Redeye Macro Note: The Latest on Data Centers, Shifting Market Sands, New Tariffs?, Portfolio Strategy Update

In this Redeye Macro Note - we discuss the latest developments and trends in the data center world in the first half of January, talk about new tariffs discussed today by the President, and more.

Don Johnson (@DonMiami3), Chief Economist

Good Sunday morning MacroEdge Readers and Community,

I hope you had a fabulous Saturday and are enjoying the long weekend. With the market holiday (and for many - work holiday) on Monday, there are many out to their favorite winter destinations, while some are seeking warm refuge at The Ocean Club.

I am gearing up for a very intensive sales & client trip haul here starting at the end of January that will last through the end of March. I will share more updates as my travels progress, but my goal is for us to hit the ground running to start of this new year - and continue to advance our Transform and Economic Advisory practices to greater heights as we continue our growth. The travel next week is taking me, my business partner, and Six to Scottsdale and Park City, and I am looking forward to the first leg of this long travel schedule ahead. This will not alter our report releases in any way, shape, or form - so expect continued improvement from us in the weeks to come. We also have several new exciting contributors joining the lineup in future articles that will discuss both broader macro topics - like real estate - and go deeper into the equity research component, which I am placing great emphasis on this year for Ozone.

This morning, I am going to provide a new update on the developments in data center land - as a second part to the broader series of our coverage on the industry - and we’ll discuss continued shifting market sands as tech underperformance becomes more notable.

Additionally, we also saw the threat of fresh tariffs Saturday on the European Union from the President, as they discuss a potential acquisition of Greenland. Protests occurred throughout Denmark & Greenland Saturday in opposition to any acquisition, and a purchase would likely require $2-5 trillion USD to occur, which would take the US many years to fund. The Western Hemisphere focus continues to be part of a broader theme, and the Administration quickly pulled back on striking Iran when it was announced that the Iranian Regime would take much more than airstrikes to disrupt. Other focuses include Cuba, but for the time being, these geopolitical events have been much more priced into things like metals than they have equity markets, which haven’t done a whole lot since October (especially for the S&P and Nasdaq) while IWM and Dow Industrials have outperformed. I expect that some of the *beef* with the EU & Denmark are resolved by Monday evening futures open. Cryptocurrencies continue to be rangebound after their sharp move lower, and we’ll discuss them more in the next Weekly Macro Note.

… for those in a speculative mood:

MacroEdge Radio #67 - Danielle DiMartino Booth

If you missed MacroEdge Radio #67 from last night, you can catch it below, via YouTube:

MLK Market Holiday - Monday

Due to the government and market holiday on Monday, the Weekly Macro Note will be published on Monday, January 19th, in the evening.

Portfolio Strategy Update

We’re consolidating operations, including membership management and billing, under the Substack umbrella to simplify our Ozone offering. This means that trial periods and delivery will now occur through Substack. Additionally, we are gradually phasing out the PDF report format for Ozone to eliminate duplicate emails for each report.

As we continue to expand our Economic Advisory practice, there is a greater need for customization in our reports and beyond. I am making this shift to simplify things for both our team and yours. The portal on the website will remain available, and Ozone Pro members will continue to have access to the Ozone Pro dashboard. As we finalize our 2026 plans, there will be additional changes and adjustments to our Macro Research offerings.

This year, we are placing a much higher emphasis on the portfolio strategy and equity research components under the Ozone umbrella. By leveraging our full data suite, we are transforming insights into real-time strategy and building a runway for success with initiatives like Trident and our Economic Advisory engagements. With our innovation-focused approach, things will be constantly shifting and improving for you all.

To experience MacroEdge Ozone for 7 days through Substack, you can subscribe below:

The Latest on Data Centers - January 2026

We’re watching the latest trends in shifts in the data center world - since it’s closely tied to the entire AI trade / infrastructure boom that has drove much of the economic *growth* in the last 18 months. While specialty engineering employment has remained near record highs - and construction job postings have rebounded off of their lows - the Administration is going to be scrambling to find its next growth engine as the data center machine winds down as a tailwind.

