Weekly Macro Note: Crypto Review, a Global Macro Review, & Technical Deep Dive

In this Weekly Macro Note - we enter the holiday week with a review of the cryptocurrency underperformance seen in 2025, start a global macro review that we'll explore, and dive into technicals.

Don Johnson (@DonMiami3), Chief Economist

Good Sunday evening MacroEdge Readers & Community,

Welcome to winter, first of all. Pretty amazing that it’s already 12/21 - today was a long travel day for me as I shift into a recovery & planning mode for 2026. A lot was accomplished in 2025, but there’s much more to do in the coming years as we continue to build the foundation for our 10 year+ vision at MacroEdge. We’ll have much more over the next 10 days on updates coming in 2026, new datasets being prepared for release at the beginning of the new year, and so much more. See the below for the remainder of the year, in terms of releases:

12/22 - A Look at What’s Ahead for MacroEdge in 2026: Engaging Us.

12/23 - Updates to MacroEdge Ozone & New Data from MacroEdge on 1/1

12/24 - Christmas Eve Midweek Macro Note

12/26 - MacroEdge Martini Roundtable - X Spaces

12/27 - A Special Ozone Welcome for 2026 - Ozone & Pro + Redeye Macro Note

12/28 - Weekly Macro Note

12/29 - Ozone Special

12/31 - Year Ahead - Welcome to 2026

As we head into the two major winter holiday weeks - we’ll encounter a number of market holidays and half days. While the President announced new federal holidays for the 24th & 26th of December, Christmas Eve, and the day following Christmas, the below outlines our holiday schedule:

Wednesday 12/24: Half Day

Thursday 12/25: Full Day

Wednesday 12/31: Half Day - Bond Market

Thursday 1/1: Full Day

As the Fed ramps up more aggressive market involvement again (as we highlighted in the previous Midweek Macro Note - discussing things like the discount window – all out complacency has again entered the market to wind down the year). For the employment situation - the term ‘normalization’ continues to be utilized - even though the rate of change continues to be late cycle and concerning if layoff momentum accelerates again in December. Though job cuts have decelerated this month, along with a taper in the pace of job opening reductions - the Fed’s more aggressive policy is still going to take time to bleed its way into the system. Precious metals continue to catapult higher on global macro risk & monetary institution failure (look at the BoJ as case study #1) - with both gold and silver making new highs in the overnight hours.

Big breakdown in gold & silver continues:

(Silver):

An absolute wow factor pushing $70/oz.

In our report this evening - we’re going to take a look at crypto for the year. While many went into the year expecting an absolutely bananas year in terms uf annual performance - cryptos have been flat to down. The October liquidation event structurally damaged many other altcoins, in addition to Bitcoin, and I think the real question is whether or not all of the excitement about Wall St. flooding into the sector was warranted.

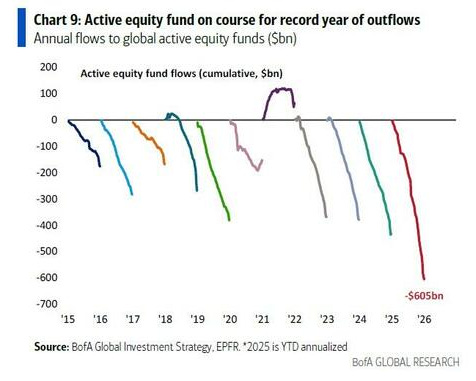

Another interesting datapoint that could see a reversal next year is the rush out of actively managed funds in favor of passive management. With macro funds performing strongly this year (their best performance in a decade) - I expect to see tailwinds for actively managed funds if volatility begins to see another upward swing to start 2026 - and then persists.

If you aren’t yet a MacroEdge Ozone subscriber - you an take advantage of our offering through Substack through 12/31 for just $399/yr - by subscribing through the button below - many of our new updates and releases will be outlined over the next week - and continue to feature this subscribe option:

Data for Christmas Week

Tuesday 12/23: Q3 GDP Estimate, Durable Goods, CB Consumer Confidence, PCE, Manufacturing Data

Thursday 12/25: Tokyo CPI, Christmas Day (USA)

Crypto Review - A Year Full of Whiffs for the Tom Lee Types, Wall St. Goes All-In

Just as Wall St. & the Tom Lee types hyped digital assets like crazy through 2025 and into the summer months - their timing once again fell fat as most coins have struggled greatly since the October liquidation event.

Bitcoin is flat on a year/year basis, and the setup looks like a signal for financial conditions to continue tightening in risk markets. While low volume and speculation this week may blur the line (or where the needles stand) - crypto continues to be our best real-time signal for financial conditions - especially as the Fed continues to ease through both QE-lite & rate cuts.

A Global Macro Review - Inflation, FX, Employment, Bonds, & Markets for the USA, Canada, Eurozone, New Zealand, United Kingdom, Japan, Australia

In this section we’re going to do our final year-end wrap-up for the Western nations + Japan from a macro & markets standpoint.

