Weekly Macro Note 10/26: More of the Same, FOMC Preview, Last Stand for the JPY, Trade Pauses, Crude Connections into Winter

In this Weekly Macro Note - we dive into the Chinese/US tariff extension announced this morning, discuss the USDJPY last stand for the BoJ, continue trade discussions, talk data, and more.

(@DonMiami3, MacroEdge Chief Economist)

As I noted on X this morning - more of the same was expected going into early Sunday morning. We saw much of the same of what we’ve seen for the past 8 weeks, a bizarre yet similar catalyst to send equities spinning higher into the Monday open. In the case of the announcement this morning, China & the United States agreed to extend a 90-day pause for more discussions, and the 100% tariff was walked back (which we were all well aware of as of two weeks ago, when VP Vance noted that it was only a negotiating tactic).

Overnight, this was enough to push futures up +.66% on ES at the time of this writing, and .8% on NQ. The Yen is weaker overnight - and at a really critical spot - which we discuss below. Both oil and natural gas are moving higher on the extended and latest pause with China, announced this morning, and both look constructive for the time being into the winter months. It would be even more positive for CL if some sort of peace deal is eventually reached between RUS/UKR - which remains largely elusive as strikes intensified over the weekend.

The signal to watch for in a ‘risk off’ move would be one of these comments or Sunday remarks eventually being faded (either through the week - or the day of - like tonight). While we can all sit here and continue scratch our heads at how infinite expected delays are positive the more they are announced, the reality is whatever we’re being dealt. Bessent also made very interesting comments on Friday - noting that markets and market pain are of top importance now to the Admin, which we’re already well aware of following the basis trade blowup in April.

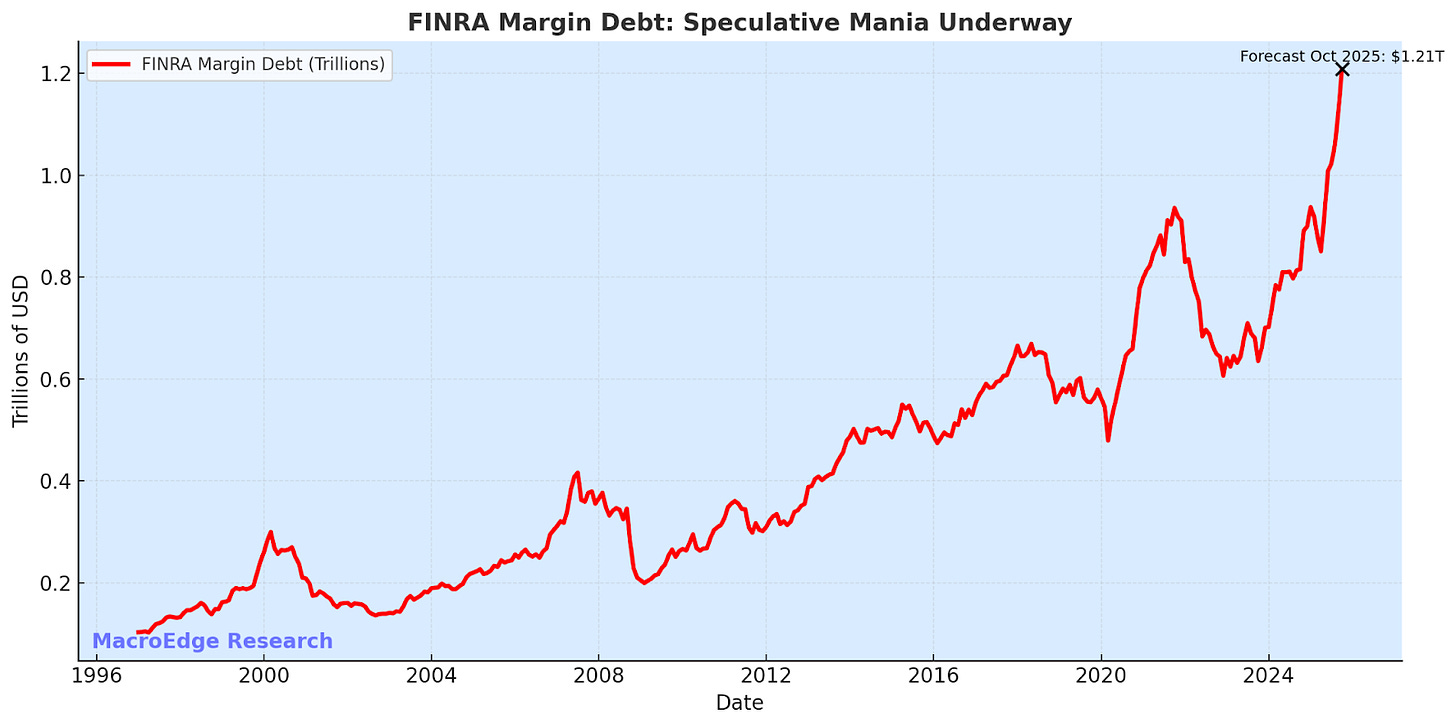

Here’s your fact of the week - investor margin debt (outstanding) is now larger than revolving credit card debt:

Don’t forget - that every single red day is now perceived as a national security threat in this market… and for good reason - we’re at a very dangerous place now, and the more that gets added, the harder the fall will be.