Community pushback is surging against data centers - and it’s bipartisan. It’s very easy to declare on data centers and deflect problems (especially inflation ones) onto data centers, making them an easy target in the crosshairs for politicians. If I were running in a midterm this year, I’d be standing out in front of every data center in my district or city, and using the community fuel… luckily, I am not in the political sphere - but nonetheless, we’ve been very early in identifying this mounting trend against data centers.

Continued below: The Latest on Data Centers, Continued - Shifting Market Sands, & More:

subscribe to MacroEdge Ozone via Substack, and never miss a beat:

The community damage - from a water supply - and electrical supply standpoint (as well as from a temporary construction army coming into small towns and driving up rents and flight costs by 150-250%.

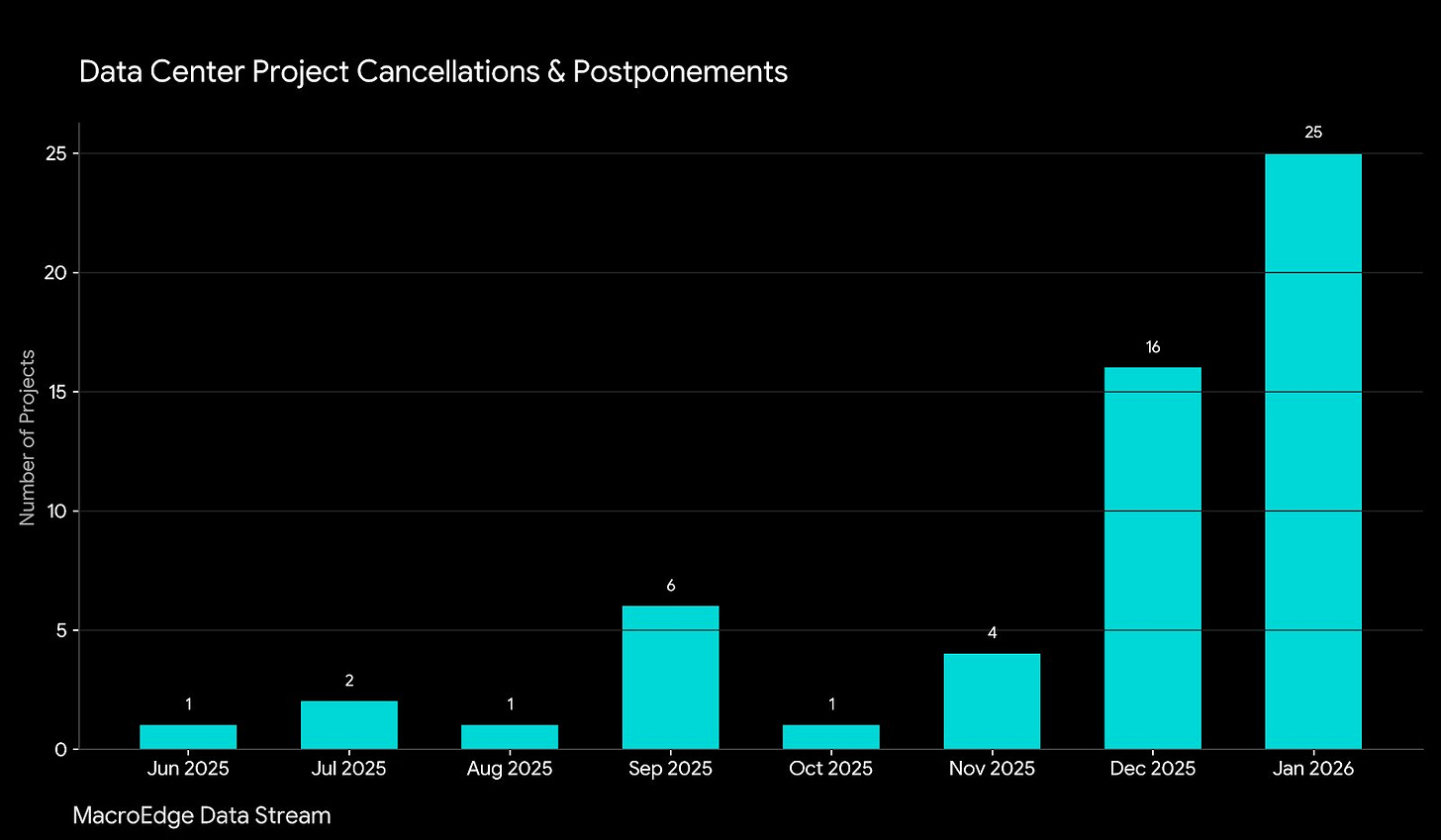

Data center project cancellations & postponements thru Jan ‘26 MTD:

That’s not to say the data centers won’t continue to drive construction employment and be defended by many bought-off politicians this year - they will - but the entire sector is one of the most bizarre that I’ve seen, having seen it first hand. Stories & data are almost impossible to aggregate - and the only place we’re sourcing much of this data is from local mom and pop newspapers that are writing about these data centers going up in towns large & small. From Cheyenne, Abilene, Amarillo, & far beyond - anonymous real estate developers come in, offer to buy off land and property owners far beyond what their property is worth, buy off the local politicians (including on things like engineering approvals), and attempt to blitz these projects forward.

Last month and this month are the first time we’ve seen a steady mounting opposition to, particularly, new projects. Last month, we talked about the mounting trend - and it seems that at the grassroots level, people are catching on. The four core drivers for Dec - Jan cancellations stem from the following:

Grid Capacity Exhaustion: Major utility providers reaching “hard caps” on transmission expansion.

Regulatory Moratoriums: Municipalities (like Madison, WI, and various Michigan townships) are passing emergency pauses on new construction.