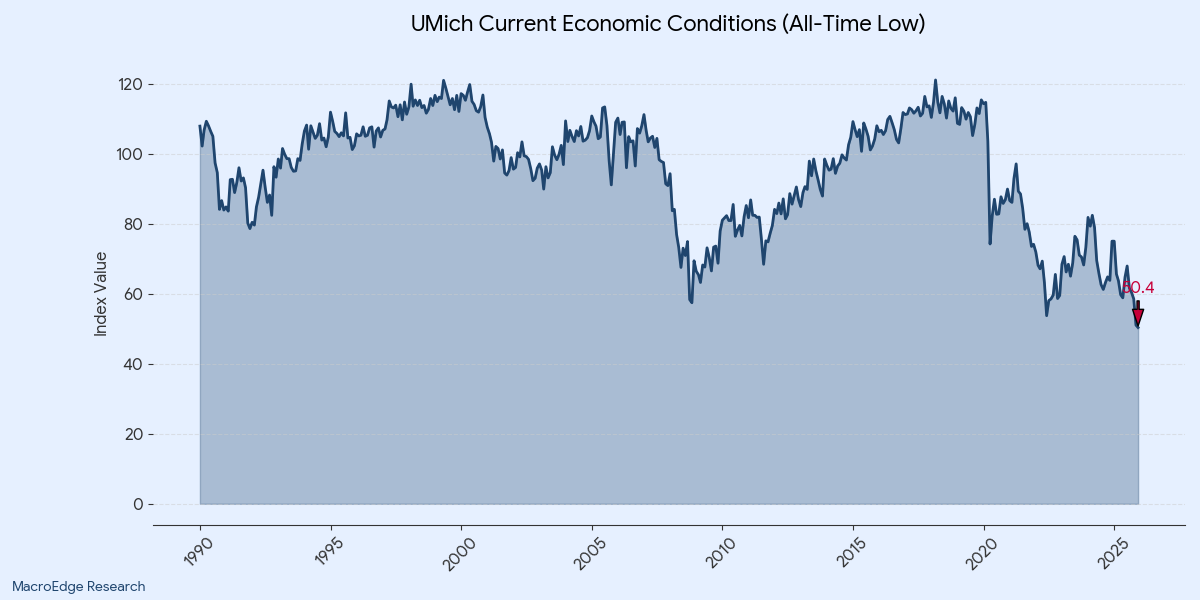

United States

Consumer confidence in the United States remains near all-time lows, while the current conditions reading for December was the lowest on record. Nothing screams ‘i’ shaped economy like these indicators continuing to flash red. We’ve continued to shift into a new ‘Gilded Age’ - and the 10Y is on the verge of a major move - which is currently leaning higher. The setup is somewhat similar to late 2021 in many regards, though unemployment and its momentum are in a far worse place.

It’s hard for those in the Administration to broadly tout a strong economy when so much of it is reliant on the AI/data center bubble continuing through 2026. While other sectors may materalize as growth engine - the outsized risk of the AI sector - given its relative size now in equity markets, is quite substantial and should not be ignored.

10Y on the verge of a move back to the mid-high 4s if it pushes higher here:

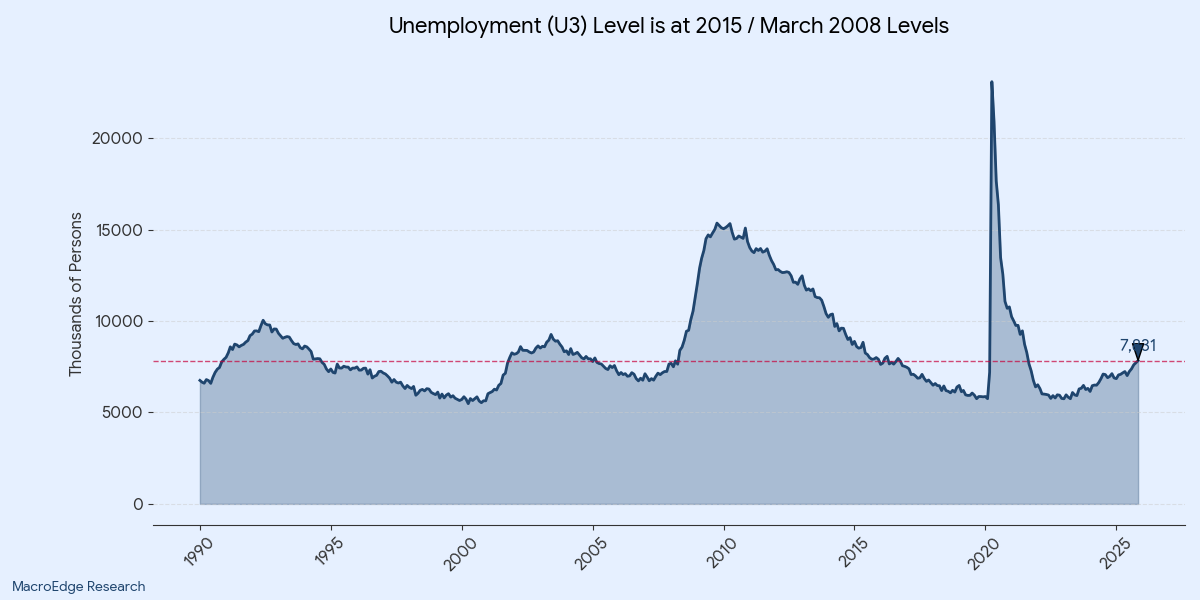

There’s little reason to expect tailwinds to just start supporting the labor market - with U3 at another cycle high through November - and likely ending the year at 4.6-4.7%. From an absolute standpoint from the cycle lows, this is clear labor deterioration and unless momentum stops - we could have a situation in which both the 10Y and U3 continue to move higher into 2026.

Unless job cuts & postings start going the other direction, respectively, momentum in the labor market continues to be lacking (there is essentially none).

(Continued below. Subscribe for full Ozone access).

Keep reading with a 7-day free trial

Subscribe to MacroEdge to keep reading this post and get 7 days of free access to the full post archives.