Redeye Macro Note: Putting the 2026 Wheels in Motion, Another Mid-Air Stall

In this Redeye Macro Note, we preview our 2026 outlook, talk the equity markets being in another 'mid-air' stall, talk about the global macro picture going into 2026, global bubble gauges, and more.

Good Friday evening MacroEdge Readers & Community,

This evening we’re going to cover some ground missed over the last few days. I hope you had a fantastic New Year’s Eve & Day, and I was able to pay a quick visit to North Florida to spend a few days with my co-founder, hunkered down during a very cold stretch of cold front weather. That gave me a chance to put our new MacroEdge apparel to use - so I was not particularly sad about the cold weather (which can be very hit or miss this time of year in North Florida, especially near Destin)... Apologies on our end for the lack of releases over the last week, there wasn’t a whole lot to talk about without beating a dead horse, and we’re working on several new contributors joining our research lineup in 2026 that will enhance our coverage of different macro & micro sectors. We spent a lot of time in planning mode over the past week, and that continues through next Monday, when the wheels of a new year begin to turn with greater speed.w

We published our first apparel batch for the winter/spring 2026 lineup on X about a week ago - and you can place pre-orders on all available merchandise through the form below. Quantities are limited to what we ordered, though I will say we did not hold back on quality - with the winter jacket and vest coming from Brooks Brothers, the corporate raider zip from Port Authority, and the remainder of the items (quarter zip, hat, beanie) all coming from Nike. Given our plans to get out and about much more in 2026, I am excited for some of you to say hello in an airport or at a restaurant if you see me repping our new style. Pre-order form available below:

There’s mixed feelings about the economy going into 2026, and we’ve heard a lot of positive rhetoric from the Administration about huge expectations for this year, including with the expectation of record tax refunds, the continuation of tailwinds from the ‘One Big Beautiful’ tax bill signed into law in 2025, a year-end surge in trucking/transportation stocks & industrials, and the fact that we’re seeing a much more supportive Fed of the economy than we had from 2022-early 2025 when they were in inflation fighting mode. While the pivot to easing so soon may prove to be a mistake (just look at the BCOM commodity index) - clearly the Fed continues to be concerned about the labor market.

MacroEdge Ozone will remain available through Substack for the next two weeks at the the year end 2025 pricing, found below, and you can continue to access a two week trial period, as we continue to prepare to rollout updates for Ozone Pro at the end of the month. Both links can be found below, through their respective buttons:

Let’s get ready for a very jam-packed 2026, and I am excited to capture opportunities and new asymmetric opportunities with you all this year. Let’s dive in.

2026 Preview and Projections

We’re coming into the year with a (yes, continued) bifurcated macro landscape. We’ve heard a lot about the ‘K-shaped’ economy to end the 2025 year, which I would more accurately describe as ‘i-shaped’, and we’ve seen some minor flare ups on the geopolitical front with mass protests in Iran and with the US inches from broader action against the Venezuelan regime. As discussed below, there are a lot, lot, lot of moving pieces from a global macro standpoint - with equities surging across the globe in the second half of the year in many countries, while Japanese yields continued a historic charge higher, China continued to suffer under a deflationary regime, and the US consumer continues to battle persistent inflationary pressures.

On Sunday evening, we’ll talk about our outlook for the year for employment, inflation, markets, the rest of the world, and much more. Stay tuned for the Weekly Macro Note for the deep dive and preview of what’s upcoming in the data realm, as well.

No Santa Rally to End Holiday Season

This holiday season, we saw no massive ‘Santa Rally’ that was being expected by many pundits. In fact, when you zoom out, it was much more reinforcement to the distributive pattern we’ve seen in many names & indices since late summer - sideways action with low volatility that’s seen some of the largest orders within ETFs and single-names on records. As highlighted a few weeks ago in the tweet I mentioned from VolumeLeaders, there’s directionally no ‘’guaranteed’ signal on these large outlier prints, but when looking at a combination of signals like technicals, internals, valuations, (AND) things like this transaction data, we can make more sense of expectations into the new year.

For the ‘Santa Rally’ performance, from December 21st - January 1st:

S&P 500: +.16%

Nasdaq 100: -.28%

Dow Jones: -.15%

Russell: -1.88%

Cryptocurrencies have also continued to struggle, and without any major move in the cryptos, I expect equity market actions to track quite closely to our best real-time financial conditions signal (being crypto). While Tom Lee, Saylor, and others had very large expectations for digital currencies to end the 2025 year, a resumption of ‘shadow-QE’ and further financial easing wasn’t enough to get the ball rolling on any sort of rally. While the drawdown in many cryptos has been quite significant from the major October sell-off, when we saw billions of dollars in forced liquidations, and hundreds of billions lost in market cap, it provides a useful signal in a very noisy market environment still operating with record bullish positioning and household investment.

New Contributors & A Follow-Up to Our 2026 Update

The Daily Macro Minute (DailyMacroMinute.substack.com) - our morning update of the 3-5 most important charts and datapoints for the day, will resume next Monday ⅕

Our Winter/Spring Apparel (Winter Jacket, Quarter Zip, Beanie, & Hats) are all available in limited stock for the month of January. You can find the link for preordering above via the button, or click below:

We will announce 3-5 new contributors over the next two weeks - that will write alongside me for the 2026 year. You will continue to see familiar names and faces this year, such as Six, John, and more.

