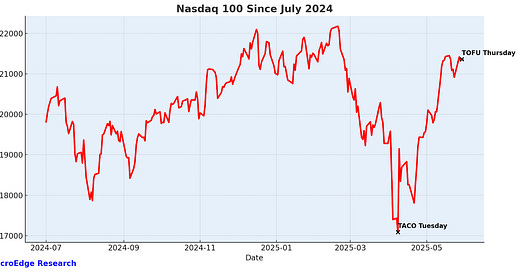

Saturday Express Macro Note 'TACO to TOFU', BoJ's Katana, Macro Summer, & More

In this Saturday 'Express' Note - we talk about the TACO to TOFU pivot underway - the BoJ's Katana, first signs of weakness in tech names/crypto, other macro data, the 10Y and more.

Good Saturday, MacroEdge Readers and Community,

In today’s Saturday note, we’re breaking from the usual Redeye Macro Note timeslot with an early delivery—since we’ve got such a comprehensive report on the way tomorrow from Ozone, Vision, and RESights. I’m very much looking forward to tomorrow evening’s delivery to your inboxes, given what I’ve seen so far from the team.

There have been some shifts in tone from the Administration since our Thursday evening note, and we’re likely seeing a short-term trough in inflation data for the summer—though OER (rents) and home price gains are slowing. U.S. crude supply continues to decline, even as OPEC+ just committed to another small output hike of around 400K bbl. The 10Y yield dropped notably on Friday, while equities ended the day relatively flat following a renewed wave of hawkish narratives from the Administration.

If we see abrupt rate cuts at any point this summer, the initial market reaction may be one of excitement—but the underlying reasons will tell a deeper story. Such a move would likely be interpreted as a ‘risk-off’ signal for equities.

For now, June is shaping up to be an interesting month—and July could bring more directional fireworks, so stay tuned. A Fed pivot in June looks unlikely given the loosening in financial conditions throughout May. That said, the Fed’s tone has also shifted slightly in recent days—toward a softer brand of hawkishness.

Trident / Ozone

With Trident - we’re turning our leading macro perspectives into action. Learn more about the Trident I Global Macro Fund below:

Access MacroEdge Ozone for two weeks and never miss a beat on our reports, research, data, and more:

Subscribed

‘TACO’ Thematic Fading? (TACO to TOFU)

On 5/17 when we first discovered the TACO trade - much of the ‘TACO’ itself had been priced in through the first half of May. While market performance for May was the best in 25 years - every other Substack release and tweet on my timeline is now about TACO this, TACO that. When the reporter on Thursday dropped the TACO on Trump - the reaction of the last 2 days has been quite apparent as to how he responds to being called out on the fiscal flimsiness.

Keep reading with a 7-day free trial

Subscribe to MacroEdge to keep reading this post and get 7 days of free access to the full post archives.