Weekly Macro Note: Running on Holiday Fumes, BoJ Hike, Employment/Inflation Week

In this Weekly Macro Note, we discuss the growing 'fumes' thematic as it relates to global equity markets - in the US, Japan, Canada, & Spain, highlight key macro data for the week, and much more.

Don Johnson (@DonMiami3), Chief Economist

Good Sunday evening MacroEdge Readers & Community,

Yesterday evening we talked extensively about some of the latest developments in the data center & AI space, with rising opposition to data center development becoming a real issue to the ‘data center boom’ moat, which is narrowing going into a midterm year. It will be politically advantageous for candidates on both sides to push back against data center infrastructure - since it’s a relatively non-political issue that can unify independents, etc.

This evening we’re going to cover the busy week ahead - including the double jobs report day on Tuesday, the Bank of Japan hike - and how it’s already baked in from a rate standpoint - as yields continue to push higher there, troubles with the long end, as well as go over some technicals & our chartpack - looking at key ‘bubble gauges’ from around the globe.

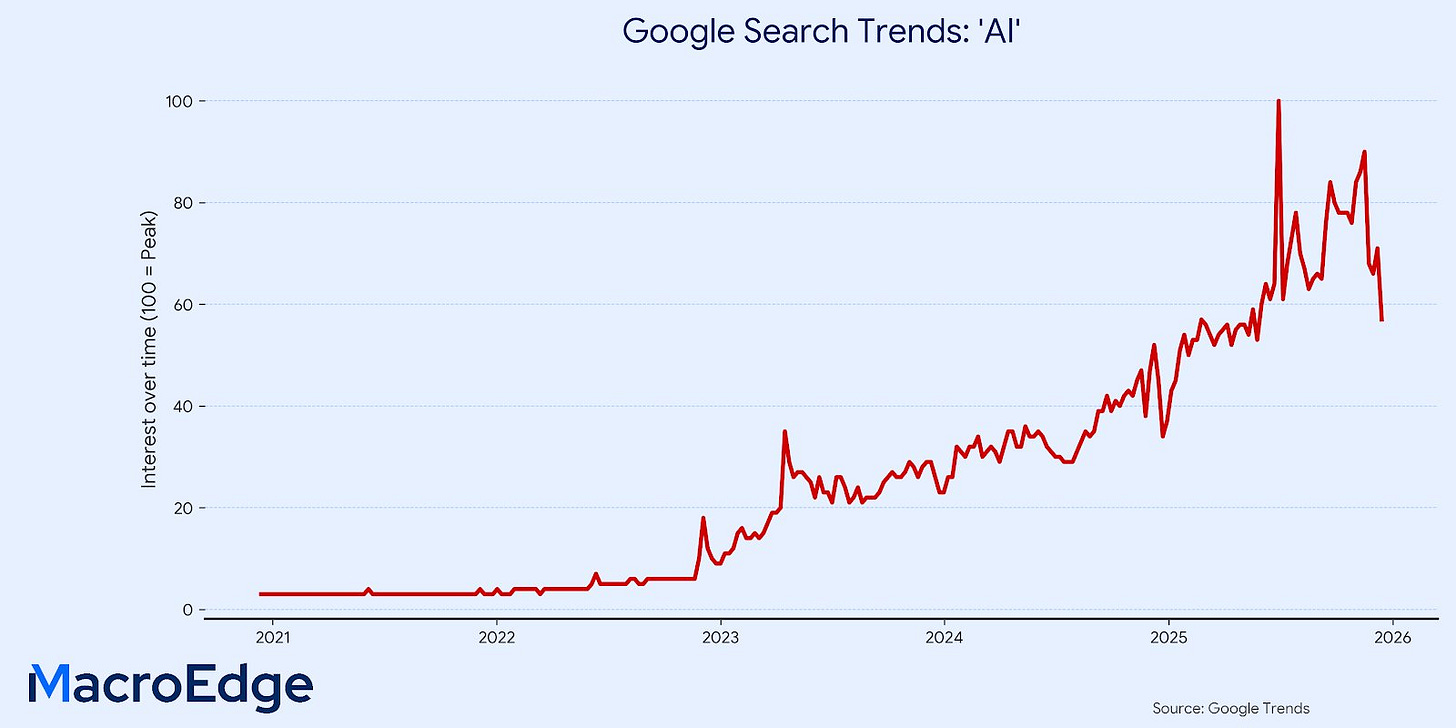

Note the dip in public search interest in AI over the last several weeks:

Let’s dive in.

