Redeye Macro Note: Real Estate Recession, ABS & Regional Bank Spook, Intervention Firepower, Institutional Research Note

In this Redeye Macro Note, we discuss the ongoing real estate recession, the increasing concern around strain in the ABS market, interventions by fiscal policymakers, and an update from the IR team.

(@DonMiami3, Chief Economist)

Good Saturday evening MacroEdge Readers and Community,

For this short Redeye Macro Note - we’ll take a look at the latest pre-Halloween ‘spook’ for the Administration and monetary policymakers - stemming from regional banks and auto stress. As discussed two weeks prior, auto continues to cause sparks - not shockwaves, in credit markets, but these early warning signs are notable. This week the story broke that a third lender - PrimaLend, had its creditors seeking to push it into bankruptcy, which has not yet occurred.

On Thursday - regional banks sold off hard - led by loan book losses at WAL & ZION, reported in earnings, and we have another week of regional bank earnings ahead this coming week. I am still more interested in developments in 2026 on the banking sector front, and we appear to be sputtering with the latest action over the last week, which required (4) different fiscal interventions to stave off a broader correction:

Simply calling a spade a spade here.

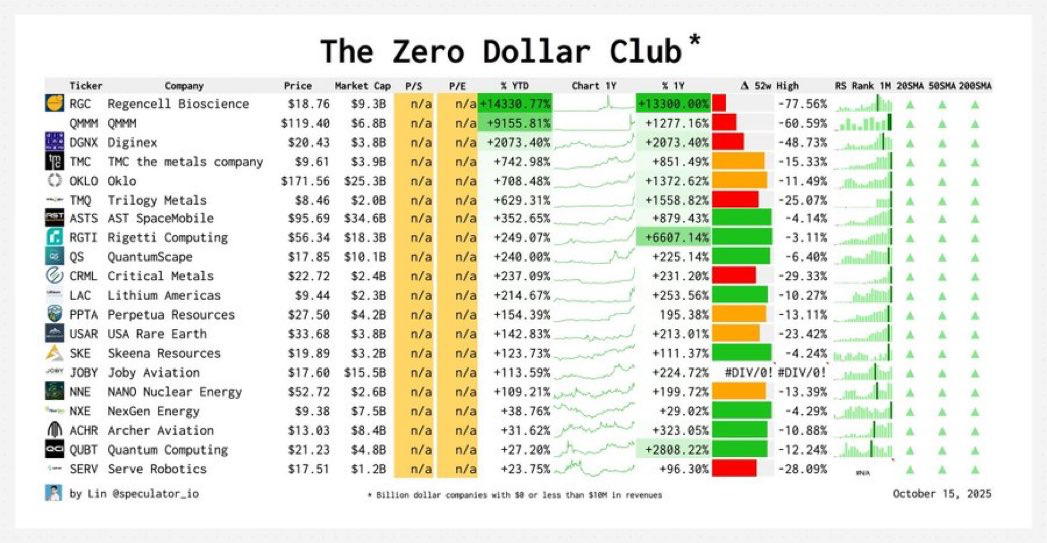

According to the fabled Tom Lee & others, this is what the third inning of our new AI slop/data center era looks like:

Maybe it’s time we start looking at Aerotyne Engineering, for those that get the reference of course…

Institutional Research Portfolio Strategy Updates

Institutional Research clients received several portfolio strategy updates for the MacroEdge Institutional Research Portfolio (MIRP), while there are no updates to report for the Global Macro Strategy Portfolio (GMSP).

Institutional Research continues to wind up to speed, with 10 additional datasets being added to the dashboard this weekend, including the Data Center Closure & Delay Tracker, a new flagship MacroEdge data series. As opposition to data centers mounts & their impact on communities becomes more apparent, we’re excited to lead the discussion with our data-driven approach.