Weekly Macro Data & Earnings Review (+ trade meetings for the week)

On the earnings front - we’ve got 6 companies reporting this week in the mega+ cap $1tn range, and many more megacaps beyond that. Quite a significant earnings week. Broad based beats have continued, though being priced beyond perfection, years into the future, any cracks or vulnerability could be enough to stall out equity gains.

Quant Quake 2.0 & Private Credit Struggles

There was a very small batch of stories over the past 2 weeks about some tumult in quant land. An affiliate $20bn+ Renaissance fund experienced a nearly 16% drawdown on the large Powell drawdown of a few weeks ago, and other smaller firms faced similar fate. The great Paulo Macro highlighted more, and the resemblance to the ‘Quant Quake’ of ‘07 are notable and interesting, even though it’s already in the rear view mirror, just as it was then.

(What Happened to the Quants In August 2007?*)

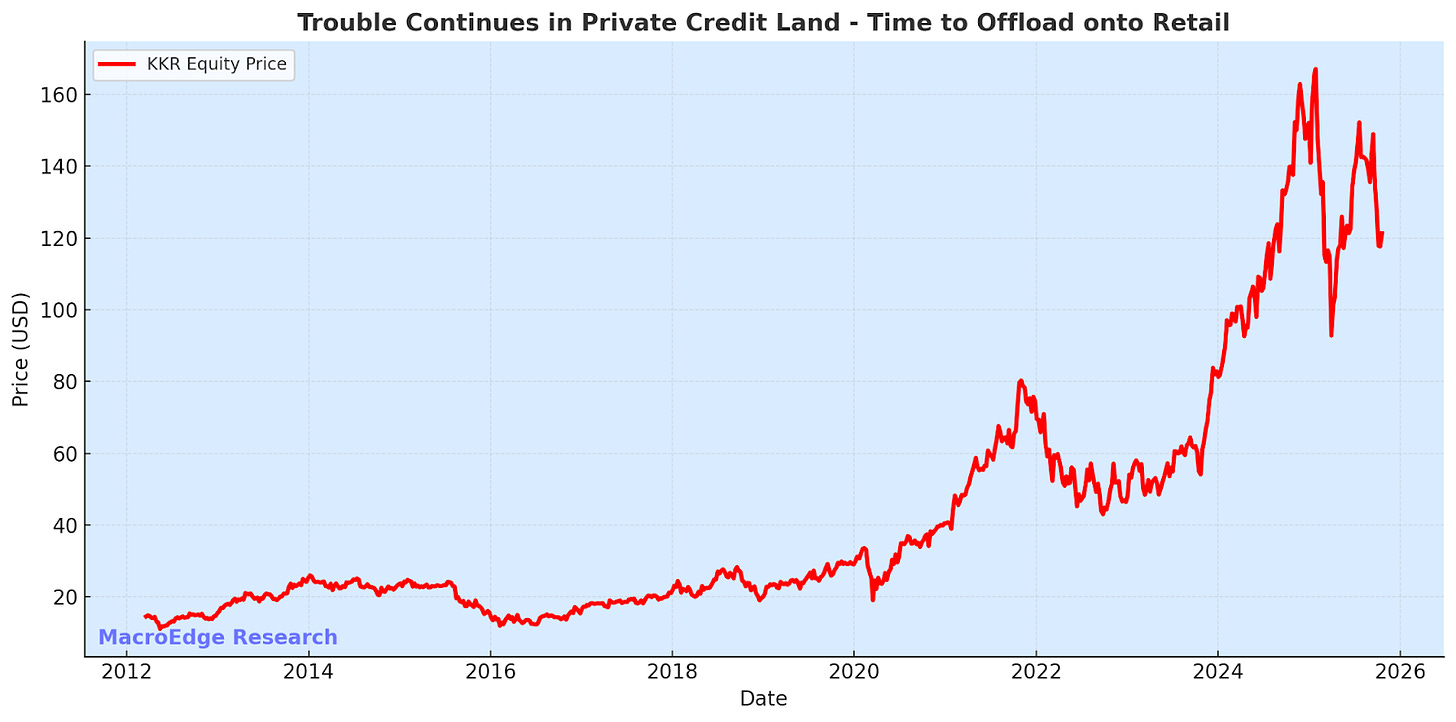

Trouble in private credit land continues - with leaders well off of their ATHs.