Updates on our New Datasets Arriving in January

As we expand our coverage across key macro areas - like inflation - we’ve got three new datasets rolling out in the new year.

MacroEdge Inflation Tracker

MacroEdge Data Center Tracker

MacroEdge Hiring Tracker

All three will expand upon the capacity we’ve built up to monitor, track, and deliver the most critical economic data - especially in a time of great confusion around government data. With the chance of another government shutdown in January - and looming battle over ACA subsidy credits - our data will continue to serve as a vital picture into key economic realms.

In addition to our new datasets, we’re going to be expanding our MacroEdge contributor network in the new year, adding another 2-3 contributors, covering various sectors within the economy. Stay tuned for more there.

Don’t have access to MacroEdge Ozone? Get two week access below, and transform your financial & data insights:

Daily Macro Minute has Arrived

The first Daily Macro Minute will arrive tomorrow morning at 7am EST, and every market day from here on out (excluding holidays). This will be a fantastic way to digest the most important information from the previous day, and the coming day, quickly - and we’ll include 3 - 5 takeaway charts in shareable format.

Whether you want to include a chart in an executive presentation, or are looking to keep your own clients informed, this is going to be a great way to get what matters, quickly.

To join the Daily Macro Minute distribution list - which is separate from this one - you can subscribe to that email list below:

Weekly Macro Data Preview

Monday: Empire State MFG, NAHB Housing Market Index

Tuesday: Double Jobs Report (delayed October - limited data) & November data, Retail Sales

Wednesday: Housing Starts & Building Permits (for several months)