To access Institutional Research, schedule a conversation with our team below, or get 30 day access below:

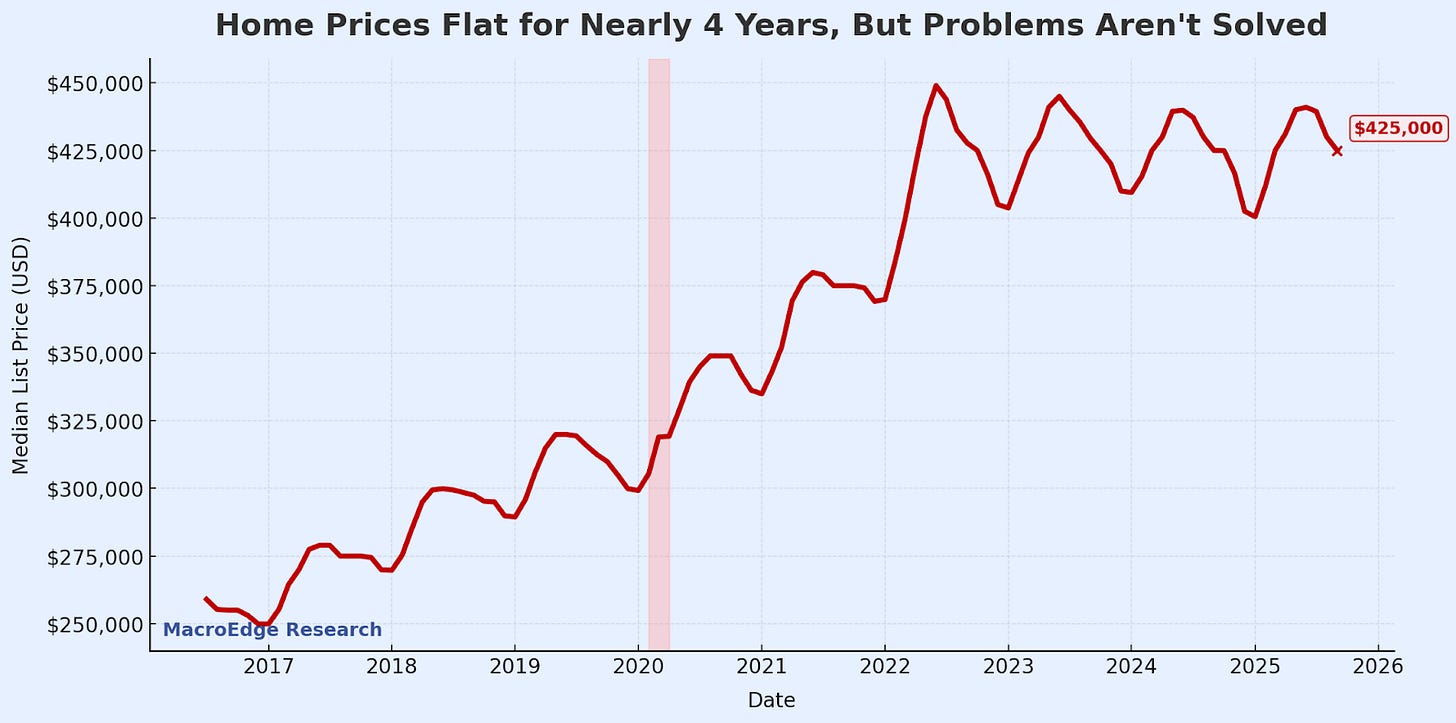

Real Estate Recession: Math Still Doesn’t Pencil

