Weekly Macro Note 11/2 - Back in the Cadence, the Mother of all Bubbles Grows, Financial Conditions Tighten, Yields Tick Higher

In this Weekly Macro Note - we kickoff November with a preview of macro data, earnings, and more arriving this week. We discuss rising stresses in the banking system, echoes of Q3/4 '07, and much more

(@DonMiami3, MacroEdge Chief Economist)

Good Sunday evening MacroEdge Readers & Community,

It’s fantastic to be back at an office on the road for the next few days as we accomplish a few things from Arizona this week after wrapping up a deal closure in Nevada, and attending a fantastic event by Cirrus Aviation at Camarillo Airport in California. Those of you that follow me closely enough on X have properly realized by now that I am an aviation junkie myself - and the time we spent at Camarillo on Thursday was special. The event happened to be attended by none other than the Jenner family, and we met some fantastic new folks that I can’t wait to see again in the future when we make it back west come January or February.

Lots to do & the list only continues to grow, but what a great October it was for the MacroEdge Team & everything we’re doing. We saw our data featured across Bloomberg, Fox Business, CBS, and several local stations - a sign of things to come as people seek out the alternative in real hard data, powered by reality rather than political fantasies.

From a market & macro standpoint, markets (particularly equity markets) have lost a little bit of pep in their step for the time being - and this week we have a Supreme Court ruling on the Trump tariffs, which I don’t think will matter much from an implementation standpoint. It’s another big week for earnings, government shutdown length projections continue to tick higher now - at 47 days - and we’ve seen the Fed tone down its own expectations for a December rate cut as inflation concerns and elevated yields continue to sour the mood that rate cuts = valhalla, this bizarre phenomenon that’s been established over the past 17 years since the GFC… While we’re in this data blackout period, inflation and price pressures are remaining elevated, and the labor market continues to cool - though not crack as is required for equity markets to break. The Fed and the Administration alike continue to be stuck between a rock and a hard place, and if yields begin to advance higher, the situation for them will go from bad to worse as we attempt more aggressive ‘BoJ’ style interventions.

With all that being said, we’re now back in our normal rock and roll cadence, and it’s great to be back. Thank you all for sticking with MacroEdge, and let’s have a great start to November.

The ‘stagflation’ to ‘deflation’ seems to be the current charted course, and we’re in tune and touch with all of the risks going into November and December now as even Bessent today was forced to note that

Ozone Pro Update

We’ve been thrilled to onboard and transition MacroEdge clients over from Ozone, and welcome new MacroEdge customers to Ozone Pro over the past 2 weeks. Ozone Pro is at the forefront of our transition into leadership status in our industry as we progress through the 4th quarter.

We continue to make strides with the Ozone Pro Dashboard, with the backend expected to go live over the next two weeks. That’ll mean more frequent (and even live) data within the dashboard, and more robust portfolio strategy reporting and visibility. Ozone Pro is the future of Ozone, and you can access Ozone Pro for four weeks below, for the remainder of the year:

Data This Week

This will be another week of very limited macro data because of the government shutdown. While SNAP payments are continuing under the order of a judge, we’re likely to ride through Election Day at this point and see where things stand before having more direction on when we’ll actually get any data. For the first time in a very long time, we may have a full 2-3+ month data gap (as intended by those in power), so we’ll continue to do our best to fill the void.