Capital Repricing: Rising long-term energy costs are making large-scale “speculative” AI builds financially non-viable for certain private equity backers.

Grassroots Opposition: Bipartisan activist groups are rising from the grassroots level to oppose new projects and forcing pivots on the part of the major corporations.

Ask yourself this - with many power providers pushing back connection times to 2028-2030 for newly constructed data centers, why do we need more without additional power capacity built first? Why aren’t the Chinese rushing to build additional capacity? There are many, many questions that we should be asking. Sure, it might be a bit edgy to do so still, but it’s not Luddism to question a technology that’s being pushed and rolled out in almost total secrecy - from data center to product release.

The most notable developments in the last 2 weeks from the data center realm:

Madison’s ‘Hard Pause’: On January 13, the Madison City Council unanimously approved a one-year moratorium on all new data centers. The freeze applies to any facility over 10,000 square feet, allowing the city to study the “critical impact” of massive water consumption and grid strain on local residential infrastructure. This is one of the largest cities in the country to effectively ban new construction of all viable facilities.

Microsoft Community First Pivot: Responding to the wave of local moratoriums, Microsoft announced a shift toward a “Community-Driven AI Infrastructure” model. To bypass zoning friction, the company will now offer pre-negotiated energy deals that guarantee a portion of new power capacity is diverted back to the local residential grid to lower consumer rates.

Springfield Township 180-Day Pause: Springfield Township trustees enacted a 180-day emergency moratorium this month to block new data center developments. The move is a defensive response to prevent developers from “site-jumping” into the township after nearby Saline Township faced similar intense public opposition and project withdrawals.

PJM and California Interconnections Delays: PJM & major California power providers have begun pushing connection dates back to 2028-2030 for new data centers due to grid limitations. This, of many factors, should put caution into investor minds.