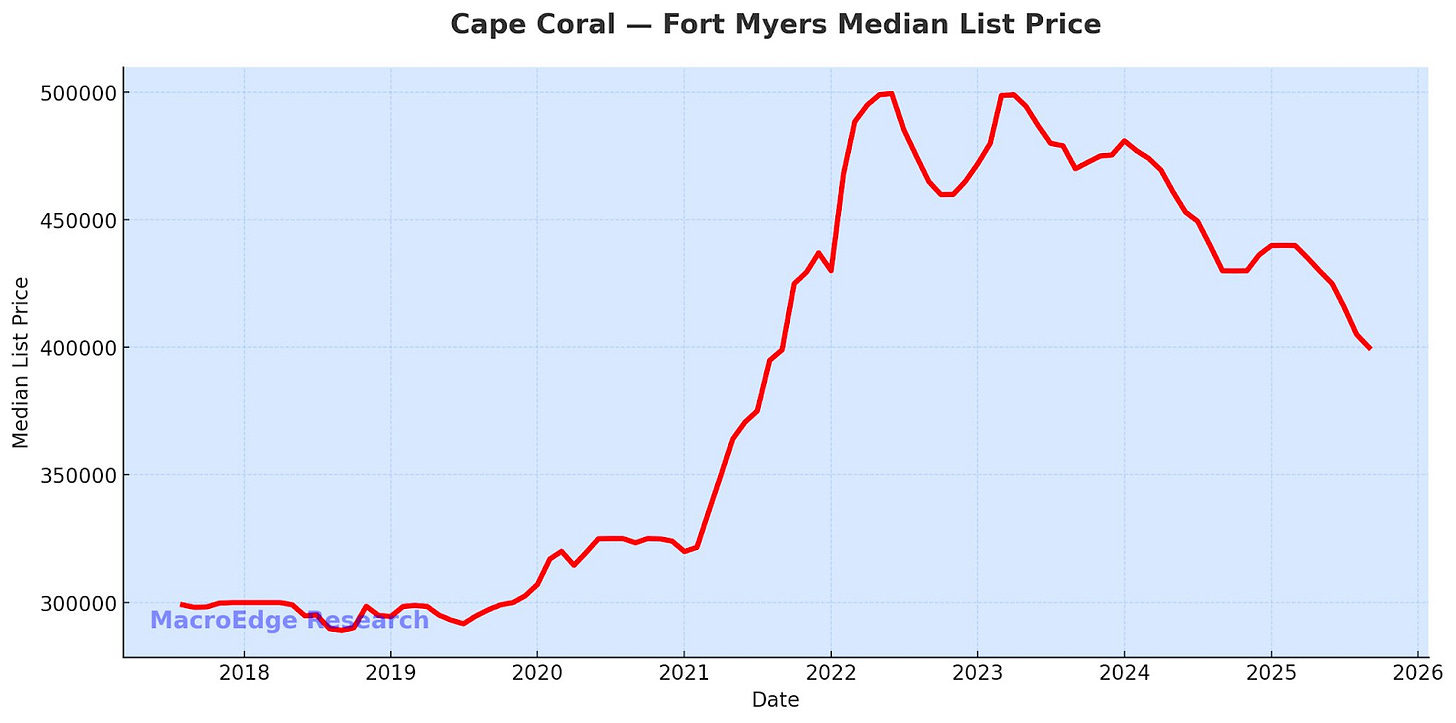

In Florida - certain markets are seeing listing prices down as much as 20% in nominal terms from their pandemic-era ATHs:

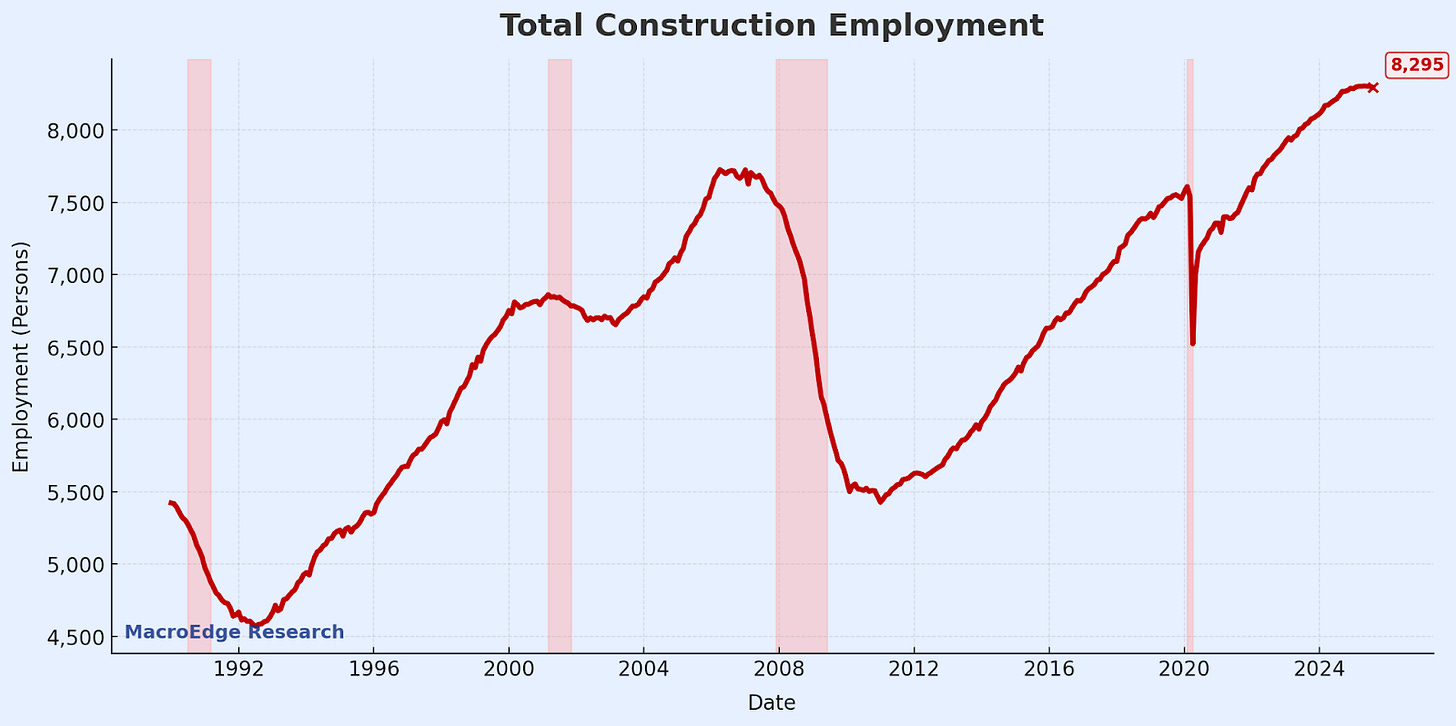

The Sunbelt continues to see the most substantial softness from a listing and pricing standpoint, and we continue to watch for signals of a broader rollover in construction employment in residential / commercial real estate. Data center employment did remarkable things to anchor temporary construction employment, but prior to the government shutdown, the trend was becoming quite apparent, especially in states like Nevada.

In September - inventory ticked higher nationally, while prices softened:

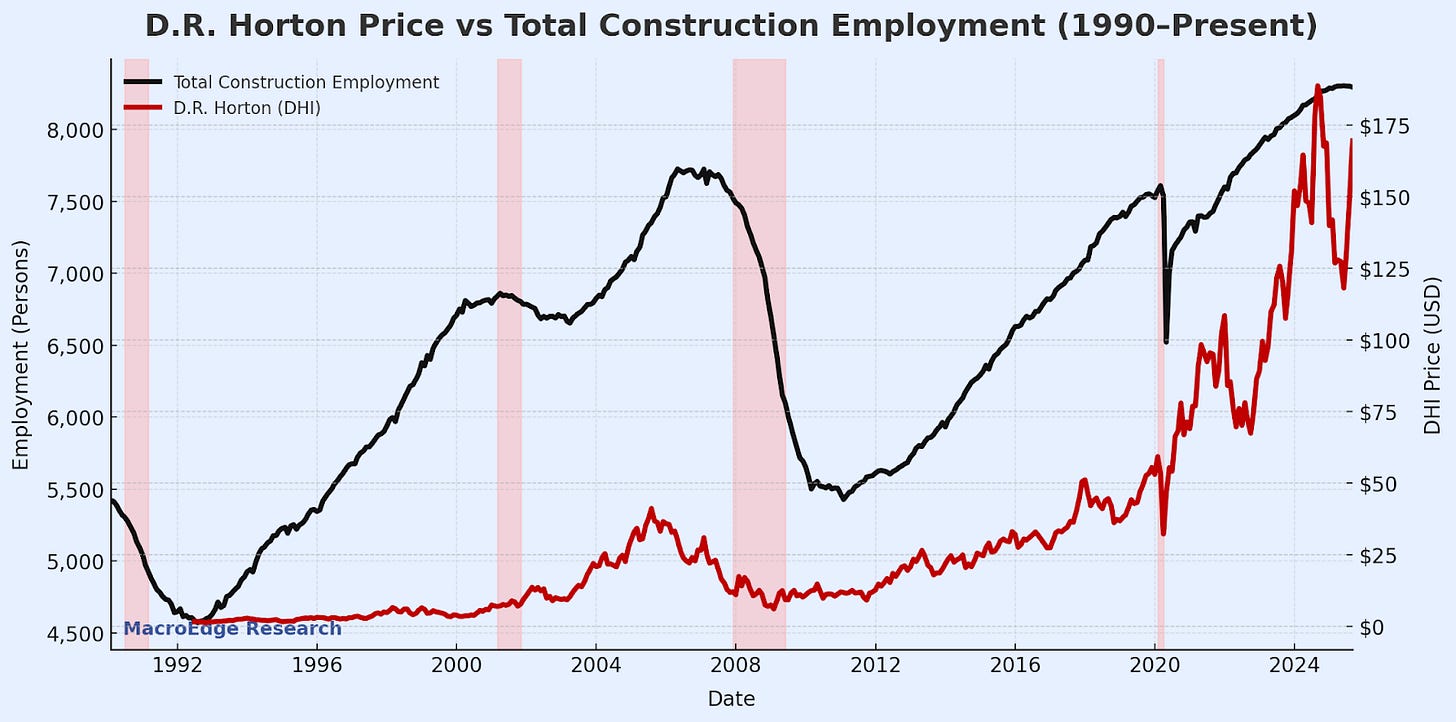

DHI v Construction Employment

DHI & construction employment alike, do a decent job of sniffing out the business cycle beforehand. For the time being, DHI has indicated a broader business cycle warning signal, just as construction employment rolls over.

ABS Problems - From Two Lenders to Three & Regional Bank Spook

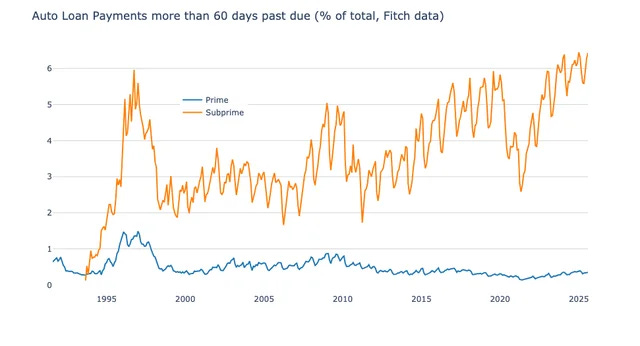

Jamie Dimon was clear when he warned about the two cockroaches in the financial system. He was talking about subprime automotive lenders. When one fails, it is never alone. These lenders built their business on pushing deep subprime loans and moving them off balance sheet through securitization. The cracks in that market are now visible.

Delinquency rates across subprime auto ABS are hitting levels not seen since the last cycle. Loss rates are climbing, especially in deals issued between 2021 and 2023 when underwriting standards fell apart. The first cockroach is the subprime lender that bet on constant refinancing and perpetual vehicle appreciation. The second is the shadow lender funding them through warehouse lines and private credit structures. Both are now under pressure as defaults rise.

PrimaLend is the latest sign that this is not isolated. The firm is facing stress across its dealer floorplan financing operations. Liquidity is thinning out because investors are starting to reprice risk across the entire auto ABS space. What was treated as a steady yield product is now showing structural fragility.

Carvana represents the same risk at scale. Its securitization channels depend on investor confidence in used car collateral. The moment that confidence breaks, the company’s funding model becomes unstable. Used car values have fallen, refinancing costs have jumped, and the credit markets that once fed Carvana’s growth are tightening. The stock is not a reflection of balance sheet strength, it is a bet on market liquidity holding together a fragile ecosystem.

Regional banks are not insulated. Many have exposure through auto dealer floorplans, secondary lending partnerships, or small tranches of ABS on their books. Rising delinquencies and collateral markdowns will pressure loan-to-value ratios and create stress across already weak balance sheets. In a system still digesting commercial real estate losses, the return of consumer credit risk is the last thing these institutions need.

This is the same story every cycle. Leverage piles up in areas that look boring until it doesn’t. Subprime autos are the early warning signal this time. The cracks are small now, but they always start that way.

