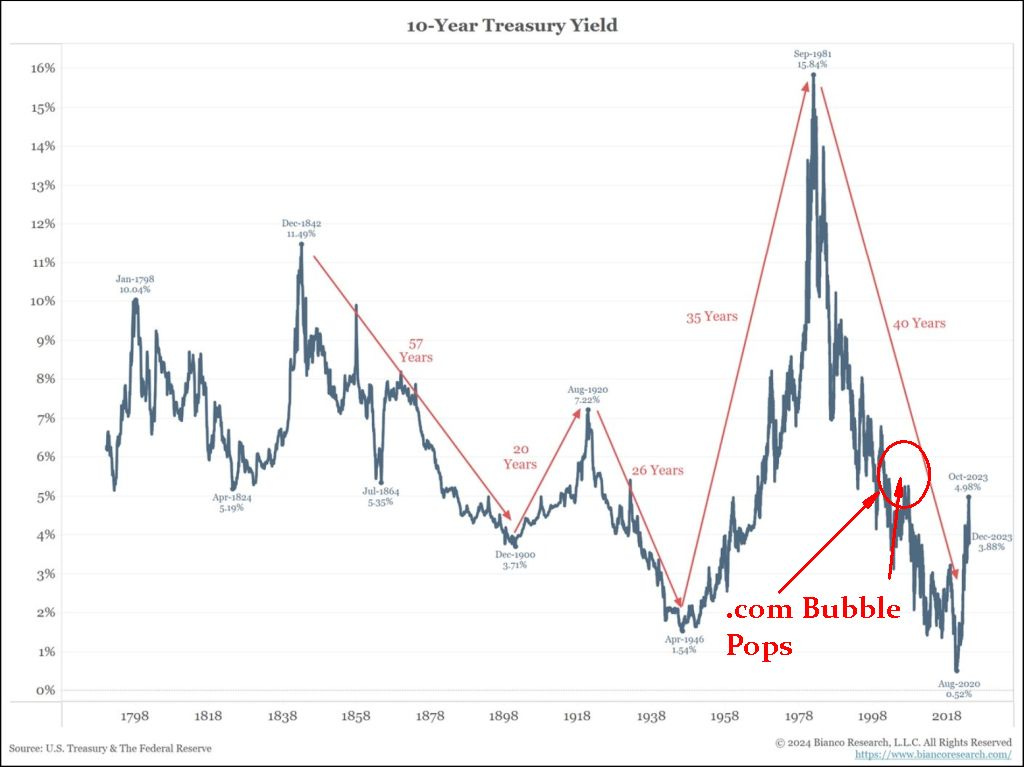

In the case of the modern era, that government includes a politically active and economically meddling central bank known as the Federal Reserve. As Jim Bianco reminded one of his readers this week via “X” the cycles of the primary US bond yield, the 10 year US Treasury, has been yanked, teased, and taunted in different directions.

The chart Bianco published points out one glaring, if not alarming feature:

Ignore the cycles, look at the sub-cycles. From 1998 to 2002 the 10 year US Treasury yield surged on an a move back above 5%. Combined with the puncturing of the speculative Wall Street fervor, this sent the US economy into a short recession which punished the middle class, eradicated the NASDAQ bubble, then allowed the genius Alan Greenspan to justify creating the housing bubble which lead to the Great Financial Crisis (The Depression that Never Was).

“Cisvidia” is just a symptom of what is happening.

There has been no mass adoption of artificial intelligence as a practical profit guaranteed tool for corporations outside of remote switchboard operators, poorly constructed customer service representations, and the ability to block the American public from getting services that they have been paying for in various service industries.

In the mean time, the American people are simply looking for a get-rich-quick scheme to justify their existence and the ability to offset inflationary pressures created by government largess via speculative investing. It is akin to the now massive legalization of sports wagering and online casinos yet justified by presenting the cover of a retirement future, even if the largest institutions eventually crush their plans with their own confidence game.