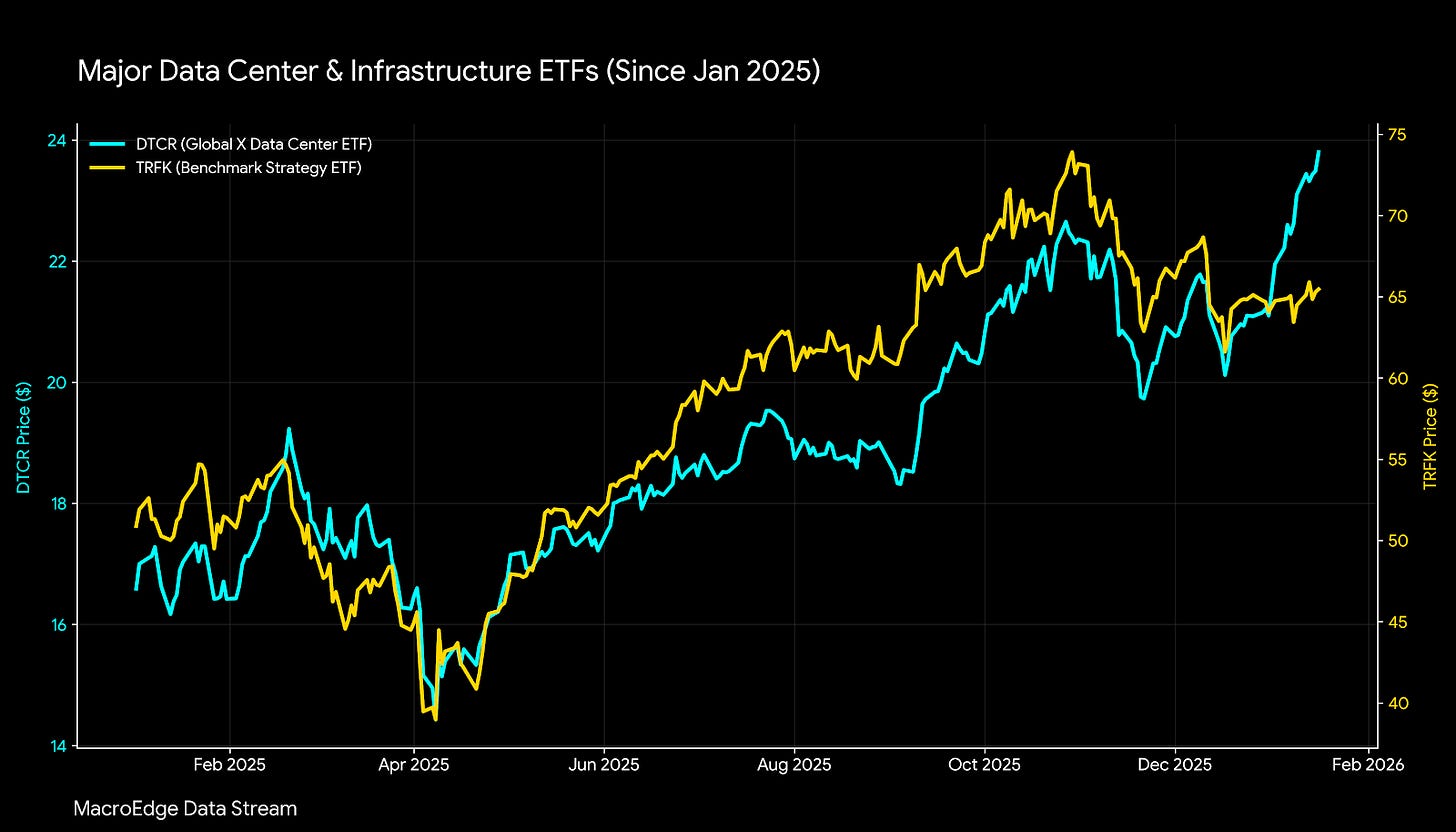

Looking at the two major data center ETFs, performance has varied on their baskets:

As project cancellations, postponements, and moratoriums heat up in 1H of this year, this eventually weighs on the entire trade - namely the infrastructure side to those selling chips to these facilities. While they continue to operate largely under a shroud of secrecy, we’re shining some light on developments here as problems mount.