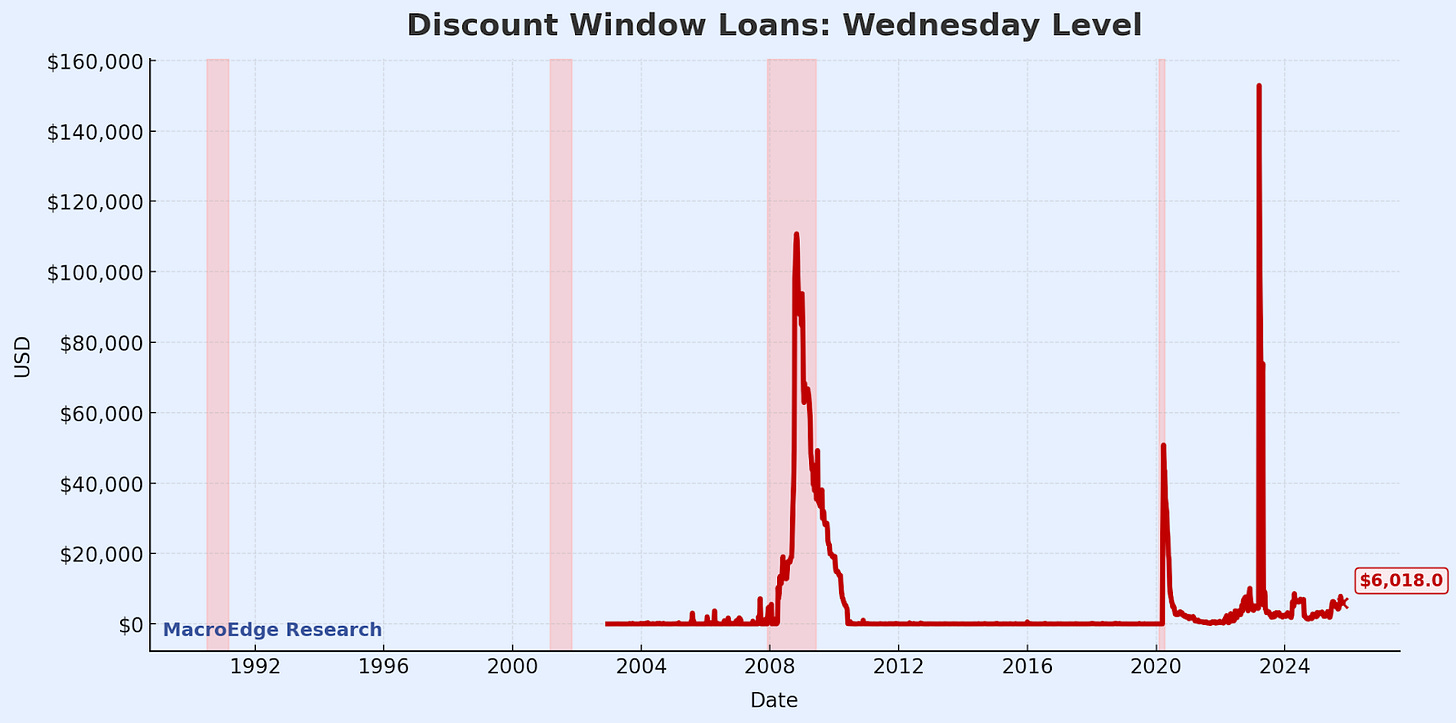

This credit cycle may take another wave of banks down with it -

Just as the Fed prepares to fire up new ways to keep liquidity flowing through the system.

Intervention Firepower

The Trump administration has become the most hands-on stock market administration in modern history. Every significant drop in equities has been met with direct or indirect fiscal action. The goal is simple: keep asset prices supported and sentiment high. Market stability has become a political benchmark, not just an economic one.

(below) - Intervention Firepower, Institutional Research Note ‘Markets Test Their Limits’

Unlike past administrations that leaned on the Federal Reserve, this one has treated fiscal tools as part of market management. They time announcements to cushion volatility and use fiscal communication as a signal to investors. It is a deliberate effort to merge policy with price action.

For the time being, in waiting for our next ‘April’ left tail moment to strike - especially for positioning and the GMSP - broader indices have been flat now going on a month, something I’ve taken careful note of.

With an FX agreement now in place between the United States & Japan - the USD/JPY pair is again back in focus… A notable candle print on Friday.

Bitcoin continues to have broader liquidity and risk signal factor, and is currently living below its 200dma for the first time since the April drawdown.

Have a great evening, and see you again tomorrow.

DJ

Markets Test Their Limits (@SixFinance), Head of Research)

While trade continued to dominate the headlines this week, causing whipsaw volatility sending the VIX to 29 Friday morning before falling all day on easing trade rhetoric, credit concerns caused a modest widening in credit spreads and fear of contagion spreading amongst regional banks. Regionals today largely bounced, with this morning’s suite of reporting banks showing better-than-expected provisions for credit losses. While these concerns could certainly wane into obscurity, they send up red flags across the credit complex when lenders have begun requesting redemptions as we saw with Morgan Stanley and Blackrock requesting from Jeffries following their First Brands exposure.

This coincided with momentum stocks taking huge drawdowns this week, quantum and rare earths, and other overheated sectors experiencing large mean reversion and blowing off their parabolic rises and settling back into their shorter-term moving averages.

(continued below)

Keep reading with a 7-day free trial

Subscribe to MacroEdge to keep reading this post and get 7 days of free access to the full post archives.