Redeye Macro Note 10/10: Winds of Hamamatsu Touch Leveraged Gamblers, Auto Market Troubles, Technical Deep Dive, Institutional Update

In this Redeye Macro Note - we dive into the 'Winds of Hamamatsu' as we finish the note on a downside move that resulted in extensive losses in the tech & crypto trades. We also cover macro data+more.

(@DonMiami3, Chief Economist)

Good Friday evening MacroEdge Readers & Community,

This evening we’ll have a brief Redeye Macro Note from myself & @SixFinance to discuss the data & price action from the week as we finished the week off on a very sharp downside move (86% downside v 12% advancers). In the cryptocurrency markets - things were much more severe in loss terms, with over $20 billion in 24-hour liquidations (from the time of this writing Friday evening) and nearly $700bn in market cap terms were eliminated over a 12-minute period in the early evening, and met by brief bounces across the board.

Days like today reiterate the left-tail risk on such a thin & concentrated market, and moves like today are ones that can’t be anticipated by fiscal policymakers (recall April too?). Leverage in the system right now is pervasive - especially in less regulated spaces like crypto - and we’re also seeing problems in the regional banks & financials from things like First Brands & Tricolor…

Sunday evening we’ll dive into continued ideation on the portfolio strategy front - for both MIRP & the GMSP, but expect that after the huge outsized VIX move today that the environment again gets noisier through the end of the year. The tariff announcement from Trump seemed to be more of a threat for the time being than an action statement, technicals, valuations, and internals will continue to be more valuable signal factors than headlines for predictive movement.

As we discussed extensively in the October Institutional Research Report, we remain in one of the biggest & most concentrated bubbles in US equity market history - begging the question, is it really a new paradigm for permanent paradise & sky-high valuations in profitless garbage?

From the October Institutional Report (available below):

“I haven’t ever experienced a bubble so broad where a conversation in the background, or one that I am involved in, deviates into ‘AI’, ‘LLMs’, unicorn fairy dust coins, or whatever the latest delusion potion of the day is for grand riches & a modern society powered by people speculating and gambling en masse from their smartphones doesn’t seem like a sustainable one, thus assumably based on history - this one will face a similar ending - though from a timing standpoint we cannot assume because we are in a bubble it has to stop going up.”

We seem to think not, but don’t expect that distribution will occur linearly, recalling that we have one of the most aggressive fiscal Admin’s for market intervention as well…

Macro Data Quick Review

> UMich Inflation expectations held steady at 3.7%

> UMich Consumer expectations remain near 08 & cycle lows, respondents continue to sour on the Admin’s handling of the economy

> Government shutdown is entering week 2

> Odds of a rate cut remain near 95% for October

> Real-time employment signals continue to weaken, such as Indeed Live Job Postings:

> No data releases until the government reopens, which right now still looks to be the 16th or later, at the earliest, current expected length of the government shutdown is now 29.8 days

> Mass layoffs of federal employees resumed today, with around 4,000 RIFs issued, we expect this to climb 4,000 every 2-3 days from here on out, until the shutdown is resolved

Institutional Research Update

Due to our trip to California, oversight in the final development of the MacroEdge dashboard was delayed, and final details are being applied. I do not want to release a partially complete interface for our Institutional Research users, so we are moving the Dashboard & IR launch date to Tuesday 10/14, which will be joined with an updated subsequent launch post.

For those waiting for the emailed invitation link for registration, that day is now moved to Tuesday as we prep a completed & finalized interface, as well as IR Substack for all releases there going forward.

Pre-access to Institutional Research is available below:

Learn more about Institutional Research at:

Don’t have MacroEdge Ozone & missing our critical insights, data, and reports - get access to MacroEdge Ozone below:

Winds of Hamamatsu

Today marked a slight shift in price action from the April - October melt-up retail madness, with a large down-volume move. Days like today are days that give us signal factor to the cracks that are present in this very fragile and thin market, though more data & price action have to confirm cracks in down moves.

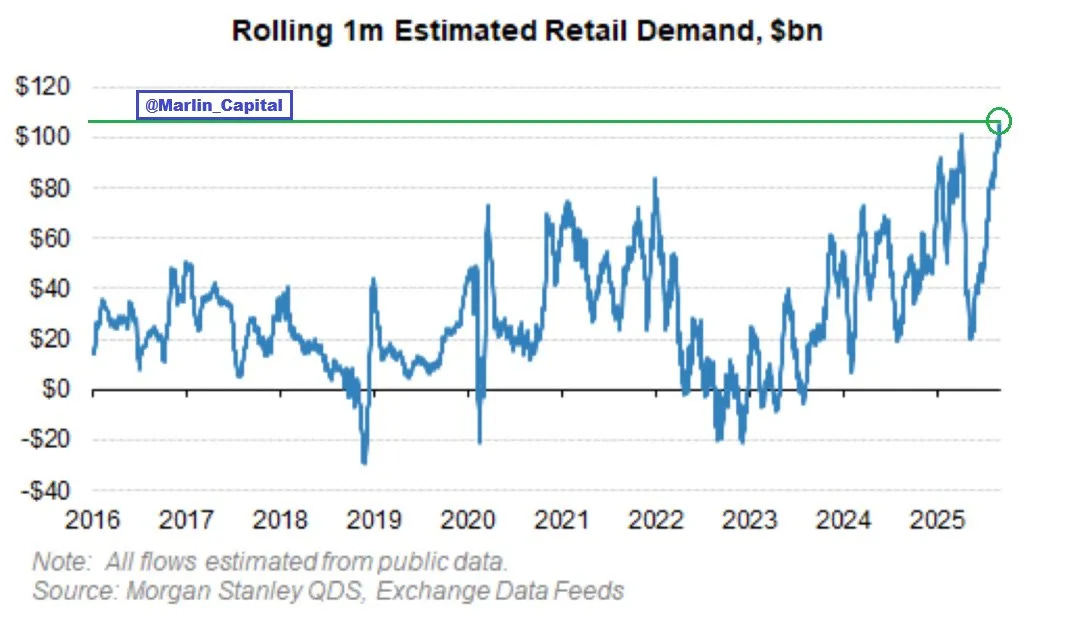

The out of control leveraged gambling and retail flows (below):

The retail buying spree through the first week of October remains unprecedented, even with this small liquidation event. We will utilize, as we did in February, our same formula of flows, valuations, internals, and technicals to pick up on broader softness in both individual equities & broader indices as we track and monitor mounting weakness. There’s going to be astonishing opportunities to generate risk on down moves, just as there has been in this up-only environment, & asymmetry is at one of of its fattest dispersions we’ve seen in markets since an environment like 2000/early 01, late 80s Japan, and less-relevant from a modern market standpoint – 1929.

Auto Market Troubles

What’s New (Last 30 Days)

A major subprime lender collapsed outright. Tricolor Holdings, a deep-subprime buy-here-pay-here lender, filed for Chapter 7 in late September, triggering a scramble over roughly 100 thousand loans and leaving warehouse lenders exposed to losses approaching two hundred million dollars. The case revealed serious weaknesses in underwriting and servicing controls and has forced a broad reassessment of counterparty and operational risk across the auto-finance chain.

(what’s below? Auto Market Troubles continued, Technical Deep Dive, Tariff Shock & the TACO Trade from @SixFinance - Head of Research)

Keep reading with a 7-day free trial

Subscribe to MacroEdge to keep reading this post and get 7 days of free access to the full post archives.