Thursday: CPI, Claims, Philly Fed MFG, Bank of Japan Policy Decision

Friday: PCE Data

Lies About Inflation Continue

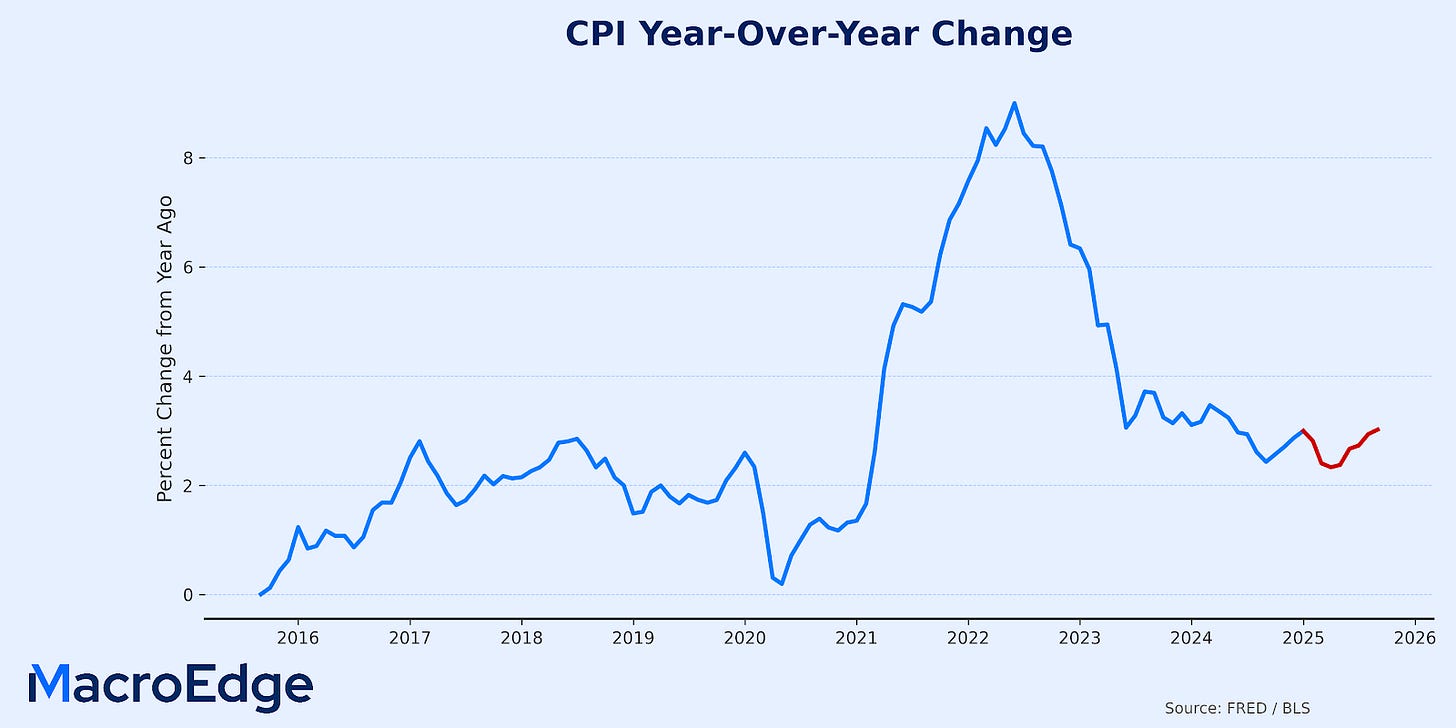

The CNBC & Fox Business guest lineups are continuing to push a narrative that Americans should accept a 3% YoY change in CPI in exchange for a continued melt-up in equities. The Administration has also bought into this narrative - though it is politically damaging given what we’re seeing in consumer and small-business surveys.

CPI for November - given the lack of higher input from oil (which lags) - isn’t likely to be a *shock* but we do know that October data was likely hotter - especially for producer prices, which were not released.

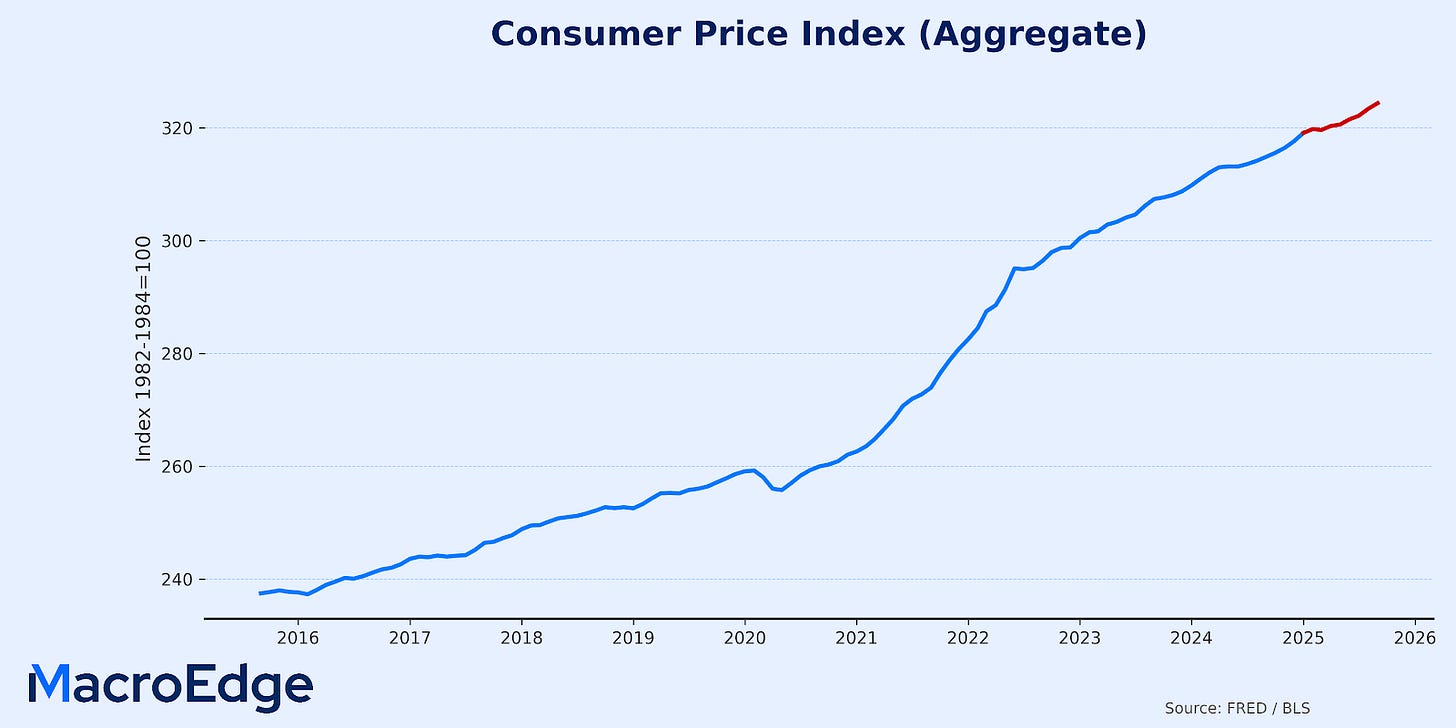

Trump’s term (in red) below, for the aggregate CPI basket, which understates true inflation.