(KKR)

(APO)

Risk Dislocation - Weakness in Homebuilders & Regional Banks - Why It Matters

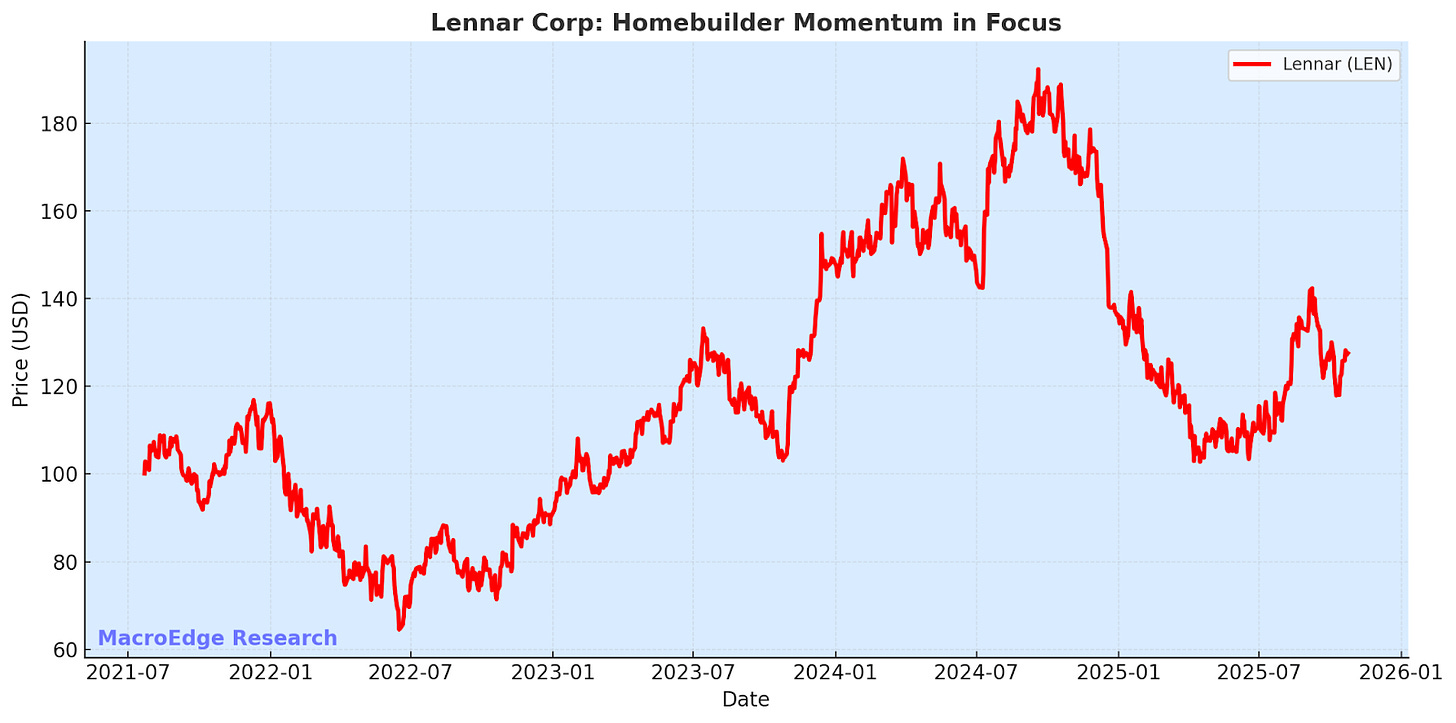

In terms of risk dislocation in the cyclical names - and as tools to measure the state of the *macro* landscape for real estate - homebuilder equities and regional banks remain useful. Both have lagged the broader tech bubble dramatically, and homebuilders in particular remain bogged down by margin compression, a desire to move inventory off of the books quickly, and rising inventory nationwide (and especially in the Sunbelt).

The setup is somewhat constructive here if yields fall. Though the 2Y below hasn’t chosen a direction.

US02Y - no signal here until directional factor is determined:

Given the 2+ year range, the bigger move in the pipeline is likely to be substantial / violent. This will impact both the regionals and homebuilders to a great degree.

Government Shutdown to Continue Until Pain is Felt

My logic here is that the government shutdown will continue until pain is felt for enough of the voting populous. For the time being, minor air traffic interruptions aren’t enough to bring politicians back from vacation, and it looks like they may last through elections in early November before coming back to DC. With the 40 million SNAP beneficiaries set to see their payments lapse, this could be an interesting development as food bank demand remains at all-time highs.

(continued below)…

Keep reading with a 7-day free trial

Subscribe to MacroEdge to keep reading this post and get 7 days of free access to the full post archives.