In the mean time, look at the older charts from above and decide if the risk of a repeat of one’s own portfolio is worth it.

(@MrAwsumb, “RE BLDR”)

RE BLDR

No, that's not some acronym for someone who rebuilds things. It's the topic of today's discussion: Real Estate (RE) and both the ticker BLDR, and the health of Builders in general.

You may have heard Federal Reserve Board member Christopher Waller's commentary that the Commercial Real Estate problem is both predictable and manageable. Which might be news to Commercial Real Estate operators. Despite the claim it's manageable, The Irish Times reported that bad property debt has exceeded loss reserves at the largest US Banks, including the largest, JP Morgan Chase, Bank of America, Wells Fargo, Citigroup, Morgan Stanley, and the Octopi (Goldman Sachs). Which probably doesn’t bode well considering that commercial real estate prices are trading at massive discounts nationwide.

While losses are making an impact on banks, fundraising continues its decline for the sector. According to Costar, fundraising for nontraded REITs in 2023, was 1/3 of what it was in 2022. It would have been worse yet if the University of California hadn’t tossed 50% of the 2023 dollar amount into REITs. (you read that right)

While office and retail have been hammered, there’s been 3 classes of real estate people keep telling me are doing well: 1) Industrial 2) Multi-Family 3) Homebuilders

Let's start with the commercial side.

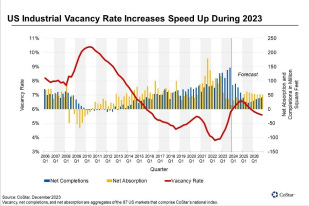

Some serious cracks are beginning to appear in Industrial class real estate. According to Costar again, Net Completions in Industrial construction are at levels not seen since pre-2006. While Net Absorption is at worse levels than Pre GFC. I’m not sure how they calculated their projections, but I sure would like some of whatever made them think that’s where things are going. Take a look at that actual vacancy rate rocket ship.

Let's move onto Multi-family. If you haven’t been keeping track, we’ve never BLDR’d more multi-family in the history of record-keeping in the US.

Multi-family builders are doing their part to make YIMBYs happy, and creating negative pricing power in the sector. It’s become so obvious, even Bigger Pockets has capitulated. Stating that Multi-family is at high risk of “continuing its historic crash”. If you’ve read MacroEdge before, you’ve seen some of the incentives being tossed about in Multi-family. 3-4 months free rent. Remember, 3 months of free rent is a 25% rent reduction. All fun and games until it isn’t.

Which brings us to Homebuilders.

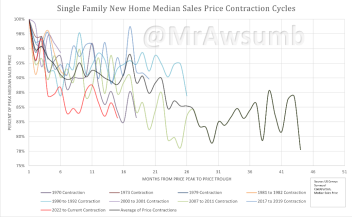

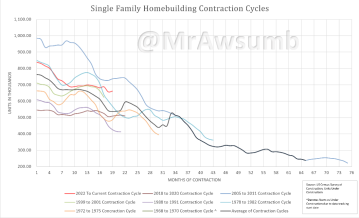

We are continuing apace the fastest and most severe new home price contraction cycle since record-keeping began. If you’re interested in both the cycle expansions and contractions, you can find them broken out by cycle here. What happens when prices drop? Building contracts.

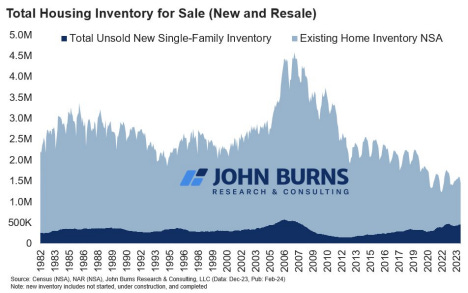

In 50+ Years, these two contractions have always preceded recession. But let’s dig in a little bit into the stock components. It should be noted that things are so challenging, even John Burns Real Estate Consulting is discussing the inventory piling up at historic levels.