In YoY terms - we’re currently at 3%.

Fed’s Long End Troubles & Bank Stress

The CPI data this week is key for the long-end (as well as things like the 2Y). The data this week is the deciding factor, in my opinion, of the January rate cut, which should be priced around 50/50, and will be 95% no cut if CPI remains elevated, and employment data is okay this week. A 4.5% U3 reading for November is to be expected.

The 10Y is at a very key level this week:

A push above would take us back to the 4.35 - 4.4% range.

The Dollar (DXY) Index has been weakening concurrently:

2YR Yield is setting up for a significant directional move

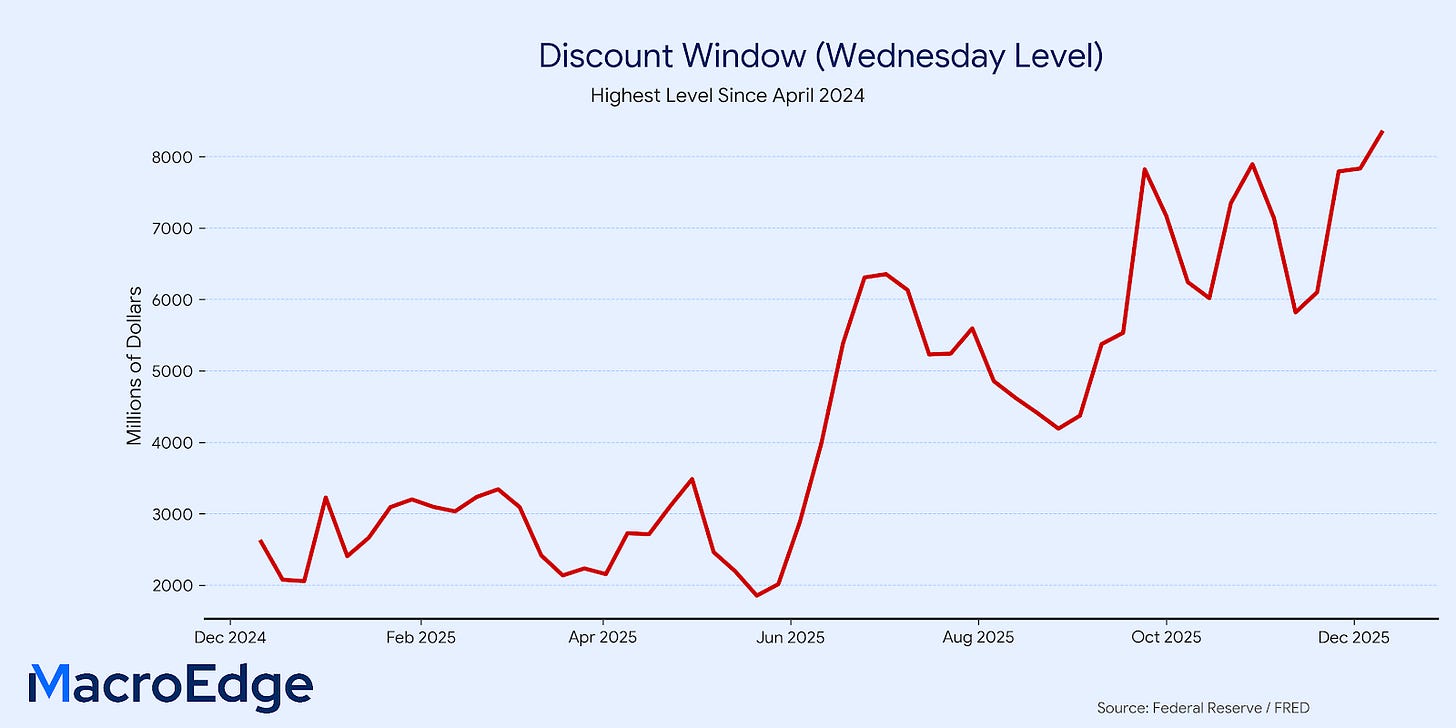

Discount Window usage hit its highest level since April 2024 - highlighting some minor bank stresses.

(likely taking place at regional & community banks)

Bank of Japan Hike Week

As we’ve discussed numerous times of the past few weeks, it’s about a 90% chance that the Bank of Japan hikes this week.

(Continued below - Japanese Rate Decision and Technicals / Chartpack)

Keep reading with a 7-day free trial

Subscribe to MacroEdge to keep reading this post and get 7 days of free access to the full post archives.