What will the breaking point for local voters be? We’ll track the developments this year.

Shifting Market Sands

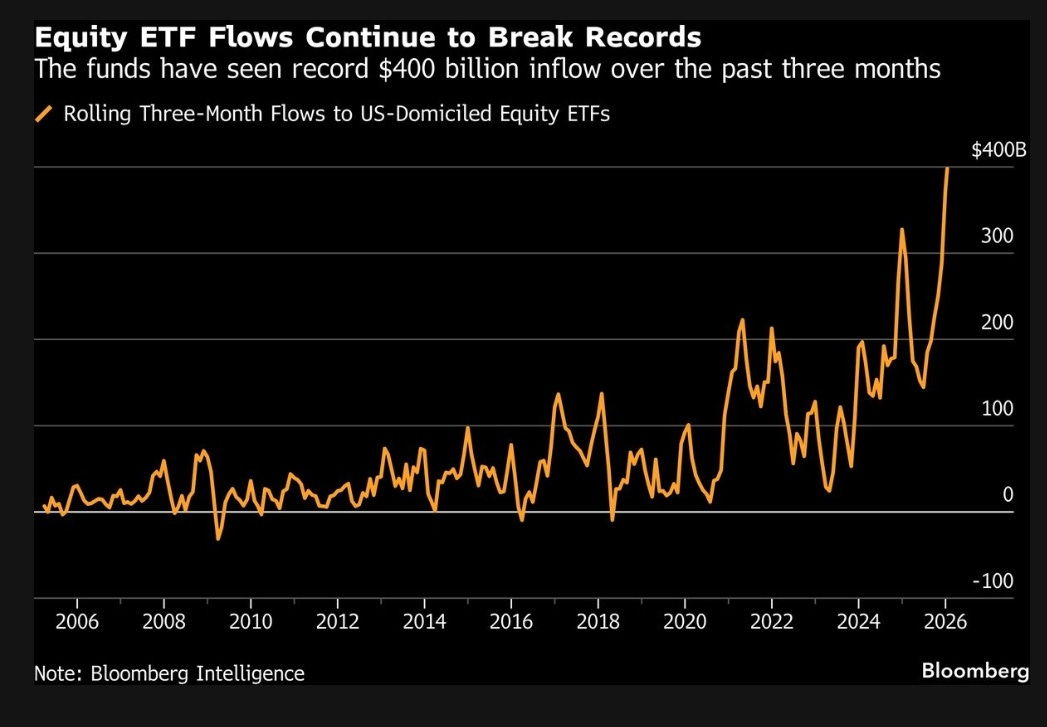

We’re going to talk a lot more about this in the Weekly Macro Note on Monday, but the sands continue to shift under the market, and have for the last several weeks. While we saw the largest retail ETF inflows ever (and this trend is global - especially into leveraged ETFs) - massive single orders continue to flash in the tape one after the other, and this was quite noticeable yet. While directionally, the signal is somewhat limited - we can look at the speculative mania nature of markets from a valuation perspective, and turn to macro risks to assess if this is sustainable. We already know that the fiscal arm is terrified of any 3-5% drawdown or greater, given what we’ve created - and the Japanese are even more fearful given carry trade implications, ultra-long dated puts at extremely low implied vol is not at a bad idea at this point. While premiums have been churned - especially in tech the last few months - it appears to be a market that is gradually losing the wind in its sails. While ‘differentiation’ will be the theme of the year, we’re waiting for things like a reversal in BoJ tone and the carry trade to see actual downside potential in tech. But things are once again weakening in the sands underneath the market - even as valuations near their highest levels ever.

Project… South Africa… Venezuela? Who even knows at this point - but I have additional things in a new series in the works.