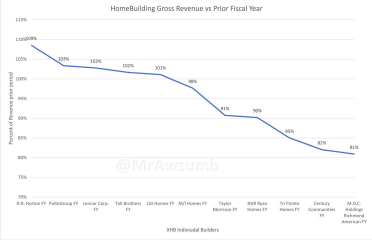

But what about everyone’s “favorite” version of “homebuilding good” the XHB. The Homebuilder ETF. Let’s start with the actual homebuilders in the ETF.

Only 5 builders reported an increase in gross revenues. Only 2 reported an increase in Net Income. The rest saw a decrease in Net Income, even if they had increased Gross Revenue. To add insult to injury, Warranty spending was up 20% in 2023 vs. 2022. (H/T Melody Wright)

It should also be noted that Lennar took a major hit on its Multi-family rental, going from a $250M profit to a $50M loss, and has put a huge chunk of its portfolio up for sale.

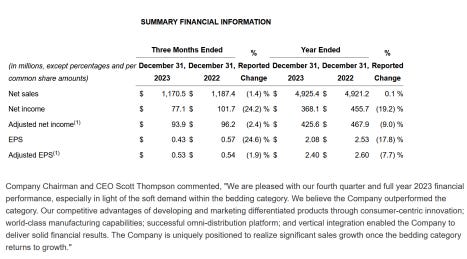

Back to XHB. One of its top holdings is Williams Sonoma. The kitchenware company. I’m going to leave this comment here for you. Another holding is Sealy. The mattress company. They sell to more than just homeowners, think Hotels. Then take a look at the change from 2022 to 2023 Net Income and EPS. Perhaps my favorite “Cycle Fad” is “Adjusted” statistics. Particularly because it was born of greed, to make everything look even better. Now some companies are so used to using it, they use it even when it makes their numbers look even worse. Karma something something.

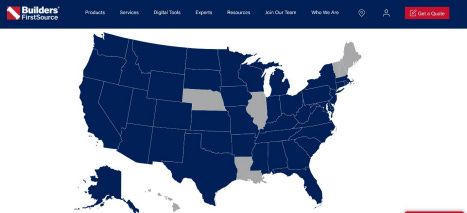

That brings us to another component of XHB. A Very important one. You might even say it’s the BLDR portion of the Builders ETF. We’re talking about none other than Builders First Source. If you’re not familiar, they provide materials for new Homes, Apartments, Industrial Buildings, Office Buildings, and more. And I’m not talking about them being in the same category as Lowes or Home Depot (Who just reported negative earnings, and both are part of XHB. I’m talking about the source for Contractors to get materials nationwide. In Fact, let’s take a look at their footprint. BLDR operates in all but 5 US States.

BLDR offers products from start to finish for construction projects. This isn’t like going to Home Depot.

This is one of the companies you get a “package” from no matter what you’re building. A package like, lumber, doors, windows, hardware, roofing, siding, etc etc etc. And they contract with National Home Builders (public and private), apartment developers, and so much more. This company represents construction cycles. So, on to earnings shall we?

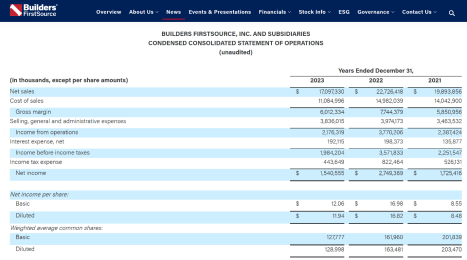

Fewer net sales than even 2021. Smaller Gross Margin YOY, Income before Taxes way down, Net income way down (again below 2021), EPS down.

What we have here is, the supplier to all builders, in contraction.

We’ll save construction spending for another day. But for now, the hit to BLDR should give everyone a cause for concern. When the people supplying the subsectors stumbles, the sector tends to follow suit.

Thanks for joining us on the Red Eye at MacroEdgeRes. Looking forward to sharing more with you soon. -@MrAwsumb