MacroEdge Radio will resume next Friday, as being on the road, and down with another cold, it was difficult to get another show assembled during the holiday period.

MacroEdge Ozone will expand in 2026, with new contributors, coverage, and data in 2026 and we will continue to offer a two-week access period for all new members. You can get two weeks access below, or subscribe through Substack:

Our 2026 divisions breakdown:

Macro Research (Ozone / Ozone Pro / Economic Advisory)

Transform (Sales & Marketing, Data & Technology, Management & Strategy)

Other (Media, Apparel, Data, Partnerships)

Learn more about all things MacroEdge by contacting us at info@macroedge.net, or by visiting MacroEdge.net

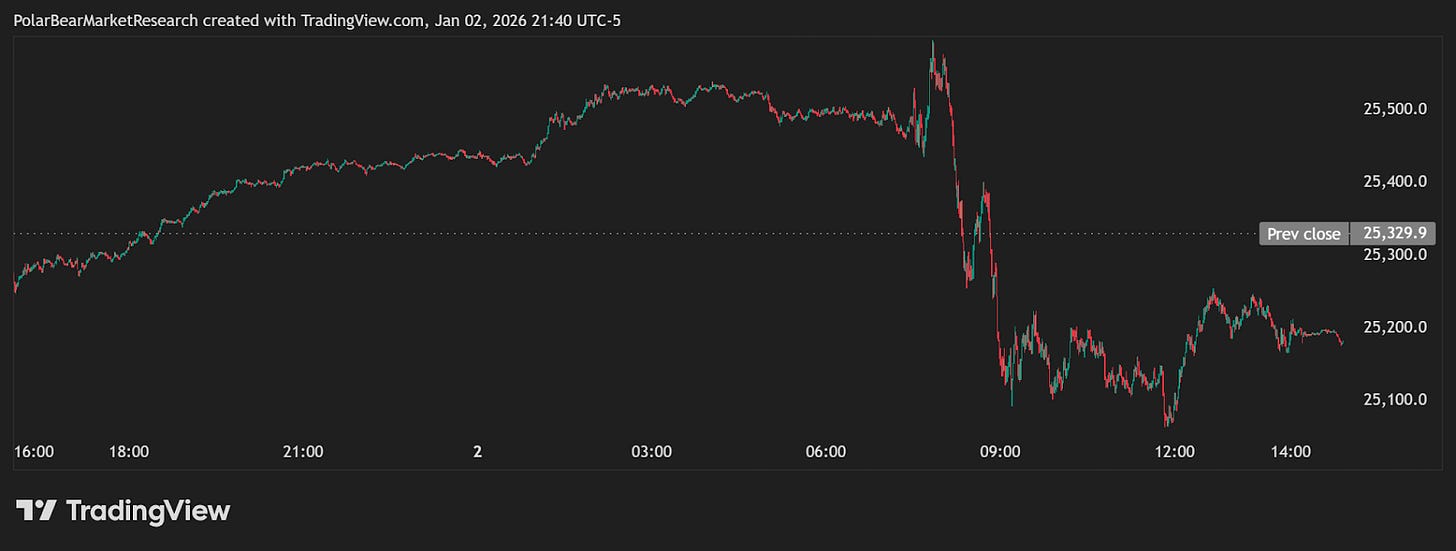

Equities were set to start the first 2026 trading day on a very high note, but that was reversed in tech, small-caps, and the S&P early in the day:

Another Mid-Air Stall

It’s hard to believe that 2025 is already fully in the rearview mirror, and that means we can look at the entire market picture and structure with a clear lens. While more bearish developments that what occurred in April did not materialize in the second half of 2025, as we saw massive fiscal interventions in markets (through both language and policy), and a lack of broad enough bearish macro trends like softening earnings, markets have broadly lost momentum from late September, looking at all of the indices. If a similar distributive pattern is playing out as we saw in late 2021, 2025 from January to February, and now present again, we can expect that risk has not just left the ballroom completely for the new year.

The Nasdaq has been rangebound since late September:

This broad pattern developing will determine the tone of the first 1-2 months of the year.

Just waiting on a catalyst across the board:

Negative divergences are also coupling this pattern development.

Bitcoin is down 7% on a y/y basis:

It’s likely we get our directional move here during the course of January, which will set the tone for equities for the first quarter. We’ll talk more about that on Sunday evening. Even though we could see a few percentage points higher in some of the highlighted patterns, the setups have some resemblance to early 2025, late 2021, and other distributive patterns that take time to develop. Some of these developments align with the broader macro picture, which we’ll talk more about below.

(continued below: The Macro Picture Going into 2026: The Globe, Yields, Bonds, Inflation, Employment) - subscribe to MacroEdge Ozone to read all of our Ozone releases:

Keep reading with a 7-day free trial

Subscribe to MacroEdge to keep reading this post and get 7 days of free access to the full post archives.