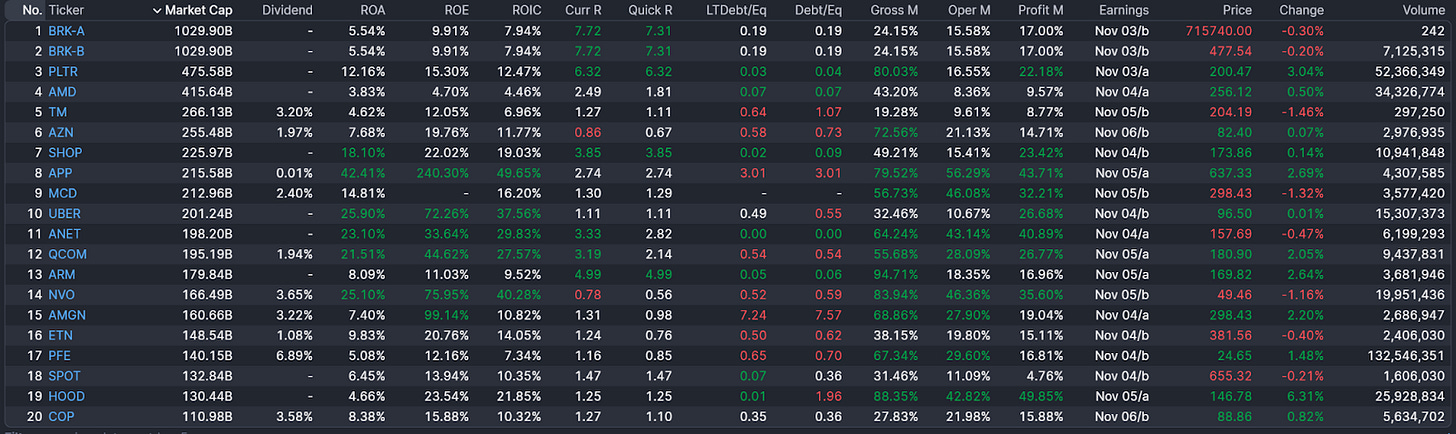

On the earnings front:

October Employment Report

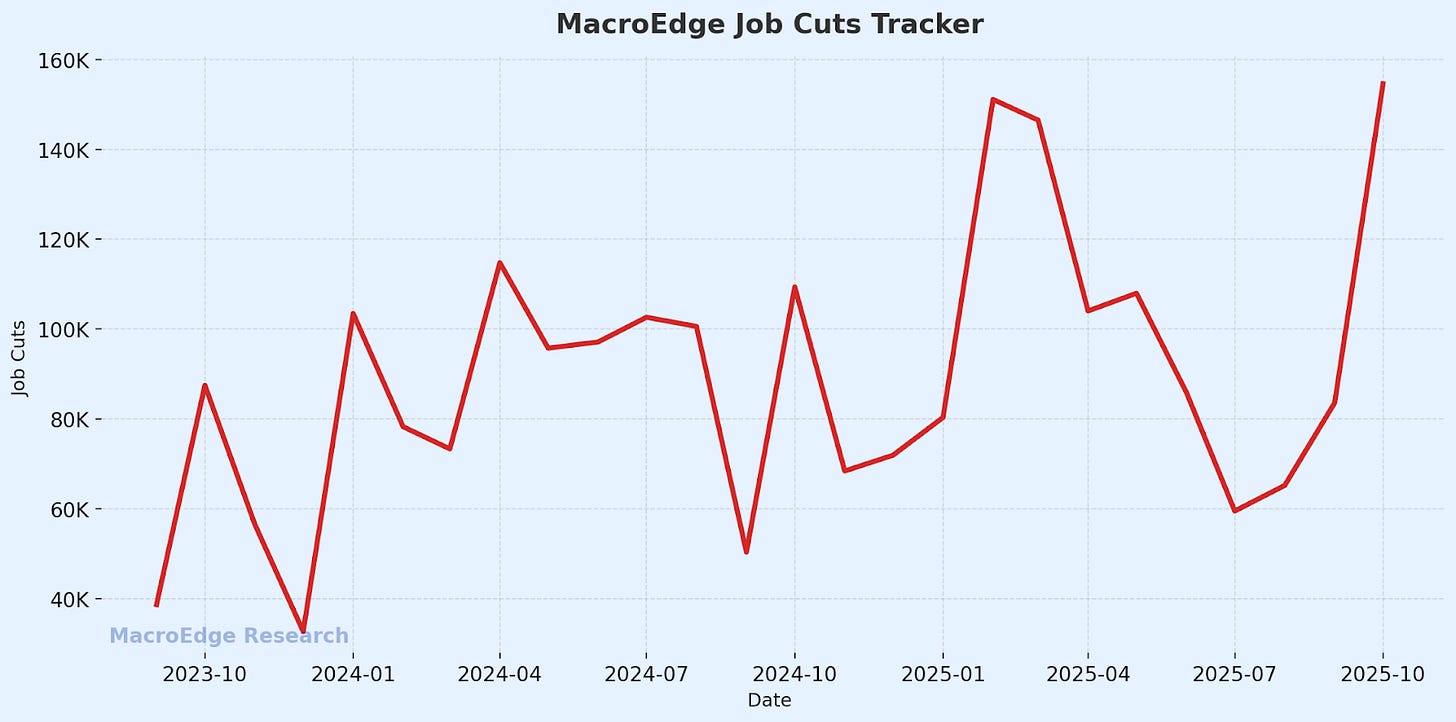

The employment situation continued to weaken in October - with job cuts surging to a new record high for our own data series. We have several new employment and inflation metrics in the pipeline as we continue to build out our own internal data infrastructure.

Job cuts finished month-to-date at 154,559 - driven largely by substantial private sector corporate layoffs in white-collar labor, though cuts were broad and non-discriminatory last month. We should take note of this trend as if it sustains anywhere near the current pace through January, that would be a concerning sign for payrolls, unemployment, and the broader economy.