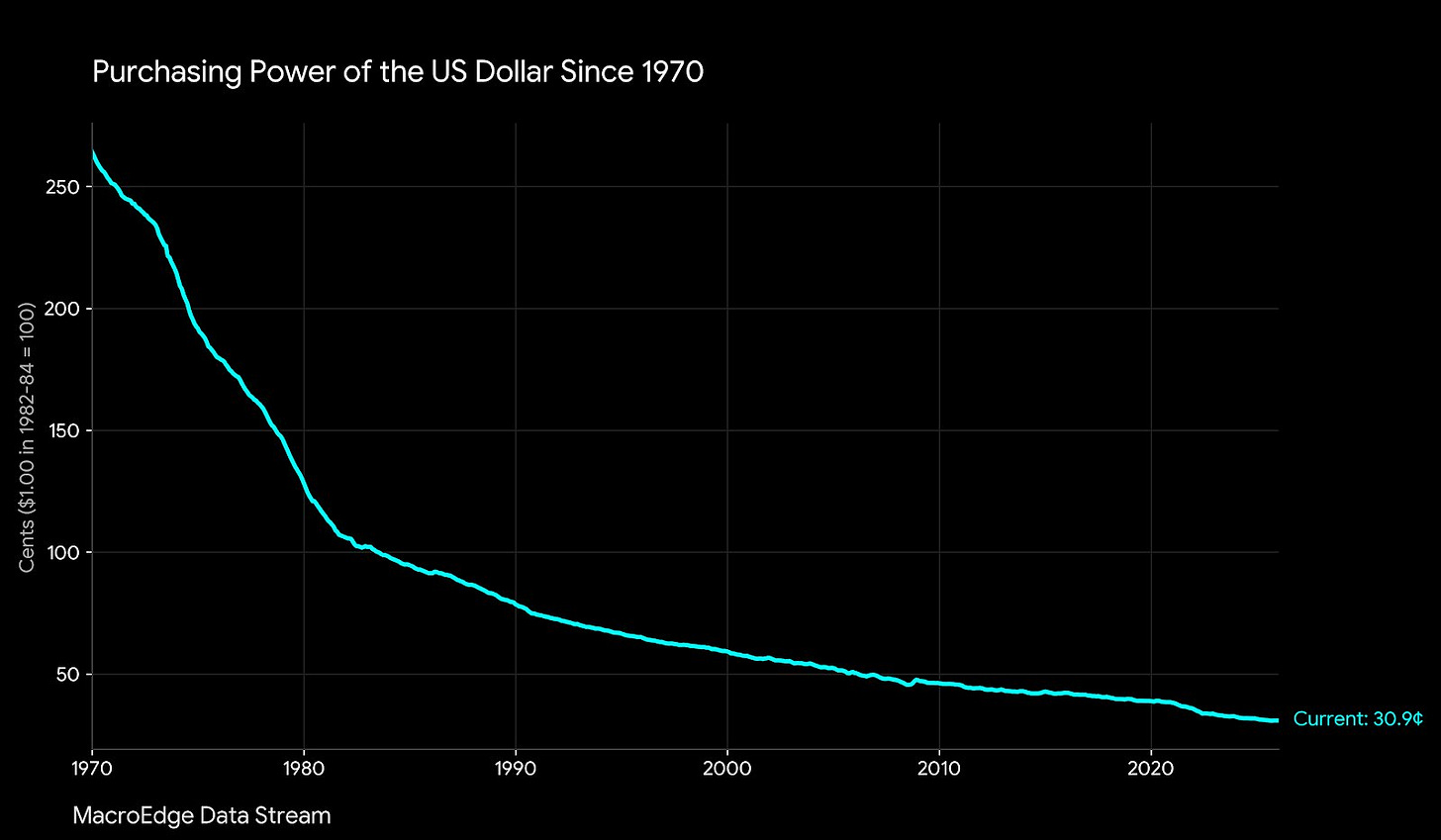

A permanent market meltup amidst the most significant demographic crisis in US history is a symptom of a series of policy failures - not a sign of efficiency.

For more details, please refer to our Terms and Conditions.