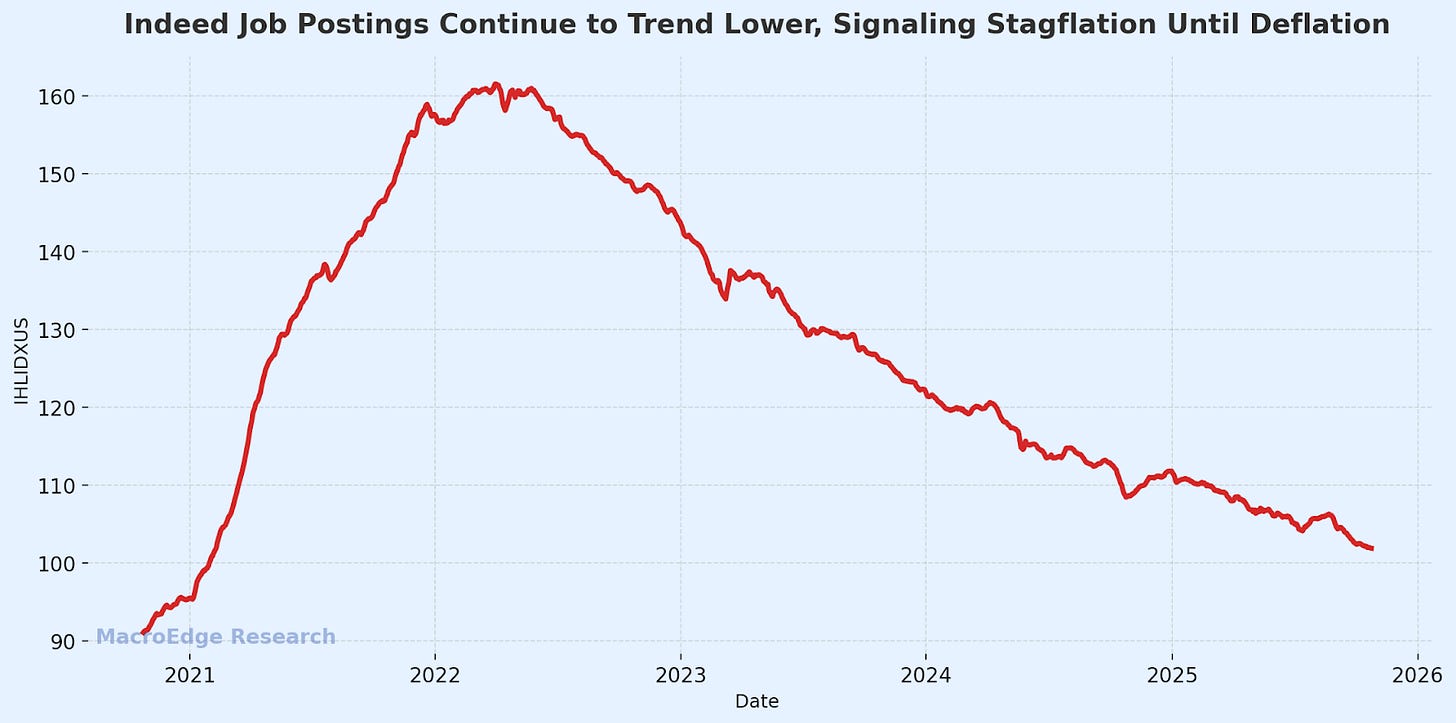

Note that Indeed Job Postings are nearing their pre-Feb 2020 levels:

While I estimate that 40-50% of these are so-called ‘ghost listings’ - it highlights the significant decline and lag time of Fed rate cuts actually to impact labor, and continue doing so. While we can correlate the decline in job postings to the first rate hike almost one-to-one, employment historically continues to weaken 18-24 months after the first cut. Unemployment is now likely to land between 4.4-4.5% by the end of the year if the current trend of weakening continues - especially in real estate.

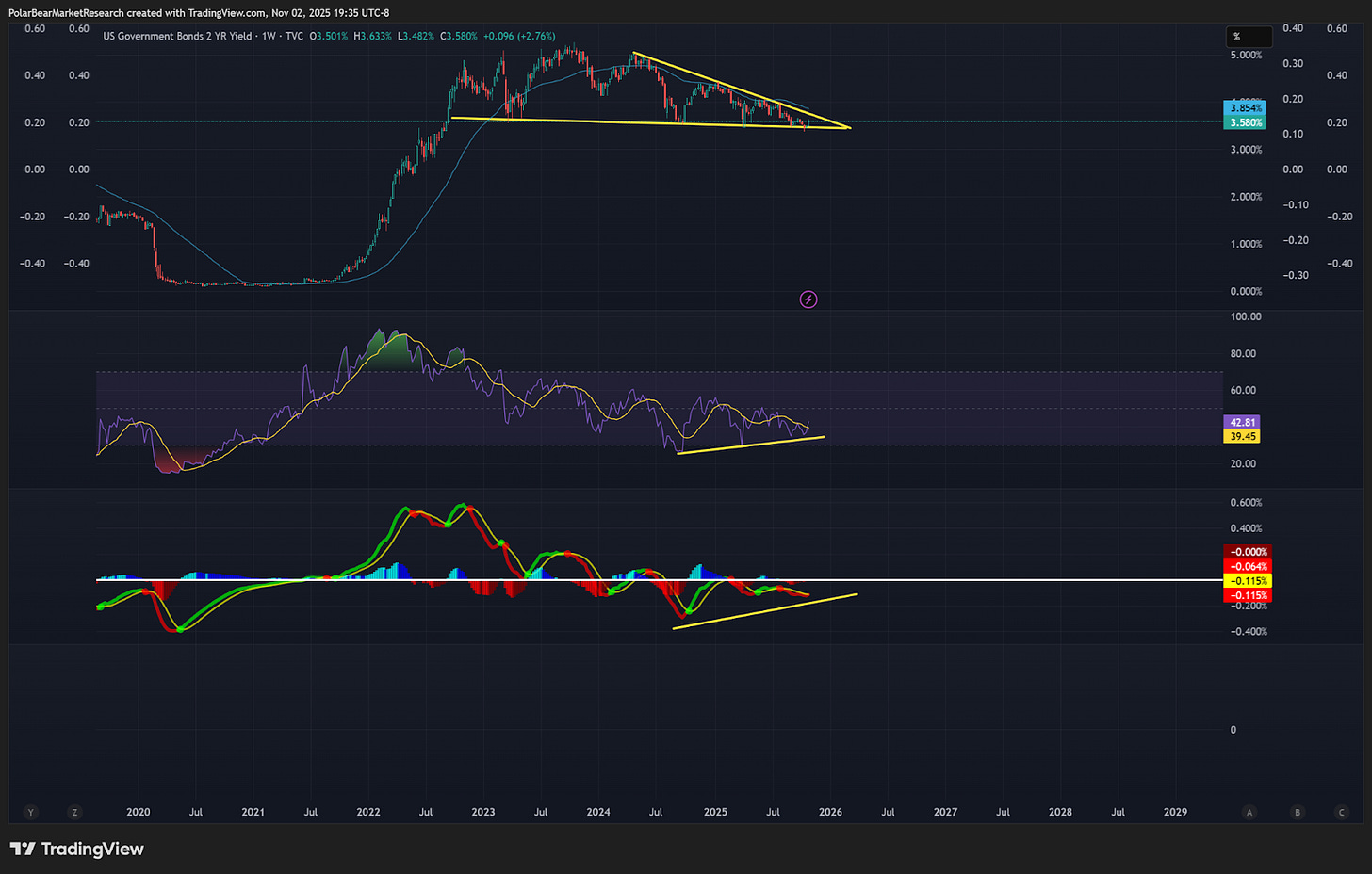

Financial Conditions are Starting to Tighten

Yields have stopped moving lower for the time being, and jumped sharply after the latest 25bp rate cut. Based on movements in yields, and with the imminent end of quantitative tightening arriving less than a month from today, cuts are now too aggressively priced into the curve while we continue to lack data. The ‘stagflation until deflation’ environment will continue until something breaks as the price levels are simply not viable, even in a largely ‘i’ shaped economy.

Financial conditions have begun to tighten again, signaling a more cautious and fragile environment across credit markets. In the past two weeks, several notable developments have underscored this shift: multiple auto lenders have paused or severely restricted new lending, reflecting growing concern about consumer credit quality and rising delinquencies. We’re seeing a continued practice of tightened lending standards in the single-family mortgage market, record-high auto repos, and a VIX that is once again finding a new base. Another signal that we utilize, Bitcoin (and cryptocurrency more broadly), has now been flat for nearly a year:

Concerns in Automotive, Real Estate, Banking, and Private Credit

While I’ve noted the obvious risks and concerns now about AI for over a year— which is rapidly approaching ‘too big to fail’ bubble status— we’re well aware of the fact that the entire bubble itself is a national security risk. The Administration will continue to play whack-a-mole with interventions…

The automotive and real estate sectors are sending a clear warning that financial pressure is building across the economy.

Keep reading with a 7-day free trial

Subscribe to MacroEdge to keep reading this post and get 7 days of free access to the full post archives.